Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has damaged out of a technical formation which will place it on monitor towards a decisive check zone between $96,200 and $102,100. If confirmed within the coming days, the motion would signify a significant worth growth in Bitcoin’s ongoing market structure. A crypto analyst highlighted this zone as one the place Bitcoin’s trajectory might both lengthen to new highs or face its subsequent rejection.

Associated Studying

Descending Broadening Wedge Breakout Clears Path To $100,000 Once more

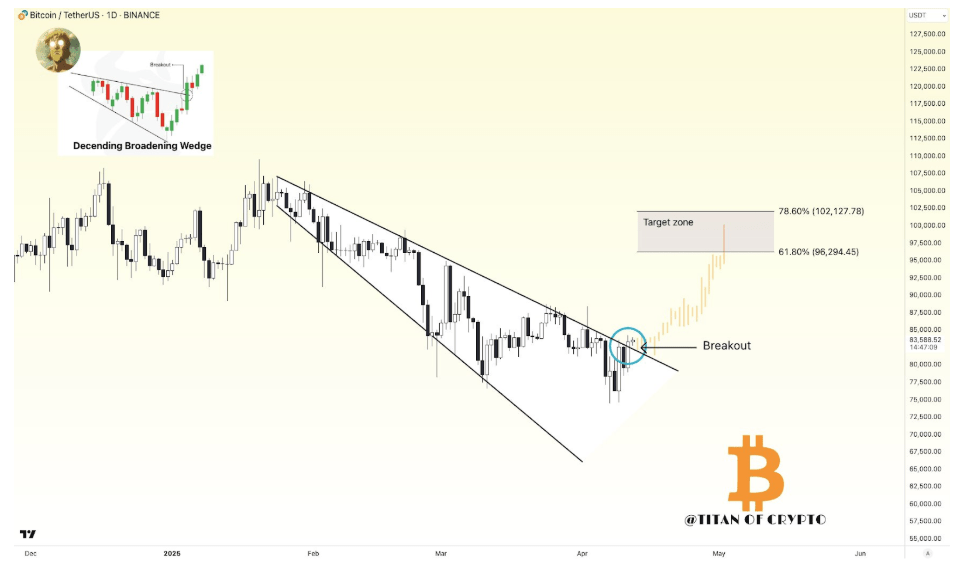

Bitcoin’s worth motion prior to now 24 hours is highlighted by a return to $85,000 as shopping for stress began to creep in. Apparently, this shopping for stress has damaged out above the higher trendline of a descending broadening wedge formation. This sample is often thought-about a reversal sign, and its breakout implies sturdy upward continuation if validated.

The breakout of the formation was famous in an analysis posted on social media platform X by crypto analyst Titan of Crypto. Notably, the worth chart shared by the analyst exhibits that the wedge formation has been happening within the every day candlestick timeframe over the previous three months. The wedge started forming after Bitcoin’s peak above $108,000 in late January and step by step widened.

On the time of the evaluation, Bitcoin’s worth had already made two every day candlestick closes above the higher trendline of the broadening wedge. In keeping with the analyst, the breakout will most definitely be confirmed this week. If confirmed, it will open up the stage for a run above the $100,000 worth stage once more or not less than $96,200.

Significantly, Titan of Crypto highlighted the area between $96,200 and $102,100 as the following goal zone. The analyst emphasised that this vary might act because the precise check of Bitcoin’s power, as it should reveal whether or not the breakout results in continuation or stalls into rejection.

Picture From X: Titan of Crypto

Leverage Construct-Up Factors To $8 Billion Brief Squeeze Potential Above $90,000

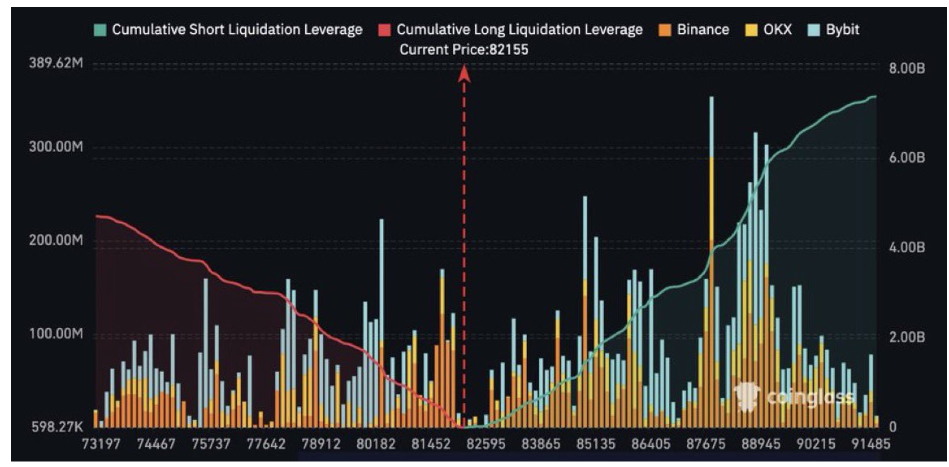

Crypto analyst Sensei also commented on Bitcoin’s present worth construction, noting {that a} transfer to $90,000 might set off an enormous liquidation occasion. Primarily based on knowledge from Coinglass, greater than $8 billion briefly positions can be weak if Bitcoin rose above $90,000 again.

The cumulative quick liquidation chart from Coinglass exhibits a big wall of leveraged quick curiosity concentrated beneath that stage throughout main exchanges like Binance, OKX, and Bybit.

Picture From X: Sensei

Associated Studying

The info displays a major imbalance within the derivatives market, with quick positions dominating till the $90,000 mark, past which liquidation-driven shopping for might intensify. If Bitcoin does push into this zone, the ensuing cascade of liquidations amongst quick positions might present the momentum required to push the Bitcoin worth towards the $96,200 to $102,100 goal zone.

On the time of writing, Bitcoin was buying and selling at $84,706.

Featured picture from Freepik, chart from TradingView