Ethereum has entered a risky and decisive part following weeks of sturdy shopping for stress and speedy worth appreciation. After pushing above $3,800, ETH is now dealing with resistance, with bulls stepping in to defend key decrease demand zones. The market seems unsure, caught between a possible continuation towards new highs and the chance of a broader cooldown.

Associated Studying

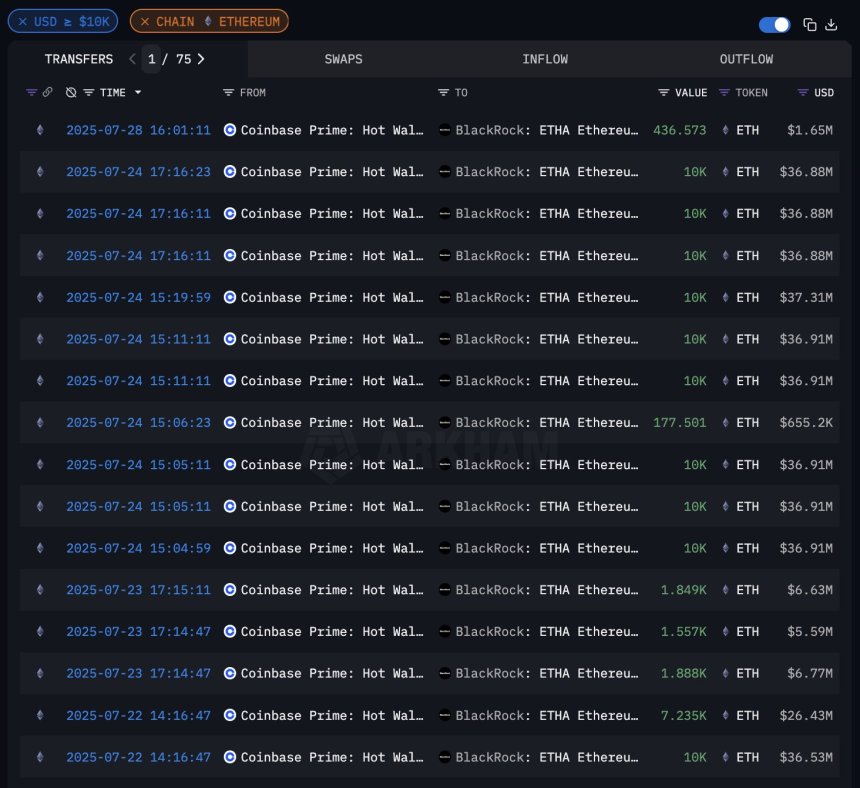

Including to the momentum, new information from Arkham reveals that BlackRock bought over 4 occasions extra Ethereum than Bitcoin final week. This shift marks a major second for institutional involvement in Ethereum and alerts rising confidence in its long-term potential. Analysts throughout the trade are starting to take notice, decoding the transfer as a sign that Ethereum could also be gaining favor amongst conventional finance giants.

As Bitcoin consolidates close to all-time highs, Ethereum now stands at a crossroads. Will it proceed climbing and shut the hole, or will rejection above $3,800 mark the start of a neighborhood prime?

BlackRock’s Ethereum Allocation Indicators Rising Institutional Shift

Arkham data has revealed a major improvement in institutional crypto allocation: BlackRock bought over $1.2 billion price of Ethereum final week, in comparison with simply $267 million in Bitcoin. This 4.5x disparity alerts a decisive shift in institutional technique, with capital now flowing extra aggressively into ETH than BTC. For a lot of available in the market, that is what true institutional Ethereum adoption seems like—large inflows that reshape market dynamics.

This shift didn’t begin in a single day. Institutional curiosity in Ethereum started constructing again in April, when ETH hit a cycle low close to $1,380. Since then, a mixture of authorized readability, progress round ETF approval, and Ethereum’s maturing position within the monetary ecosystem has fueled a gradual wave of accumulation from giant gamers. BlackRock’s newest allocation is solely essentially the most seen and vital affirmation of that development.

Because the broader crypto market heats up, Ethereum seems well-positioned to proceed its upward trajectory. Nevertheless, not all the things is easy. ETH is now struggling to interrupt by means of resistance across the $3,800 stage, and the failure to reclaim new highs is starting to stir uncertainty. Some analysts warn that the present rally could lose steam and not using a breakout, and worry of a short-term correction is rising.

Associated Studying

ETH Faces Key Resistance After Parabolic Rally

Ethereum has staged a formidable rally over the previous few weeks, surging from sub-$2,000 ranges to a present worth of $3,782.61. The weekly chart reveals a powerful bullish breakout from the $2,852.16 resistance zone, with ETH now approaching a vital barrier close to $3,860.80. Worth briefly reached a excessive of $3,941.86 earlier than pulling again, signaling potential short-term exhaustion after an aggressive upside transfer.

Quantity has elevated considerably throughout this breakout, confirming sturdy shopping for curiosity. The 50, 100, and 200-week SMAs—all converging round $2,700–$2,850—now function key assist, reinforcing the energy of the breakout. So long as ETH stays above the $2,850 stage, the broader construction stays bullish.

Associated Studying

Nevertheless, the present pause under $3,860 suggests indecision as bulls encounter historic resistance. A clear weekly shut above this stage may open the door to a continuation towards $4,200–$4,400. On the draw back, a rejection adopted by a drop under $3,500 could set off a short-term correction as merchants safe income.

Featured picture from Dall-E, chart from TradingView