Subsequent Expertise Holding (NASDAQ: NXTT) stated it filed for a shelf registration that might let the corporate provide as much as $500 million of widespread inventory, and stories say a few of the cash may very well be used to purchase extra Bitcoin. Based on the submitting, the transfer offers the corporate flexibility to boost money over time.

Firm Plans And Holdings

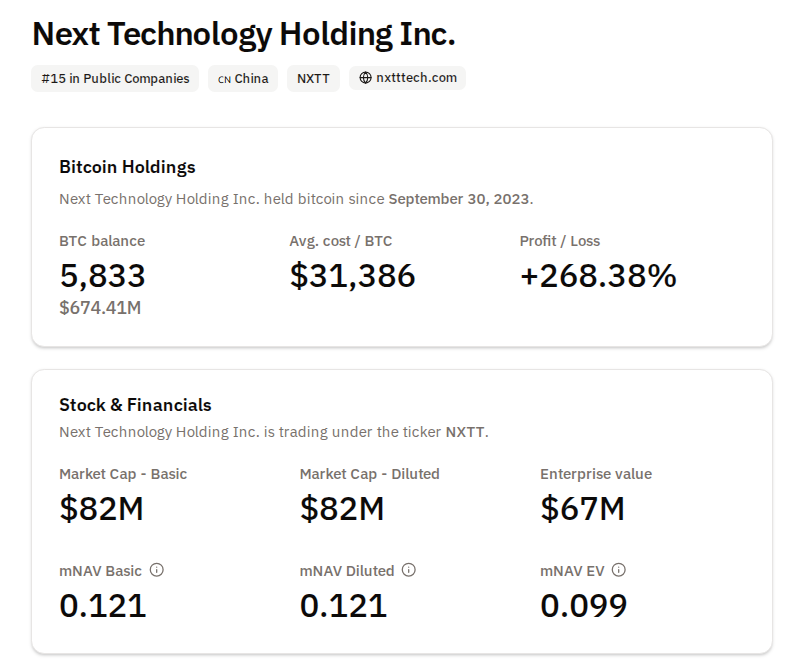

Based mostly on stories and regulatory filings, Subsequent Expertise information present it holds 5,833 BTC. The corporate’s March 2025 10-Q lists a guide worth for its Bitcoin holdings of roughly $480 million.

The shelf registration itself doesn’t pressure a direct sale of shares, but it surely does permit NXTT to promote inventory when administration chooses and market situations look proper.

Traders Reacted Shortly To Previous Strikes

NXTT’s technique of utilizing company money to construct a Bitcoin treasury has moved its share value earlier than. When the corporate disclosed giant purchases earlier this 12 months — together with a purchase of 5,000 BTC that was reported in filings — the inventory skilled sharp swings.

BTCUSD buying and selling at $115,612 on the 24-hour chart: TradingView

Some merchants see new share gross sales tied to Bitcoin buys as a option to speed up the corporate’s asset-growth plan, whereas different shareholders warn about dilution if a big providing is accomplished.

Regulatory And Funding Particulars

Based on the paperwork from the Securities and Trade Fee, the registration seems to be an ordinary S-3 shelf submitting.

A shelf lets a agency register securities prematurely after which promote them in a number of choices with out repeating the complete registration course of every time.

What It Might Imply For Bitcoin Costs

If Next Technology had been to promote shares and use the proceeds to purchase extra BTC, the corporate’s purchases may add to demand within the spot market.

That stated, the size issues. At 5,833 BTC on the books now, a follow-on purchase funded by fairness may very well be significant however would nonetheless be a small fraction of day by day international buying and selling volumes.

Analysts say market strikes rely on timing, the dimensions of any purchase, and whether or not different giant holders act on the similar time.

Based mostly on the submitting language, Subsequent Expertise can transfer slowly or act quick — it will likely be as much as administration. Dangers embody share dilution, value volatility for NXTT inventory, and the mechanics of custody and accounting for added Bitcoin. Any plan to spend capital on crypto shall be judged by traders towards these trade-offs.

Featured picture from Anne Connelly – Medium, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.