Bitcoin is presently buying and selling above $57,000 rekindling hopes that BTC would possibly get to new file highs earlier than year-end. Regaining final week’s losses triggered by the brand new Omicron Coronavirus variant and fears round regulations in India, Bitcoin worth crossed above the $58,000 psychological stage on Sunday nigh and continues to be up 5.77% over the past 24 hours.

The BTC worth forecast stays unsure for a lot of for the remaining a part of the years as fears round Corona stays. Bears nonetheless have the selection of making the most of the leveraged bulls in opposition to the backdrop of the latest rally.

Towards this background and the month set to finish in two days, you will need to perceive how technical will form BTC’s performance this week.

Bitcoin Value Bounces Off The 100 SMA

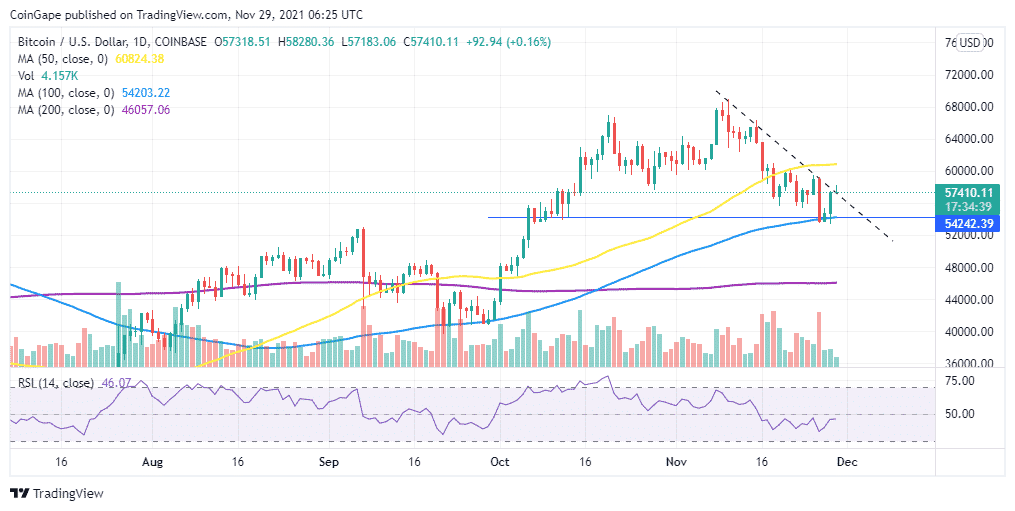

BTC/USD bounced off the 100-day Easy Shifting Common (SMA) round $54,202 over the weekend as Bitcoin worth rose to supply a weekly shut of $57,248 in keeping with knowledge from CoinMarketCap. With this closure, BTC averted its lowest weekly closure in two months.

Observe that regaining the $58,000 stage is essential for BTC bulls sustaining the uptrend. On the time of writing, the massive crypto is exchanging arms at $57,410 and is struggling to push above the downtrend line. A get away above the resistance line will see Bitcoin rise to tag the $60,000 psychological stage.

The upward motion of the Relative Energy Index (RSI) indicator accentuates this bullish outlook.

BTC/USD Each day Chart

Nevertheless, the RSI continues to be positioned within the impartial zone at 46.01 indicating that the overhead stress would possibly nonetheless push the BTC price additional down.

Observe that the $60K stage stays untouched even after the rebound as BTC has been fiercely rejected from this level since flipping it into resistance on November 18.

Nevertheless, there’s nonetheless optimism from the Bitcoin group that the asset will shut the Month above $60,000. Effectively, we’ve got lower than 48 hours to seek out out.

Disclaimer

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.