BTC worth response to the USA Client Value Index (CPI) which rose by 0.6%, beating economists’ expectations and a 0.4% enhance from July’s 0.2%, continues to shock many. Bitcoin live price managed to reclaim assist at $26,000 and is at present pushing for beneficial properties above $27,000 the place bulls shall be free from a multi-week vary channel.

CPI inflation climbed to three.7% on a year-over-year foundation, exceeding the market watchers’ forecast of three.6% in addition to July’s 3.2%.

The US financial system posted a 0.3% enhance within the Core CPI (excluding power and meals costs) in comparison with expectations of 0.2% and a 0.2% enhance in July. On a year-over-year foundation, the Core CPI dropped to 4.3%, matching economists’ projections and a major drop from July’s 4.7%.

BTC Value Bullish Outlook Submit CPI Information Launch

Bitcoin’s positive reaction to the CPI data has seen a common bullish flip throughout the market, with capitalization rising by 1.1% virtually to cross the $1.1 trillion market. BTC accounts for greater than half of the crypto market, with $518 billion.

Nonetheless, the buying and selling quantity has slowed right down to $12 billion implying that buyers are selecting to carry BTC for long-term hypothesis versus short-term shopping for and promoting actions.

On-chain knowledge unveiled by Glassnode and Blockware Options affirms the long-term holders’ narrative. Bitcoin’s circulating provide dropped by 5.4% this week to carry at 19.4 million.

This provide dip coupled with expectations from the upcoming halving is more likely to ship BTC price skyrocketing.

“Value is about on the margin, which suggests those that commerce Bitcoin backwards and forwards drive short-term worth motion.” Blockware Options stated in an emailed assertion. “As supply-side illiquidity continues to extend, as indicated by fewer provide exchanging palms, any demand catalyst will ship the worth skyrocketing.”

Bitcoin’s circulating provide dormant within the final 12 months at present holds at 70% with buyers preferring to purchase and maintain. In accordance with Glassnode, long-term holders account for 75% of the circulating provide.

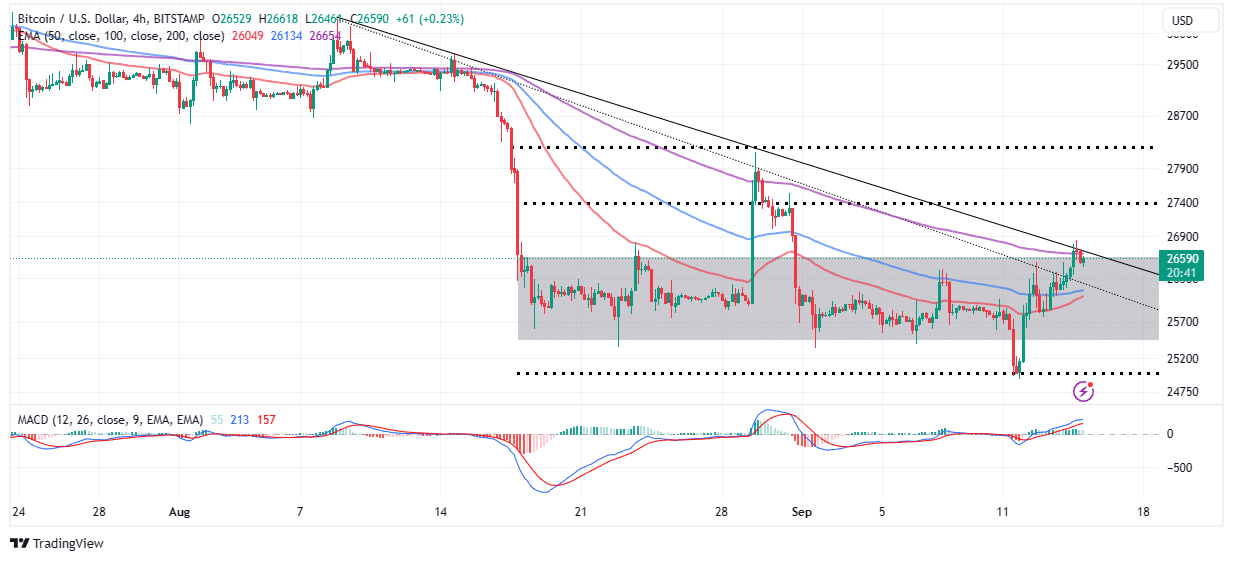

BTC Value Charts Manner Out Of The Dip

The climb from assist at $25,000 decreased the probabilities of BTC worth dropping to hunt liquidity at $22,000. Bitcoin’s weak spot beneath $26,000 satisfied most analysts that the coin wanted to comb by means of decrease ranges to gather liquidity.

Nonetheless, the continuing spike above the vary channel as proven on the chart reinforces the bullish grip whereas growing the chance of a breakout concentrating on beneficial properties above $30,000.

If merchants heed the decision to purchase BTC from the Transferring Common Convergence Divergence (MACD) indicator and enhance lengthy positions, a worth rally will most definitely erupt. Bear in mind, the shrinking circulating provide means demand rapidly will increase to drive BTC worth increased.

Though Bitcoin is just not out of the woods but, a break above the 200-day Exponential Transferring Common (EMA) (purple) and subsequently the higher descending trendline, may very well be the purpose of no return as BTC price quickly races north to $30,000.

Contemplating attainable revenue reserving strain at $27,400 and $28,200 this climb is also lock-step earlier than transferring past the psychological resistance at $30,000. On the draw back, assist areas at $26,000 and $25,000 will keep in place, so if they’re weakened, Bitcoin could drop to $22,000 in any case.

Associated Articles

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: