Ethereum has steadied the uptrend following the dip to $1,564 earlier this week. The formation of a short-term falling wedge, as discussed in the previous ETH price prediction boosted the bulls’ presence and confidence out there.

The biggest good contracts crypto, though barely unchanged on Thursday towards the top of the Asia session is buying and selling at $1,603. There was a pointy however transient breakout to $1,633 throughout the American session however information concerning the US Securities and Change Fee (SEC) delaying the choice on two spot Ethereum exchange-traded funds (ETFs) triggered a minor pullback.

SEC Postpones Choices on ETFs From Ark, VanEck

The SEC introduced on Wednesday that it’s delaying the choice on ARK 21Shares Ethereum ETF till December 26. Based on the company, the delay is critical because it permits taking “motion on proposed rule change” and contemplating the rule change and considerations that emerge from it.

“The Fee finds it applicable to designate an extended interval inside which to take motion on the proposed rule change in order that it has ample time to contemplate the proposed rule change and the problems raised therein,” the SEC filing stated.

It’s barely a month since Cathie Wooden’s Ark Make investments and 21Shares filed with the SEC. The transfer by the 2 firms was welcomed with open arms amid problems with extraordinarily low volatility throughout the crypto market.

Amidst fears of a authorities shutdown within the US, the SEC additionally delayed the choices on one other proposal, VanEck Ethereum ETF, which shall be thought-about once more on December 25.

On Tuesday, the company introduced the delayed resolution to approve or reject the ARK 21Shares Bitcoin ETF, which shall be thought-about once more in 2024 with the deadline set for January 10.

Ethereum Value Bullish Comeback

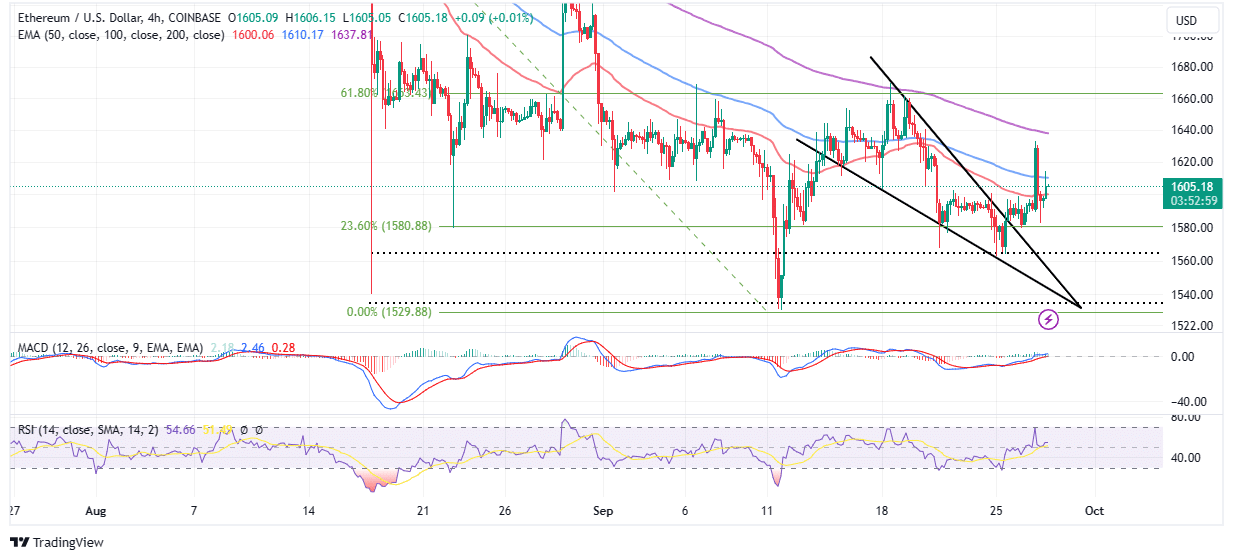

The delays on Ethereum spot ETFs triggered a minor retracement however help offered by the 23.6% Fibonacci degree gave bulls one other likelihood to reaffirm the uptrend. Ethereum at the moment holds above the 50 Exponential Shifting Common (EMA) (purple) at $1,600 and this can be a constructive short-term sign.

For Ethereum price to hold on with the uptrend, bulls should reclaim the 100 EMA (blue) help/resistance at $1,610 and do the identical with the 200 EMA (purple) at $1,640.

The Relative Power Index (RSI) reinforces the power of the uptrend because it seeks help above the midline following a rebound from near-oversold circumstances earlier this week.

Merchants may sit tight with confidence that ETH’s recovery will continue to $1,700 and later to $1,800 primarily based on the constructive outlook of the Shifting Common Convergence Divergence (MACD) indicator.

A purchase sign despatched on September 25 inspired merchants to hunt publicity to Ethereum longs. With the blue MACD line above the purple sign line, the trail with the least resistance will stay to the upside.

Associated Articles

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: