BTC value, up 1.7% on Thursday to $26,438, is making an attempt to recoup the losses from final week’s deleveraging occasion. Essentially the most outstanding crypto plunged to $25,000 after an prolonged low volatility interval marked by assist at $29,000 and resistance at $30,000.

According to Dan Morehead, the founding father of Pantera Capital, a digital asset funding agency, the market “has seen sufficient.” In a written assertion, he opined that “there’s simply so lengthy markets will be down.”

Bitcoin’s efficiency this summer season has been noticeably dismal in comparison with different comparable durations previously. It “skilled the longest interval of unfavorable year-over-year returns in its historical past, lasting 15 months.”

BTC Worth Bullish Comeback

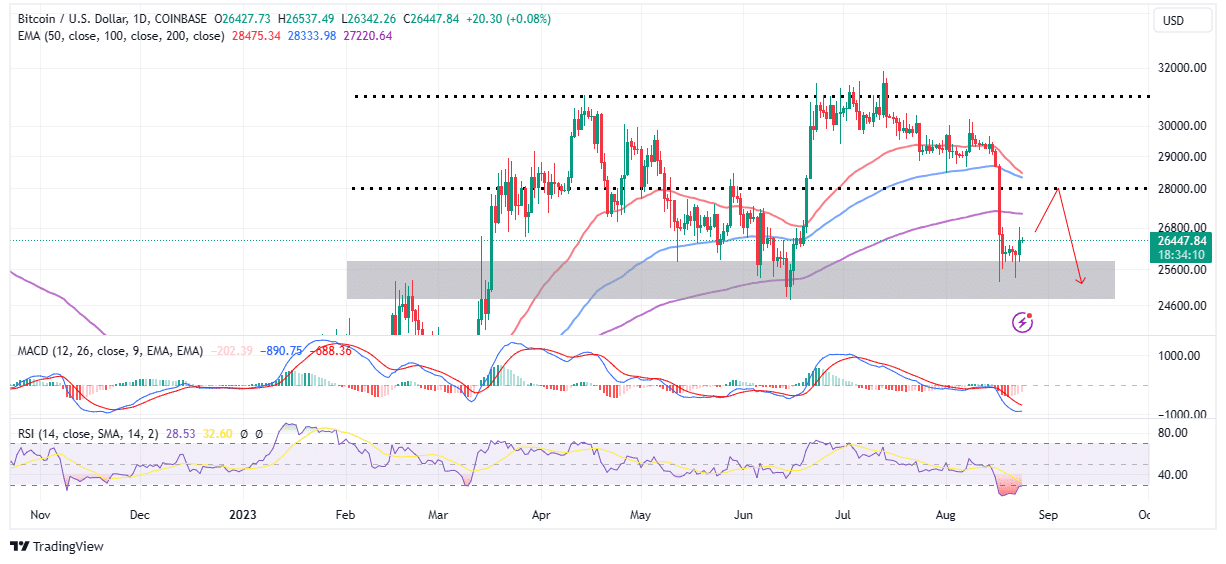

As reported beforehand, BTC bulls put up a strong defense at the $25,000 support/resistance, holding off a possible decline to $20,000. This bullish outlook has seen Bitcoin reclaim resistance at $26,000 and climb to $26,800.

Following the large hunch to $25,000, the Relative Energy Index (RSI) grew to become extraordinarily oversold, and this may very well be the catalyst as consumers transfer to hunt contemporary publicity to BTC.

The biggest crypto may be mirroring positive aspects in the US fairness market, with the S&P 500 and Nasdaq Composite climbing by 1% on the shut of buying and selling on Wednesday. Wall Avenue positive aspects got here after the discharge of S&P International’s flash US Composite PMI Index used to gauge financial exercise in manufacturing and repair industries.

The information prompt that financial growth in August was on the point of a pause. Traders harbored optimism {that a} deceleration in shopper expenditure may immediate the US Federal Reserve to droop their sample of charge hikes—promising information for the cryptocurrency market, as mirrored by in the present day’s value surges.

In keeping with the derivatives market tracking platform Coinglass, Bitcoin noticed $37.7 million in complete liquidations on Wednesday. This was inclusive of $9.64 million of liquidated lengthy positions. It additionally marked the primary time since Sunday that liquidations of BTC shorts dwarfed liquidated lengthy positions. Market individuals understand this as a sign that sentiment is enhancing.

BTC Worth Recovers, However There’s A Catch

Bitcoin is within the strategy of finishing its second consecutive bullish candle on the each day chart. If the approaching vendor congestion at $26,800 weakens and provides means, the following stopover can be $28,000 forward of the anticipated climb to $30,000.

Merchants in search of publicity to Bitcoin longs and are conservative might need to wait till the Shifting Common Convergence (MACD) indicator flashes a purchase sign. This name to purchase BTC can be of significance, contemplating the final time there was a purchase sign on the each day chart was round mid-June.

The Relative Energy Index (RSI) would make its bullish case because it rebounds from the oversold area under 30 into the impartial space and eventually into the overbought territory above $70.

With September approaching and the Federal Reserve anticipated to launch its choice on financial coverage, merchants ought to proceed with warning. The earlier FOMC minutes noticed members calling for extra charge hikes to mitigate inflation within the US. Such charge will increase are prone to dampen risk asset markets like Bitcoin and crypto, thus stretching the restoration interval.

Associated Articles

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.