In a current report by Messari, the evaluation sheds mild on the developments and challenges confronted by Binance Chain (BNB), the blockchain created by Binance, the world’s largest cryptocurrency change concerning trading volume.

The report highlights the separation of BNB Chain from Binance and numerous occasions and allegations which have impacted Binance and its related entities all through the third quarter of 2023.

Binance Chain Separation And Challenges

The Messari report emphasizes that BNB Chain has distinguished itself as an unbiased entity separate from Binance regardless of its origins as a product of the biggest centralized cryptocurrency change. Nevertheless, the market has not totally acknowledged this separation, resulting in an absence of distinction between BNB Chain and Binance.

Through the third quarter, Binance encountered quite a few challenges, together with dropping partnerships, shutting down traces of enterprise, conducting layoffs, and going through accusations of violating sanctions.

These occasions coincided with a downward strain on the worth of BNB, which skilled a 25% decline in comparison with the earlier quarter. In distinction, the cryptocurrency market dropped by 9% throughout the identical interval.

The Messari report mentions that Binance, together with its subsidiary Binance.US, was accused by the Securities and Change Fee (SEC) of participating in unregistered provides and gross sales of “crypto securities”, together with BNB.

These allegations additional added to the challenges confronted by Binance and its related entities in the course of the third quarter.

BNB Chain Efficiency And On-chain Exercise

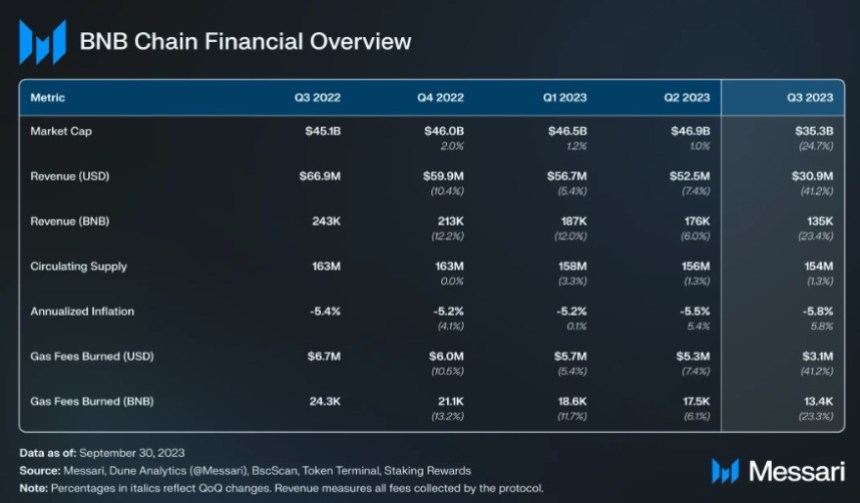

Regardless of the challenges, BNB maintained its place because the fourth-largest cryptocurrency by market capitalization, with a market cap of $35.3 billion. The circulating provide of BNB decreased by 1.3% within the third quarter as a result of token-burning mechanism employed by BNB Chain.

The report additionally highlights the influence of antagonistic occasions on BNB Chain’s on-chain exercise. BNB Sensible Chain’s income, measured in BNB, fell consistent with the decline in BNB’s market cap, indicating a lower in exercise on the Binance Sensible Chain (BSC). Day by day transactions (-14%) and common charges (-12) in BNB additionally skilled declines throughout this era.

BNB Chain provides staking alternatives for cryptocurrencies comparable to Ethereum (ETH), BNB, Cardano (ADA), and others. The report notes that the whole stake and eligible provide declined by 3% and a couple of%, respectively, whereas the common annualized staking yield decreased from 2.6% to 2.1% in the course of the third quarter.

The DeFi sector on the BNB Chain demonstrated energy in comparison with different sectors. The NFT area skilled elevated secondary gross sales quantity, distinctive patrons, and sellers.

Nevertheless, stablecoin transfers and GameFi skilled declines in quantity. The report means that newer functions on BSC might have influenced the expansion of distinctive patrons and sellers within the NFT sector.

In the end, the Messari report gives insights into the separation of BNB Chain from Binance and the challenges confronted by Binance and its related entities in the course of the third quarter of 2023.

Regardless of these challenges, BNB Chain maintained its market capitalization and continued to launch new merchandise and implement technical upgrades. The report highlights the necessity for market recognition of the separation between BNB Chain and Binance and the influence of antagonistic occasions on BNB Chain’s on-chain exercise.

However, BNB has skilled a prolonged downtrend since reaching its annual peak of $350 in April. Subsequently, the token plummeted to $202 on October 9.

Nevertheless, current developments have resulted in a constructive pattern, with BNB recording a revenue of 5.2% prior to now 14 days and 1.8% within the final 30 days. Consequently, the present buying and selling worth of BNB stands at $223.

Featured picture from Shutterstock, chart from TradingView.com