Bitcoin’s shock rebound to $28,000 has satisfied analysts available in the market that the sell-off is nearly over and a restoration into the bull market is within the preliminary levels. This rally, though transient, modified the technical side of BTC value, decreasing the probabilities of one other dip under $25,000 help/resistance.

Probably the most distinguished crypto noticed a spike in buying and selling quantity as traders shortly reacted to the much-publicized Grayscale Investments’ win against the Securities and Exchange Commission (SEC).

The ruling made by the appeals court docket permits Grayscale to transform its Bitcoin Trust (GBTC) product to a spot Bitcoin exchange-traded fund (ETF) upon approval by the SEC.

Many analysts, opinion leaders, and specialists within the crypto business consider that the approval of a spot BTC ETF and the upcoming halving would gas the subsequent bull run anticipated in 2024/2025.

Nonetheless, the SEC has continued to reject proposals citing volatility and potential market manipulation amongst different causes for not giving the greenlight.

Has BTC Value Exhausted The Downtrend?

A analysis paper by JPMorgan Chase & Co., cited by Bloomberg, reckons that the longstanding crypto winter is nearly over. In keeping with the researchers, liquidations of lengthy positions, particularly in Bitcoin are “largely behind us.”

Based mostly on indicators just like the open curiosity in CME Bitcoin futures contracts, which in accordance with a written assertion from analyst Nikolaos Panigirtzoglou has gone down considerably hinting on the downtrend dropping energy.

In consequence, we see restricted draw back for crypto markets over the close to time period,” the report mentioned.

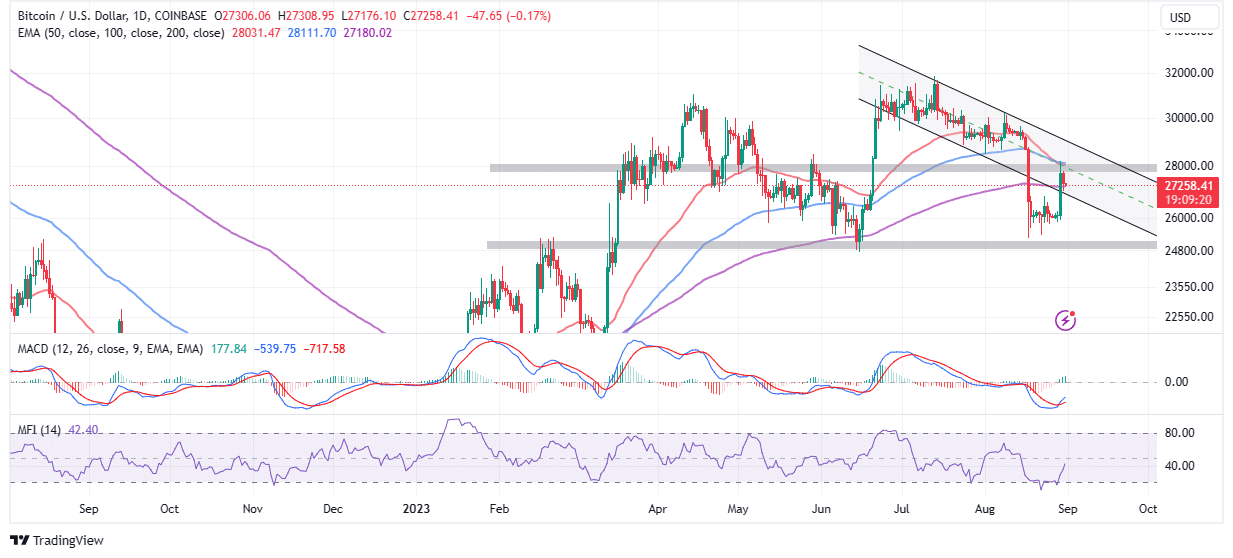

BTC value, down 0.8% towards the top of the Asian enterprise hours on Thursday, is buying and selling at $27,206. The 200-day Exponential Shifting Common (EMA) (purple) serves because the rapid help at $27,179.

Bitcoin should keep above $27,000 as this place assures traders of the potential of the downtrend carrying on above $30,000. This help additionally decreases the likelihood of one other sell-off under $25,000.

A purchase sign from the Shifting Common Convergence Divergence (MACD) indicator validates the improved bullish outlook. Because the MACD line in blue flipped above the sign line in purple, the trail with the least resistance turned towards $30,000.

Merchants could be assured to maintain their lengthy positions intact and energetic so long as this momentum indicator upholds the uptrend to the person line (0.00) and into the constructive space.

The Cash Stream Index (MFI) reinforces the bullish grip because it lifts towards the overbought area. This exhibits that the influx of funds into BTC markets outweighs the outflow volume. In different phrases, traders are extra inquisitive about searching for publicity to Bitcoin versus promoting in favor of different digital or conventional belongings.

A break above $28,000 and the higher boundary of the descending channel might mark the start of the rally above $30,000.

Associated Articles

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.