Regardless of its underperformance on this market cycle, crypto analysts proceed to supply a bullish outlook for the Ethereum value. These analysts have recommended that ETH can rally to $4,000 in thirty days amid the Ethereum ETF growth.

Can The Ethereum Value Contact $4,000 In 30 Days?

Crypto analysts have recommended that the Ethereum value can attain $4,000 in thirty days amid the ETH ETF growth. These analysts embrace Ted, who lately predicted that ETH will reach $4,500 this month. This got here because the analyst additionally predicted that the crypto might attain $10,000 within the subsequent three to 4 months.

In a current X post, the analyst once more reaffirmed his conviction about Ethereum and outlined why he’s very bullish on ETH. First, he talked about that Donald Trump’s World Liberty Monetary had purchased over $200 million value of ETH.

Secondly, the analyst talked about that Eric Trump is tweeting about ETH, which he considers bullish for the Ethereum value. Trump has tweeted that he believes now’s a “nice time” to purchase ETH.

The crypto analyst then asserted that Ethereum staking ETF can be accepted, which can also be a bullish basic ETH. It’s value mentioning that Kraken has already relaunched its crypto staking services for US clients, a transfer that might be geared in the direction of the approval of this staking ETF.

Different fundamentals the analyst alluded to that would drive the ETH value to $4,000 in thirty days embrace upcoming community upgrades, which might result in decrease charges, higher staking, and an improved token burn mechanism.

Ted additionally added that Ethereum is the one sensible contract platform with a commodity-classified coin and spot ETF help. The analyst famous that main gamers like Deutsche Financial institution and UBS are constructing on Ethereum layer-2.

ETH ETF Growth Offers A Bullish Outlook

The Ethereum ETF growth additionally supplies a bullish outlook for the ETH price. These funds recorded $83.6 million in internet inflows yesterday, sparking a bullish sentiment amongst traders.

This growth is much more vital contemplating that the Bitcoin ETFs recorded $2334.4 million in internet outflows yesterday. As such, institutional traders look to be closely bullish on ETH and used the crypto market crash yesterday as a possibility to build up extra Ethereum. These traders have been accumulating the crypto since final week, with these funds recording vital inflows.

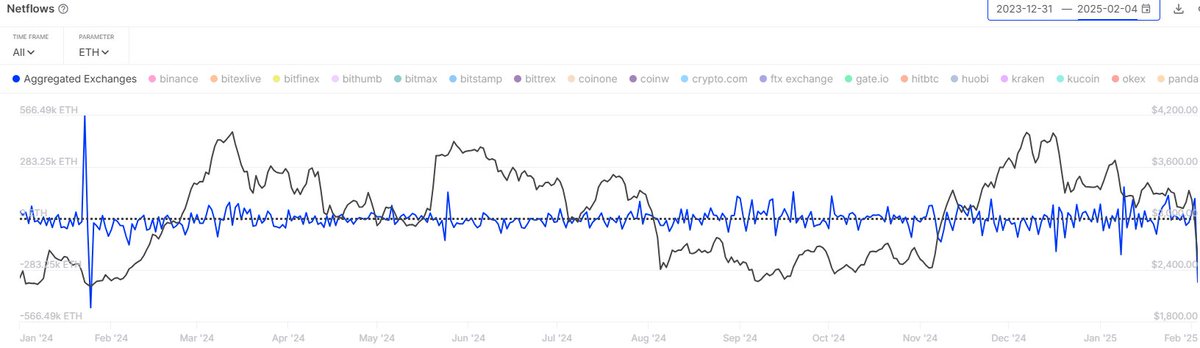

Crypto whales are additionally nonetheless bullish on the Ethereum value regardless of its underperformance. Market intelligence platform IntoTheBlock revealed that 350,000 ETH value almost $1 billion was withdrawn from exchanges yesterday.

The platform additional revealed that that is the very best quantity of internet change withdrawals since January 2024. As such, merchants took benefit of the dip alongside these institutional traders.

One other Bullish Case For ETH

Crypto analyst Titan of Crypto additionally shared an Ethereum value evaluation, which recommended that ETH might attain $4,000 within the subsequent thirty days. In an X submit, the analyst famous that ETH’s present cycle conduct intently mirrors Bitcoin’s previous cycle proper earlier than its breakout and main run-up.

The analyst added that historical past repeats, but it surely usually rhymes. His accompanying chart confirmed that the Ethereum value might break above $4,000 and rally to as excessive as $8,200 this 12 months as a part of this run-up section.

Disclaimer: The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: