BTC value has trimmed all of the positive aspects made this week, after climbing above $27,000 and stopping in need of $28,000. Down 4.4% on Friday to $26,050, essentially the most distinguished crypto has seen over $20 billion in buying and selling quantity dashing in whereas its market capitalization holds barely above $507 billion.

Shifts within the price of Bitcoin typically drag the market down or up with it, and this time it was not totally different, contemplating the three% dip within the complete market worth to $1.09 trillion. Ethereum continued with the rout following the rejection from weekly highs of $1,750. Probably the most distinguished sensible contracts token has corrected 3% in 24 hours to $1,650.

BTC Worth Dumps As 26k Bitcoin Choices Expire On September 1

Bitcoin has lost ground above $27,000, missing the momentum to maintain the rally intact after the hype round Grayscale’s win pale.

“After loads of push & pull this week, Bitcoin has returned to $26K, proper again the place it began previous to the Grayscale information boosted crypto markets,” blockchain analytics firm Santiment said in a post on X.

Traditionally August and September have been a few of the most bearish months for BTC value, marred with low volatility and dwindling liquidity.

In response to knowledge by Greeks.stay, “26k BTC choices are about to run out with a Put Name Ratio of 0.50, a max ache level of $27,000, and a notional worth of $690 million.”

Key assist areas beginning with $26,000 and $25,000 are prone to really feel the pinch as buyers soak up the losses which observe renewed investor sentiment for positive aspects above $30,000 earlier this week.

“BTC and ETH falling on the eve of expiration, inflicting the supply value to maneuver away from the maxpain level, is comparatively uncommon,” Greeks.live said via X. “It must be brought on by a renewed delay in ETF approvals, ensuing within the exit of short-term bullish gaming funds.”

BTC Worth Dilemma, To $30k Or $20k?

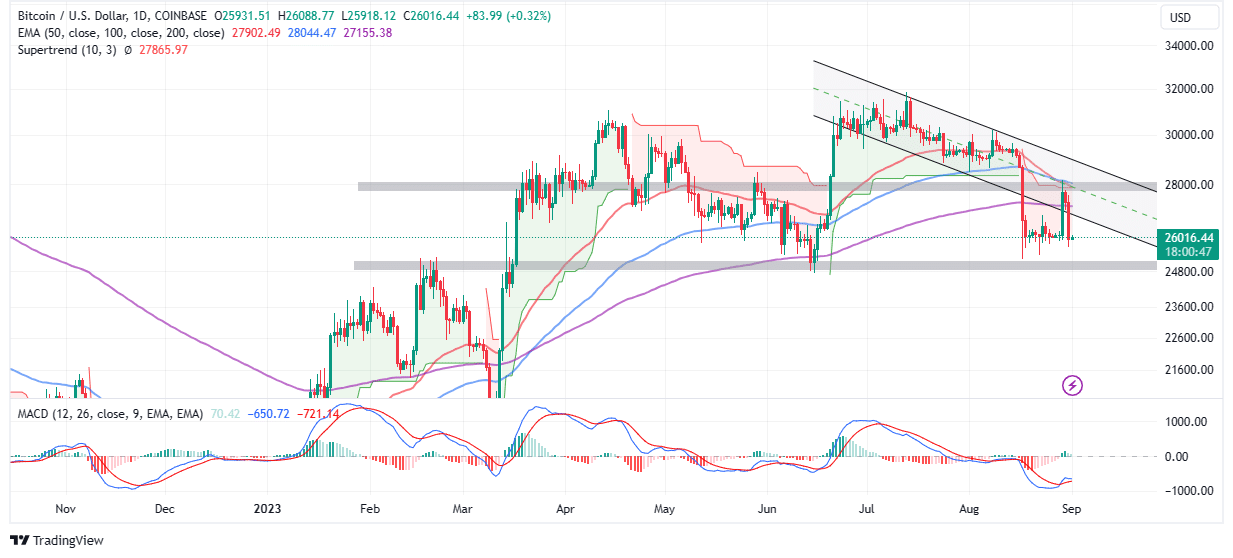

Bitcoin will doubtless try one other development reversal from the now vital assist at $26,000 if buyers rally behind it and purchase the dip. A purchase sign from the Shifting Common Convergence Divergence (MACD) indicator has come on the proper time when merchants want assurance {that a} restoration to $28,000 after which to $30,000 will observe the dip.

The purchase sign manifested with the blue MACD line crossing above the purple sign line. Holding firmly above $26,000 would rule out a possible downfall to $25,000 which can improve the probabilities of BTC value tumbling to $20,000 earlier than the 2024/2025 bull run begins.

The crypto scene in September is anticipated to push buyers to the boundaries, particularly with the US SEC delaying its decision on all seven spot Bitcoin ETFs’ proposals.

Specialists imagine the approval of a spot ETF can be one of many driving components within the subsequent bull market along with the Bitcoin halving in April 2024.

Nonetheless, the Federal Reserve has hinted at mountaineering rates of interest in September after financial indicators in August confirmed that the highway to bringing inflation down continues to be lengthy. A tighter financial coverage implies that threat property like Bitcoin would have the momentum to maintain the development increased or might retrace additional as buyers flip to different conventional property.

Associated Articles

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.