Bitcoin worth is struggling to uphold its place at $27,000 assist within the wake of the Federal Open Market Committee (FOMC) assembly, which as anticipated left rates of interest unchanged for September.

The regulator saved the course open for a minimum of yet another charge hike earlier than the 12 months ends and subsequently fewer cuts than it had beforehand outlined for 2024. Jerome Powell, the Fed Chair stated that the regulator is “ready to proceed fastidiously in figuring out the extent of further coverage firming.”

There have been no sudden reactions from traders following the announcement as the speed hike pause was anticipated and already priced in. Nevertheless, there may be proof of a trendless buying and selling interval prone to comply with so long as bulls refuse to let go of the $27,000 assist.

The place Is Bitcoin Worth Headed?

Santiment, an on-chain analytics platform, believes that unchanged rates of interest are a optimistic sign for Bitcoin and the crypto market.

“Crypto market caps have held up nicely, regardless of the SP500 plummeting to 4-week lows. A promising correlation break signal,” Santiment said via a post on X.

The early week rejection instantly after Bitcoin worth touched the $27,200 stage implied vulnerability and a attainable pullback. Bulls have the chance to maintain declines at bay with assist at $27,000 remaining stable.

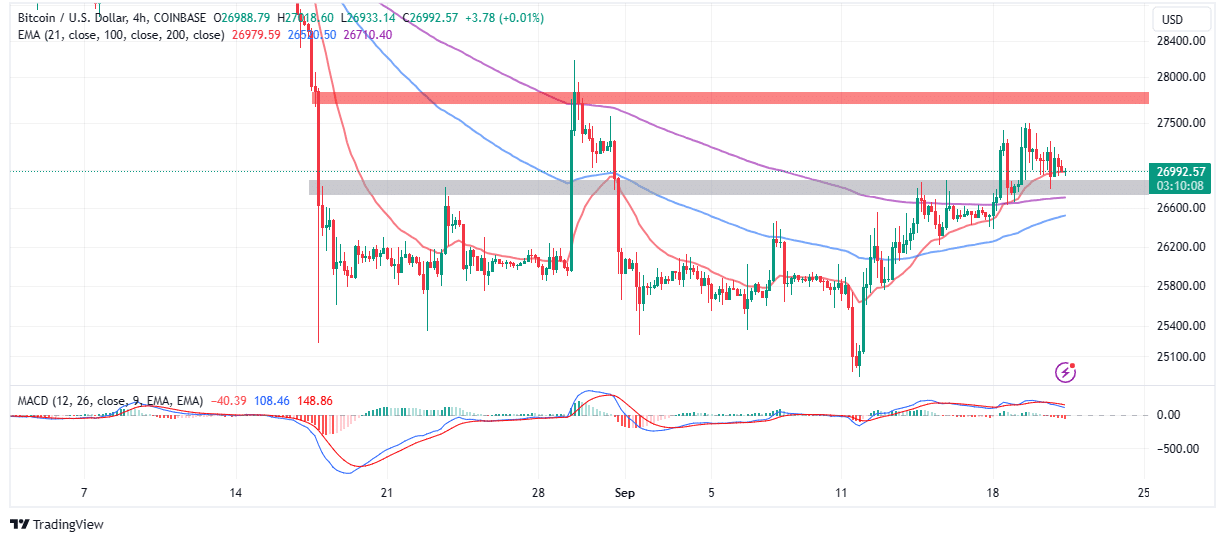

Nevertheless, the uptrend will not be sturdy sufficient to rule out a retracement to gather liquidity, particularly with Bitcoin price presently holding under the 21-day Exponential Shifting Common (EMA) (crimson).

If bears set camp at $27,000, the trail with the least resistance will flip to the draw back, the place the 200-day EMA (purple) will attempt to soak up the promoting strain at $26,710 and the 100-day EMA) at $26,519. Additional losses would goal for $26,000 and the most important assist at $25,000.

Primarily based on the place of the Shifting Common Convergence Divergence (MACD) indicator, sellers might quickly have the higher hand. The decision to merchants to think about closing their lengthy positions to short BTC manifests with the blue MACD line crossing beneath the crimson sign line.

Famend analyst and dealer, Rekt Capital, believes that Bitcoin worth is on the cusp of a pure correction from resistance at $27,150. With this “outdated assist appearing as new resistance,” a major retracement is certain to comply with.

#BTC replace with regards to the Month-to-month stage of ~$27150

Outdated assist now appearing as new resistance$BTC #Crypto #Bitcoin https://t.co/rkRsoC1ILt pic.twitter.com/TmWfJguaDB

— Rekt Capital (@rektcapital) September 21, 2023

The Bitcoin bearish fractal, mentioned earlier this week affirms the believable correction. A bearish fractal permits BTC worth to rise sharply earlier than hitting a resistance and retracing to brush by way of contemporary liquidity forward of one other vital climb.

Bitcoin Bearish Fractal Replace$BTC #Crypto #Bitcoin https://t.co/4H3OMiDzFB pic.twitter.com/Gn3iH75DFw

— Rekt Capital (@rektcapital) September 21, 2023

That stated, merchants could be in a greater place to keep away from losses in the event that they preserve their eyes on a number of key ranges together with the resistance at $27,200, assist/resistance at $27,000, $26,000, and $25,000.

Associated Articles

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: