Key Notes

- Illicit crypto flows to exchanges dropped from $14B yearly to $7B in H1 2025 as criminals keep away from fiat conversion.

- Darknet directors management over $46 billion in digital property, representing the vast majority of illicit blockchain holdings.

- Coordinated authorities seizures may strengthen nationwide treasuries as nations set up strategic crypto reserves.

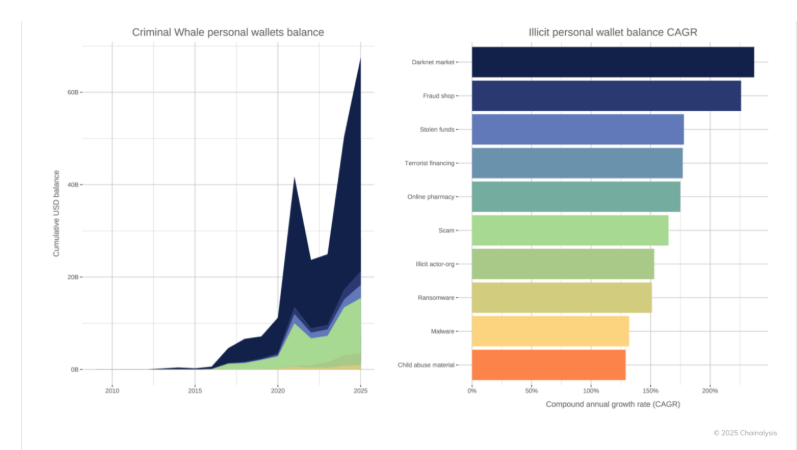

Blockchain analytics agency Chainalysis says greater than $75 billion in illicit crypto sits untouched throughout public blockchains.

According to the firm’s latest report, criminal-linked wallets at present maintain practically $15 billion in digital property, with one other $60 billion in wallets related not directly to scams, hacks, or darknet markets.

Legal pockets balances | Supply: Chainalysis

Chainalysis additionally discovered darknet directors alone management over $46 billion in crypto, accounting for the majority of the shadow economic system.

Whereas Bitcoin

BTC

$120 823

24h volatility:

2.5%

Market cap:

$2.41 T

Vol. 24h:

$70.07 B

stays the dominant asset held by illicit actors by worth, Ethereum

ETH

$4 323

24h volatility:

4.7%

Market cap:

$521.51 B

Vol. 24h:

$43.19 B

and stablecoin balances have grown quickly resulting from their rising adoption and relative worth stability.

Governments May Goal Illicit Crypto For Strategic Reserves

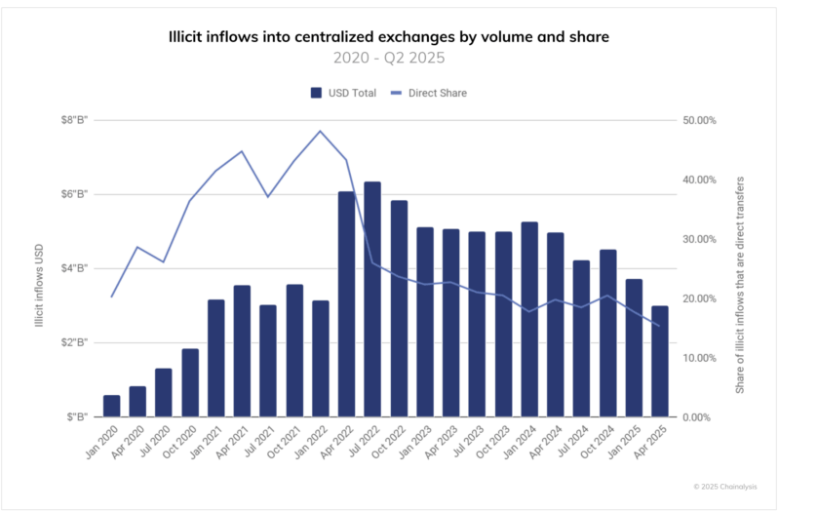

Chainalysis knowledge reveals inflows from illicit sources to centralized crypto exchanges (CEXs) have averaged $14 billion yearly since 2020 however are trending downward. Within the first half of 2025 alone, about $7 billion in unlawful crypto funds hit exchanges, a pointy decline from 2022 ranges.

Illicit Fund Flows on Centralized Exchanges | Supply: Chainalysis

The report attributes this to criminals more and more utilizing crypto as a fee methodology and retailer of worth, avoiding fiat conversion. Direct transfers to exchanges have plummeted from 40% in July 2022 to fifteen% in 2025, as illicit actors flip to crypto mixers and cross-chain bridges.

Stablecoins, which could be frozen by issuers, are the least concentrated, as criminals diversify holdings to keep away from complete losses from asset freezes.

Trump issued executive orders to ascertain the US Strategic Bitcoin Reserve (SBR) and Digital Asset Stockpile (DAS), creating frameworks for the federal government to confiscate and handle seized crypto funds.

With sovereign nations like El Salvador and Bhutan formally adopting crypto reserves lately, Chainalysis argues that coordinated seizures of illicit crypto may strengthen the nationwide treasury.

The agency has already helped world authorities together with Spain and the US seize $12.6 billion in unlawful funds by forensic investigations.

Maxi Doge Presale Nears $3M as Chainalysis Investigates Illicit Actors

As Chainalysis investigations assist governments to clamp down on illicit actors, improved market sentiment has seen merchants rotate towards early-stage initiatives like Maxi Doge (MAXI), a meme-driven ecosystem providing merchants as much as 1000% in leverage.

Maxi Doge Presale

The Maxi Doge presale has raised over $2.7 million of its $3 million goal, underscoring sturdy retail demand forward of its official launch. At the moment priced at $0.00026, early buyers can nonetheless safe MAXI tokens by way of the official presale web site earlier than the following worth tier prompts in 48 hours.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.