Chainlink is coming into an explosive section as change provide hits a multi-year low. The Chainlink Reserve initiative additional strengthens its function because the “spine” of the tokenized monetary system.

In the meantime, LINK should break by means of and maintain the important resistance vary of $24.5 – $24.85 to ignite a strong bullish wave.

Chainlink’s Provide Shock Taking place

Over the previous week, the Chainlink (LINK) community has recorded a number of important developments, reflecting the speedy enlargement of this Oracle ecosystem. A number of companies and blockchains, reminiscent of Arbitrum, Base, Ethereum, and Polygon, have built-in Chainlink requirements.

Not stopping there, Bitwise has additionally filed an S-1 with the SEC for a Chainlink ETF, giving regulated entry to LINK by means of a Delaware belief. The ETF tracks LINK’s value by way of the CME CF Chainlink–Greenback Reference Price, with Coinbase Custody safeguarding the reserves.

Chainlink additionally partnered with the US Division of Commerce to carry on-chain macroeconomic knowledge, reminiscent of GDP and the PCE Index.

“Within the Nineteen Eighties, Bloomberg terminals reworked how merchants accessed info. At the moment, Chainlink is reworking how blockchains entry authorities knowledge. This isn’t a marginal improve; it’s the basis for the way trillions in worth will transfer securely within the tokenized financial system,” one X person shared.

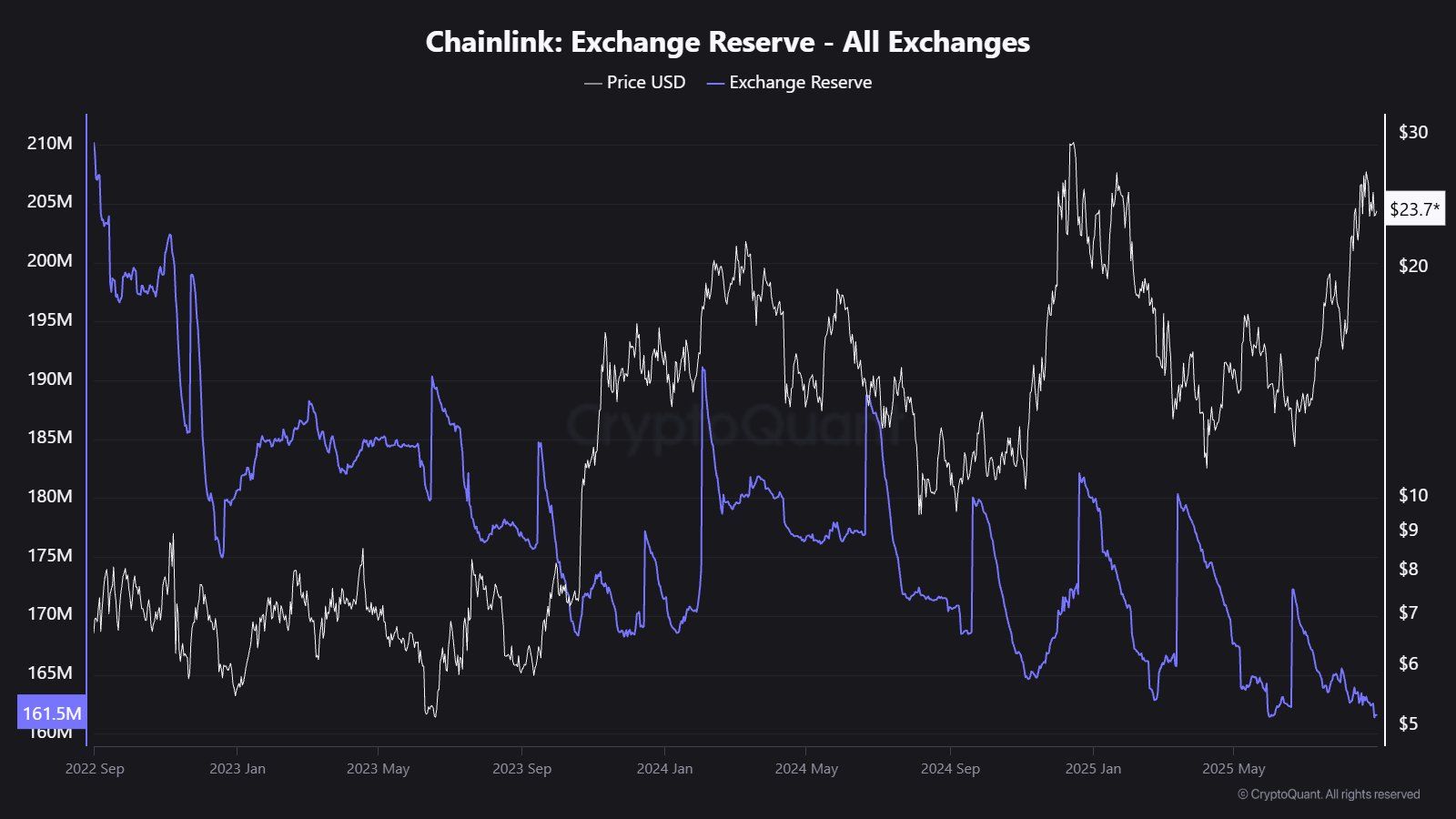

These optimistic developments have had a transparent affect on LINK’s dynamics. The quantity of LINK held on exchanges has dropped to its lowest degree in years. Mixed with the constantly growing Chainlink Reserve, this might set off a provide shock. With demand rising and provide changing into scarce, the setup for a big value rally is in place.

Key Stage for LINK

Many specialists argue that LINK is the backbone of the new financial system. World banks are starting to undertake it, an ETF might quickly be launched, and even the US authorities is partaking with it. In response to some analysts, LINK is changing into the “coin of the cycle,” with each central crypto narrative revolving round it.

From a technical perspective, LINK’s value is forming a tightening wedge sample. Analysts recommend the $24.5 zone is an important breakout degree; clearing and holding above it will verify a bullish development. In the meantime, though LINK has surged 109% over the previous 12 months, present momentum reveals indicators of exhaustion.

Nonetheless, LINK’s most up-to-date month-to-month candle closed strongly bullish. September is predicted to be an upward section, with a breakout above $24.85 probably extending the rally additional.

On the time of writing, LINK is buying and selling at $23.70, up 3.1% within the final 1 hour, down 55% from its Could 2021 ATH.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.