Within the aftermath of the groundbreaking approval of Bitcoin ETFs, the cryptocurrency panorama is present process a interval of introspection, with Bitcoin discovering stability within the vicinity of $42,000. The preliminary euphoria that accompanied the ETF approvals has subsided, prompting a contemplative part marked by strategic maneuvers and complex market dynamics.

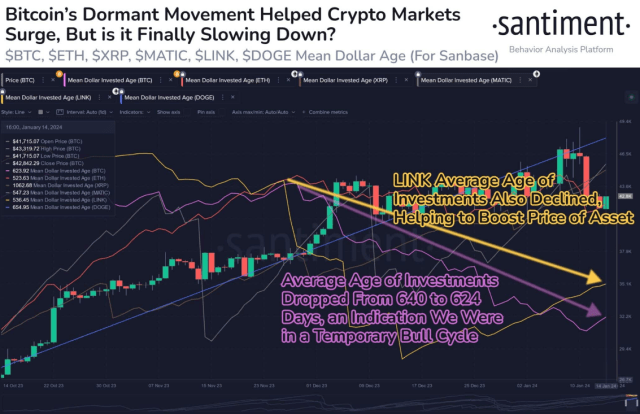

Blockchain analytics agency Santiment has supplied insights into the pre-ETF climate, uncovering a captivating dance amongst Bitcoin’s main gamers. It found giant wallets participating in a shuffle of older cash at an accelerated tempo.

Deciphering Bitcoin’s Motives

This strategic reshuffling brought about the typical age of those holdings to plummet, leaving analysts to decipher the motives behind such maneuvers. Some interpret it as a tactical profit-taking transfer, capitalizing on the current surge in costs, whereas others speculate that it may very well be a strategic play to place for an impending bull run.

Santiment, nonetheless, points a be aware of warning, suggesting that the whale waltz may need concluded for now, injecting an air of uncertainty into the prevailing bullish narrative. Amidst this near-term dissonance, whispers of market stability are starting to emerge amongst seasoned merchants.

The #Bitcoin ETF has supplied a unfavorable return because the begin.

The #Bitcoin ETF has supplied a large internet influx on the primary few days. Greater than $600 million on the primary day.

The true impression of the ETF will probably be proven within the coming few years.

A mega bullish occasion.

— Michaël van de Poppe (@CryptoMichNL) January 15, 2024

A ‘Mega Bullish Occasion?’

Analysts similar to Michael van de Poppe understand a “mega bullish occasion” on the horizon, pointing to the $600 million net inflow on the ETF’s first day as a mere prologue to the unfolding narrative. This sentiment displays the idea that the true impression of the ETFs is but to be absolutely realized, and the market could also be on the cusp of a extra important improvement.

Bitcoin at the moment buying and selling at $42,704 on the each day chart: TradingView.com

In the meantime, the choices market contributes its personal cryptic indicators to the narrative. Greeks.Dwell, an choices analytics platform, reveals a discordant melody with a considerable $120 million, equal to 16% of all block trades on that day, directed in the direction of short-term put choices.

This bearish refrain suggests a prevailing sentiment of warning amongst buyers. But, a more in-depth inspection of bigger block trades, exceeding $5 million, reveals a unique rhythm. Some distinguished gamers appear to be orchestrating a short-selling sonata by means of put choices, whereas smaller buyers harmonize with a cautious counterpoint, buying the exact same contracts.

As Bitcoin finds a short lived resting place just below $43,000, evidently the exhilarating bull run has momentarily hit the pause button, echoing the sentiment of a market in contemplation. The current ETF approvals and the strategic ballet of whales have added layers of complexity to the crypto narrative.

So, as Bitcoin takes a breather, we await the indicators that can decide the path of the following leg of this outstanding journey, pondering whether or not the pause button is merely a short intermission earlier than the resumption of the bull run, probably awaiting the following halving occasion to set the stage for renewed pleasure and market fervor.

Featured picture from Shutterstock