The week is popping out to be nice for spot Bitcoin ETFs as they began the week with a $520 million influx on Monday and recorded one other robust influx of $577 million on Tuesday. The huge influx got here on the again of BlackRock iShares Bitcoin ETF witnessing an influx of $520 million alone, stating excessive odds of BTC worth rally to $60,000.

BlackRock Leads Spot Bitcoin ETF Influx

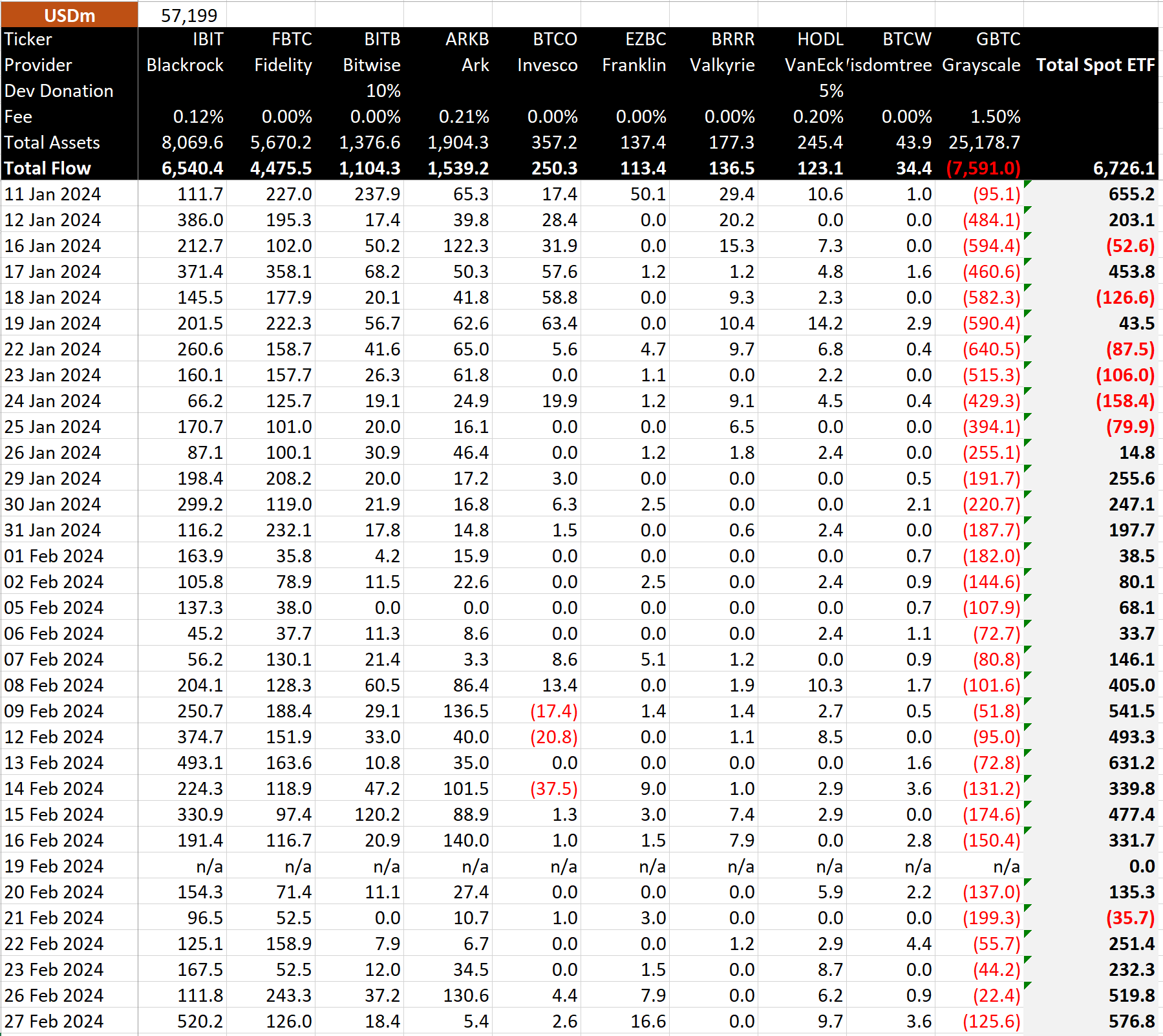

Spot Bitcoin exchange-traded funds (ETF) witnessed $577 million internet influx (or 10,167.5 BTC internet influx) on February 27, based on knowledge by BitMEX Analysis. This was the third-largest influx till launch, as all 9 spot Bitcoin ETFs recorded large buying and selling volumes. Nevertheless, Grayscale’s GBTC outflow elevated once more on Tuesday after dropping to $22.4 million a day earlier than.

BlackRock iShares Bitcoin ETF (IBIT) noticed over $520 million, breaking its largest influx thus far report. IBIT additionally noticed a report $1.3 billion buying and selling quantity, exceeding the day by day commerce quantity of most large-cap US shares. Following the most recent influx, BlackRock’s internet influx hit over $6.5 billion and asset holdings jumped over 141,000 BTC.

Constancy Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF noticed $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL), and others spot Bitcoin additionally noticed substantial inflows, indicating robust bullish sentiment amongst retail and institutional traders.

Notably, GBTC noticed a $125.6 million outflow, a rise from Monday’s $22.4 million outflow, setting apart hopes of a paradigm shift. Bloomberg senior ETF analyst Eric Balchunas stated the day by day buying and selling quantity of 9 new spot Bitcoin ETFs besides GBTC exceeded $2 billion for the second consecutive day as BTC worth holds strongly above $57K.

Additionally Learn: Sam Bankman-Fried’s Defense Counsel Proposes 6 Year Sentence or Less

BTC Worth Breaks Above $59,000

Crypto Concern & Greed Index has reached a 4-year excessive worth of 82 right now, with the market sentiment at present within the ‘Excessive Greed’ zone. The FOMO reaches into Wall Avenue as merchants’ curiosity in BTC is extraordinarily excessive. Consultants predicted BTC price to hit $60,000 earlier than bitcoin halving.

BTC price skyrocketed to $59,000, lower than 15% away from the $68.6K excessive established 27 months in the past. The 24-hour high and low are $56,219 and $59,000, respectively. Moreover, the buying and selling quantity has elevated barely within the final 24 hours, indicating curiosity amongst merchants.

Good morning,#Bitcoin is above $58K, the place funding charges are going by means of the roof.

Astonishing power, positively areas to start out on the lookout for income. pic.twitter.com/WXRzkEkaBA

— Michaël van de Poppe (@CryptoMichNL) February 28, 2024

Additionally Learn: US SEC Request Judge Torres to Extend Remedies Briefing Deadlines in Ripple Case

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: