The Bitcoin protected haven narrative could also be again as knowledge reveals the cryptocurrency’s correlation with Gold has surged in latest months.

Bitcoin Correlation To Gold Has Elevated Throughout The Previous 12 months

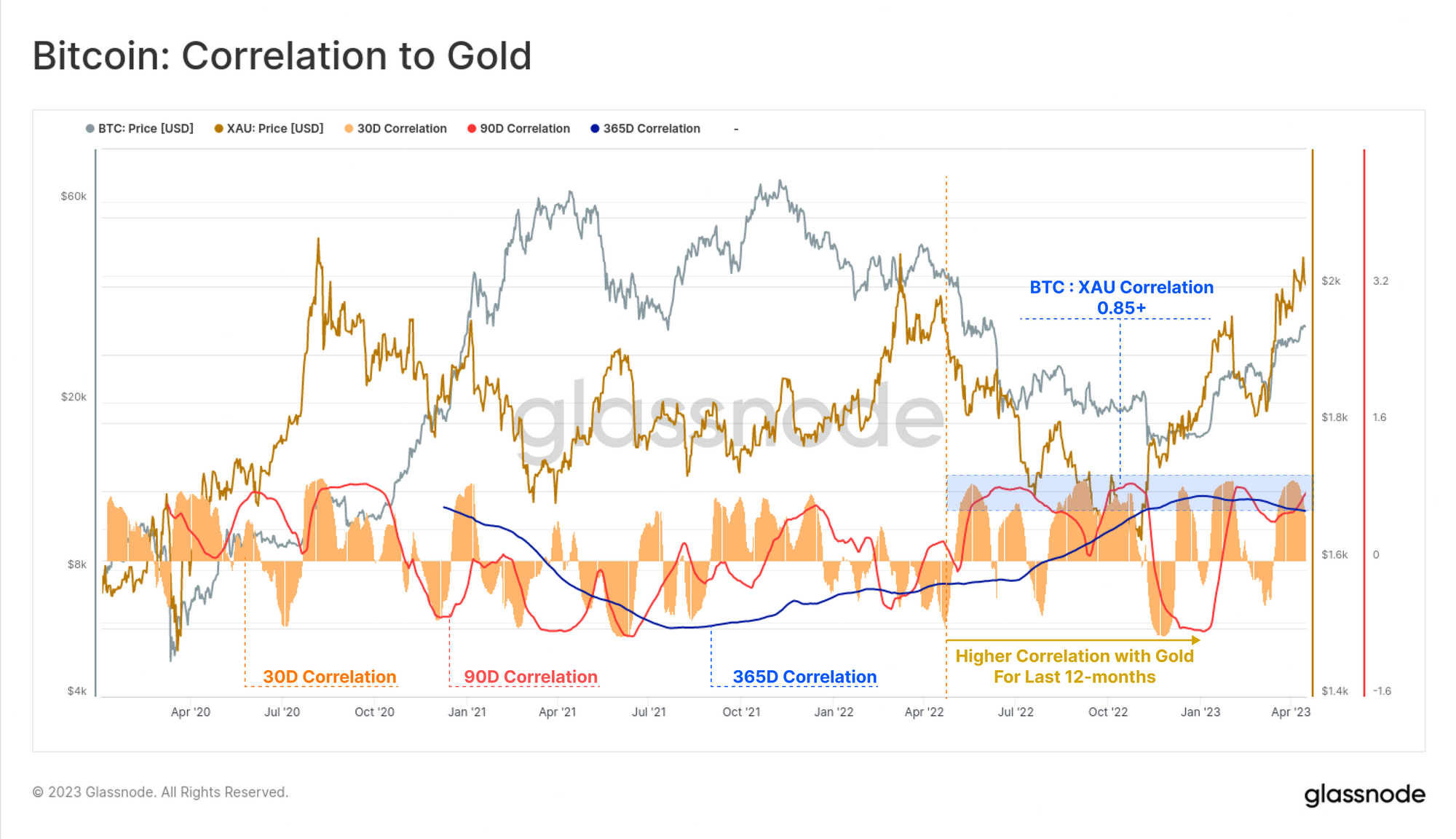

In response to the newest weekly report from Glassnode, the correlation between the 2 belongings remained excessive through the latest US banking disaster. The “BTC correlation to Gold” signifies how intently Bitcoin is following the actions happening within the value of 1 troy ounce of Gold.

When the worth of this metric is unfavourable, it means BTC is presently responding to actions within the value of Gold by touring in the wrong way. However, optimistic values of the indicator suggest the 2 belongings are transferring in an identical trajectory proper now.

Naturally, when the correlation is zero, it suggests there is no such thing as a sample relating to how the cryptocurrency and Gold are transferring relative to one another.

Now, here’s a chart that reveals the pattern within the 30-day Bitcoin correlation to Gold, in addition to in its 90-day and 365-day variations, over the previous couple of years:

Appears to be like like the worth of the metric has been fairly excessive in latest days | Supply: Glassnode's The Week Onchain - Week 16, 2023

The above chart makes use of the image “XAU,” however be aware that this time period refers to 1 troy ounce of Gold right here and never the Philadelphia Gold and Silver Index.

As displayed within the graph, the Bitcoin correlation to Gold didn’t present a lot sturdy optimistic correlation through the bull run in 2021, because the metric had assumed unfavourable values for a good chunk of the interval.

Correlation additionally remained weak within the first few months of 2022, however issues began to alter because the bear market took maintain. Within the final twelve months, the indicator has largely registered excessive optimistic values, suggesting that the 2 belongings have turn out to be strongly tied throughout this era.

The FTX crash supplied one exception, nevertheless, because the indicator’s worth had turned deep crimson across the time it came about. Nonetheless, with the rally this 12 months, the belongings rapidly grew to become strongly correlated once more, as all three MAs (30-day, 90-day and 365-day) obtained optimistic values.

Gold has historically been thought of a protected haven asset, whereas shares and BTC have usually been thought of dangerous investments. With the correlation between Bitcoin and Gold changing into excessive just lately, it appears that evidently the Digital Gold narrative could also be making a comeback.

Curiously, the correlation additionally remained excessive through the US banking disaster some time in the past, when establishments like Silicon Valley Financial institution (SVB) collapsed and shook the market. This can be additional proof of BTC being checked out in a greater mild just lately.

“This does counsel that an appreciation for each sound cash and the realities of counter-party danger are more and more entrance of thoughts for traders,” notes Glassnode.

BTC Value

On the time of writing, Bitcoin is buying and selling round $29,500, up 1% within the final week.

BTC appears to have plunged through the previous day | Supply: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, Glassnode.com