Bitcoin’s latest drop to $25,000, though anticipated by many, has left merchants and traders afraid of taking new positions. Sentiment throughout the crypto market stays detrimental, made worse by projections of one other dip to $20,000 before BTC price reverses the uptrend considerably.

This lack of energetic participation which frequently comes after dips, has confined Bitcoin to hovering at $26,000. Makes an attempt to climb towards $27,000 solely made it to $26,282 whereas on the draw back bulls set camp at $25,000 in a bid to avert an prolonged decline.

BTC Worth Bull Runs Begin in Excessive Concern

Ardent traders within the crypto market are nicely conscious of the Bitcoin cycles, which are often linked to the halving – set to happen in April 2024. These cycles are characterised by durations of euphoria and concern, which mark the start of retracements or bull runs, respectively.

In keeping with @DrProfitCrypto “The final bull run ultimately of 2020 began with absolute concern throughout covid and the mom of all crashes.”

The sell-off triggered by the pandemic set Bitcoin on a parabolic climb to new all-time highs of $69,044.

“Bull markets at all times begin with excessive concern whereas bear markets at all times begin with euphoria,” the dealer and analyst added.

Nevertheless, what differentiates traders who smile throughout bull runs and people who purchase on the excessive high (euphoria) is timing. Shopping for throughout market dips has been confirmed to be among the finest methods to construct digital belongings’ worth over time.

Nevertheless, only a few traders have the arrogance to purchase amid market downtimes like the continuing rout.

The same sentiment shared by crypto analytics platform, Santiment reckoned that whereas “merchants are praying that markets fall to allow them to get discounted Bitcoin, many really feel second ideas when offered with the precise alternative to purchase the dip.”

What’s Subsequent For BTC Worth

Bitcoin is on the sting balancing its help at $26,000 amid obtrusive dips to $20,000. Traders are fearful that these dips will put their funds in jeopardy, particularly there not being a assure that losses is not going to stretch past $20,000.

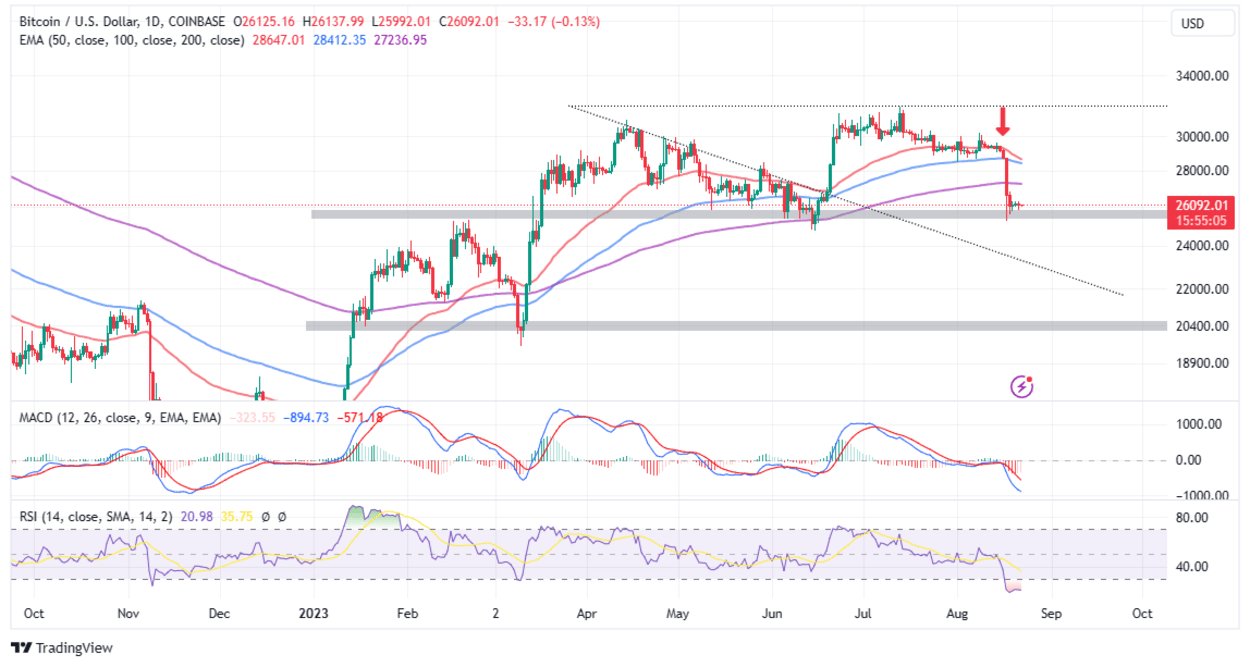

The Transferring Common Convergence Divergence (MACD) encourages sellers to maintain their positions intact because it drops additional into the detrimental area. The promote sign began in early July marked by the MACD line in blue crossing under the sign line in purple was reaffirmed final week, therefore the sell-off.

If bears preserve holding Bitcoin hostage at $26,000, one other breakdown will possible observe. Help from the descending trendline as proven on the chart might present bulls will a chance to keep away from a extra appreciable dip to $20,000 in favor of a rebound at $22,000.

Regardless of the crypto market construction weakening, rebounds are inclined to happen throughout a number of the most unsure moments.

That stated, the Relative Power Index (RSI) is vastly oversold at 20, decrease than the 2020 Covid crash. Oversold situations indicate that Bitcoin is buying and selling under its precise market value and infrequently culminate in additional vital value rebounds. In that case, it’s advisable to tread rigorously and be able to make fast choices because the scenario at hand might name for.

Associated Articles

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.