Ethereum is off to a rocky begin this 2025, and its vibrant dev group isn’t completely happy. Based on reviews, the Ethereum Foundation has just lately moved a considerable quantity of Ether. The inspiration’s transactions to maneuver and promote its tokens turned messier when one in all its staff tried to elucidate the state of affairs, producing a variety of backlash.

Associated Studying

Ethereum’s latest transactions have occurred since Bitcoin and different high tokens have been ripping by way of the charts. Value-wise, Ethereum is buying and selling between $3,200 and $3,384, which is just too removed from 2021’s excessive of $4,870.

What’s Up, Ethereum Basis?

The Ethereum Basis, the first group supporting the event of the blockchain, will not be serving to the trigger. No matter its intention or the overriding targets for unloading huge ETH tranches, these strikes nonetheless depart a nasty style within the mouths of most holders and supporters.

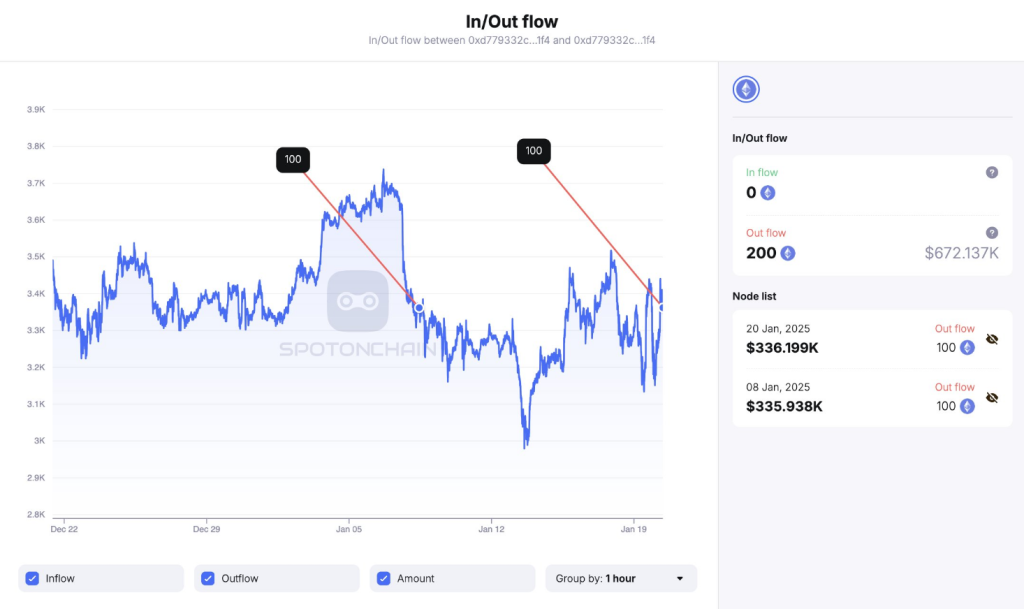

Based on a latest submit by Spot On Chain on Twitter/X, the muse has just lately moved one other 100 ETH in change for 336,475 DAI. Based on the account, the muse bought 200 ETH tokens for $67k within the first few days of 2025 at a median value of $3,361. The account added that ETH is 31% under its 2021 excessive of $4,878, whereas Bitcoin continues to retest its highs and at the moment breached the $109k stage.

[ATTENTION] The Ethereum Basis simply bought one other 100 $ETH for 336,475 $DAI!

In complete, they’ve bought 200 $ETH ($672K) in 2025 at a median worth of $3,361 over the previous 12 days.$ETH stays 31% under its 2021 ATH of $4,878, whereas $BTC has hit a brand new ATH of $109K at the moment!… https://t.co/9CWWVsrfhj pic.twitter.com/ZOr504i1HG

— Spot On Chain (@spotonchain) January 20, 2025

Ether Supporter’s Feedback Draw Unfavorable Suggestions

The inspiration’s newest transaction, the sale of 100 tokens, got here after Josh Stark’s feedback got here to mild. Stark, a well-liked ETH supporter, defended the muse’s choice to promote these ETH tokens, arguing that they’re nonetheless actively utilizing the blockchain’s native token.

the EF makes use of Ethereum on a regular basis, for example to (1) swap ETH for stables (normally @CoWSwap) and (2) to pay individuals (grantees, workforce members) in stables and ETH, on mainnet and L2s. Occasions we run (like Devcon and Devconnect) take onchain funds and use onchain ID for tickets.

— Josh Stark (@0xstark) January 20, 2025

In a Twitter/X posting, Stark defined that the muse makes use of its tokens each time. These tokens purchase stablecoins, pay their individuals in stablecoins, and assist the blockchain’s occasions.

Stark’s feedback didn’t sit effectively with some crypto observers and commentators. Twitter/X consumer WazzCrypto hit Stark for utilizing ETH “dump” as an evidence to assist the muse’s transactions. Person @VelvetMilkman was disillusioned with Stark, arguing that it’s a lame excuse for utilizing the altcoins.

In the meantime, X consumer Trading_Axe has a extra scathing, and no holds barred tackle the problem:

Their brains truly don’t work in any respect.

The fuck you want 300K for thus urgently?

What may you POSSIBLY, because the ETHEREUM FOUNDATION, when your entire world is watching, want 300K OF A PUBLIC SELL ORDER for?

Senseless cockroaches.

Retar Dio.

— ً (@trading_axe) January 20, 2025

Associated Studying

Buterin Units The File Straight For ETH

Many critics say Ethereum is dropping floor in opposition to different blockchains, notably Solana. As such, many advocate that Ethereum stake its tokens as an alternative of promoting them to generate yields. The growing variety of feedback and criticisms in opposition to the muse has caught the eye of Vitalik Buterin, Ethereum’s co-founder.

Buterin stated the workforce has additionally explored many choices, together with staking their tokens. Nevertheless, regulatory points and potential issues with the arduous fork prevented them from doing so. Though there’s a pleasant regulatory surroundings proper now, the dangers related to staking stay excessive.

Featured picture from ETF Stream, chart from TradingView