Latin America’s crypto panorama has proven a definite desire for centralized exchanges (CEXs) over decentralized exchanges (DEXs), in response to a current report launched by blockchain analytics agency Chainalysis.

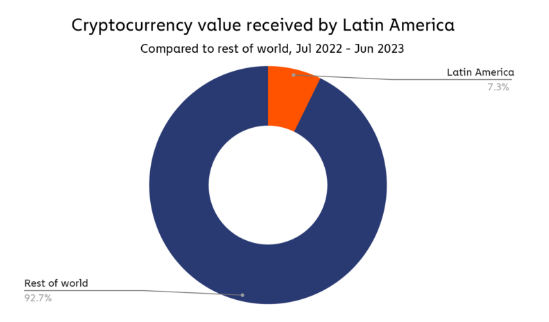

This distinctive development, as outlined within the report, has positioned the area as a big participant within the world crypto financial system, regardless of its comparatively decrease rating in comparison with areas just like the Center East and North America (MENA), Japanese Asia, and Japanese Europe.

The report underscored that Latin America exhibited the very best inclination towards centralized exchanges when in comparison with different areas. Whereas highlighting this desire, the report additionally identified the area’s deviation from in depth institutional exercise.

Supply: Chainalysis

Centralized Exchanges And Crypto Adoption In Latin America

Within the wake of the COVID-19 pandemic that gripped the globe in 2020, the function of cryptocurrencies gained prominence, particularly in Latin American nations. The report emphasised the vital role played by crypto assets in immediately helping healthcare professionals and aiding the populace through the pandemic.

With conventional cost methods going through hurdles as a result of authorities’s resistance to accepting worldwide assist, typically influenced by political motivations, the importance of cryptocurrencies as a viable different turned much more obvious.

Venezuela, specifically, emerged as a placing instance throughout the regional crypto narrative. With 92.5% of the crypto quantity being attributed to centralized exchanges, and a mere 5.6% on decentralized exchanges, the nation’s distinctive socio-political and humanitarian challenges had been recognized as the first drivers of this adoption sample.

Bitcoin buying and selling at $27,768 as we speak. Chart: TradingView.com

Chainalysis pointed to Venezuela’s ongoing humanitarian disaster, the place using crypto performed a pivotal function in facilitating assist and dealing with the socio-economic challenges that plagued the nation.

Equally, Colombia showcased a powerful desire for centralized exchanges, with a considerable 74% of the crypto quantity leaning in direction of CEXs, versus a modest 21.1% on DEXs.

Argentina, then again, distinguished itself as a frontrunner throughout the Latin American crypto panorama, boasting an estimated $85 billion in crypto transaction quantity from July 2022 to June 2023. This staggering determine underscores the nation’s sturdy engagement with digital belongings, reflecting a maturing and more and more built-in crypto ecosystem.

Latin America’s Impression On International Crypto Adoption Index

Regardless of the challenges and distinctive developments throughout the Latin American crypto house, the area has made important strides in world crypto adoption. Notably, three Latin American international locations—Brazil, Argentina, and Mexico—secured positions throughout the prime 20 ranks on Chainalysis’ Global Crypto Adoption Index.

This recognition additional solidifies Latin America’s place as a notable participant within the world crypto financial system, underscoring its potential for additional development and affect throughout the broader digital asset panorama.

As Latin America continues to navigate its distinctive mix of financial challenges, socio-political complexities, and evolving technological landscapes, the function of cryptocurrencies is predicted to stay pivotal in shaping the area’s monetary future.

Featured picture from TradeSanta