The current decline in Bitcoin value under the $59,000 mark has reignited debates about its future trajectory. Because the market grapples with potential downturns, analysts are questioning whether or not Bitcoin might plunge additional to $50,000 and even $45,000.

In the meantime, market sentiment, fueled by a mixture of concern and strategic maneuvers, means that buyers are bracing for extra turbulence within the coming weeks.

Market Traits Indicators At Additional Downturn

The favored on-chain analytics agency 10X Research has highlighted considerations over Bitcoin’s present efficiency. Their evaluation means that Bitcoin is going through a crucial part, marked by lowering liquidity and elevated market apprehension.

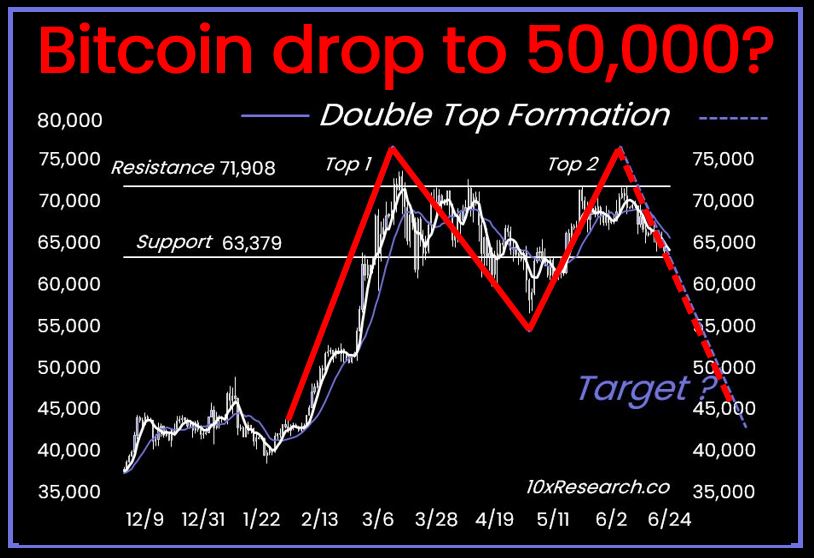

A current submit by 10X Analysis on X exhibits a value chart indicating a attainable drop to $50,000 and even decrease to $45,000. They cautioned buyers concerning the potential dangers of a “double high” formation, a chart sample that always precedes a major value drop.

In the meantime, this sample signifies that Bitcoin, after failing to surpass a key resistance stage, might have reached a peak and might be headed for a steeper decline. “As Bitcoin continues to battle, liquidity is drying up,” they famous.

As well as, the evaluation highlights the significance of threat administration, notably in such risky intervals. Their earlier warnings about Ethereum and Solana have been validated by current value declines, suggesting a broader development of warning amongst digital property.

Additionally Learn: Bitcoin Crashes 30% Against Gold, Here’s Why Peter Schiff Warns Further Dip

Exterior Components Weighing On Bitcoin Value

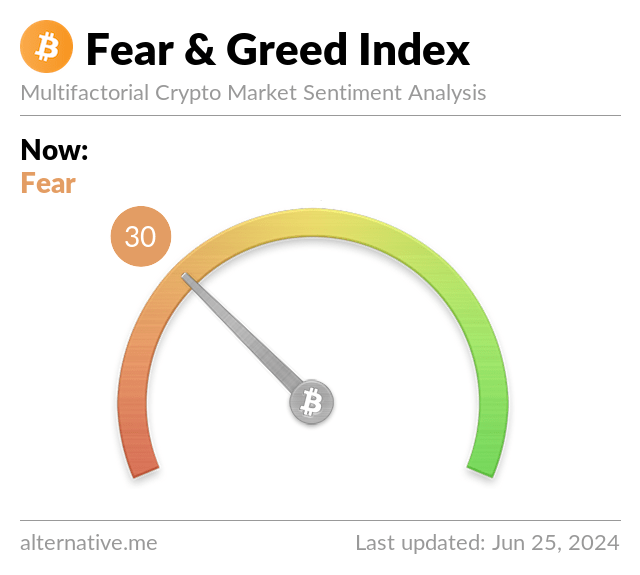

A number of exterior components have contributed to Bitcoin’s sluggish efficiency lately. The Bitcoin Worry and Greed Index, a instrument that measures market sentiment, has dropped to 30, indicating a prevailing sense of concern amongst buyers. That is the bottom stage since September 2023, reflecting rising considerations concerning the market’s route.

Including to the uncertainty, the long-defunct crypto change Mt. Gox introduced that it’ll start repaying collectors in Bitcoin and Bitcoin Money beginning subsequent week. This growth is a major step in resolving points that date again to Mt. Gox’s collapse in 2014.

Nonetheless, the potential inflow of Bitcoin into the market might exacerbate volatility, posing additional challenges to cost stability. In different phrases, the event has fueled considerations among the many market individuals over an extra drop in Bitcoin value.

As well as, Germany’s authorities lately deposited practically 400 Bitcoins, price roughly $25 million, into exchanges Kraken and Coinbase. This transfer follows the same switch of about 1,700 Bitcoins, heightening considerations about elevated provide and potential market impacts.

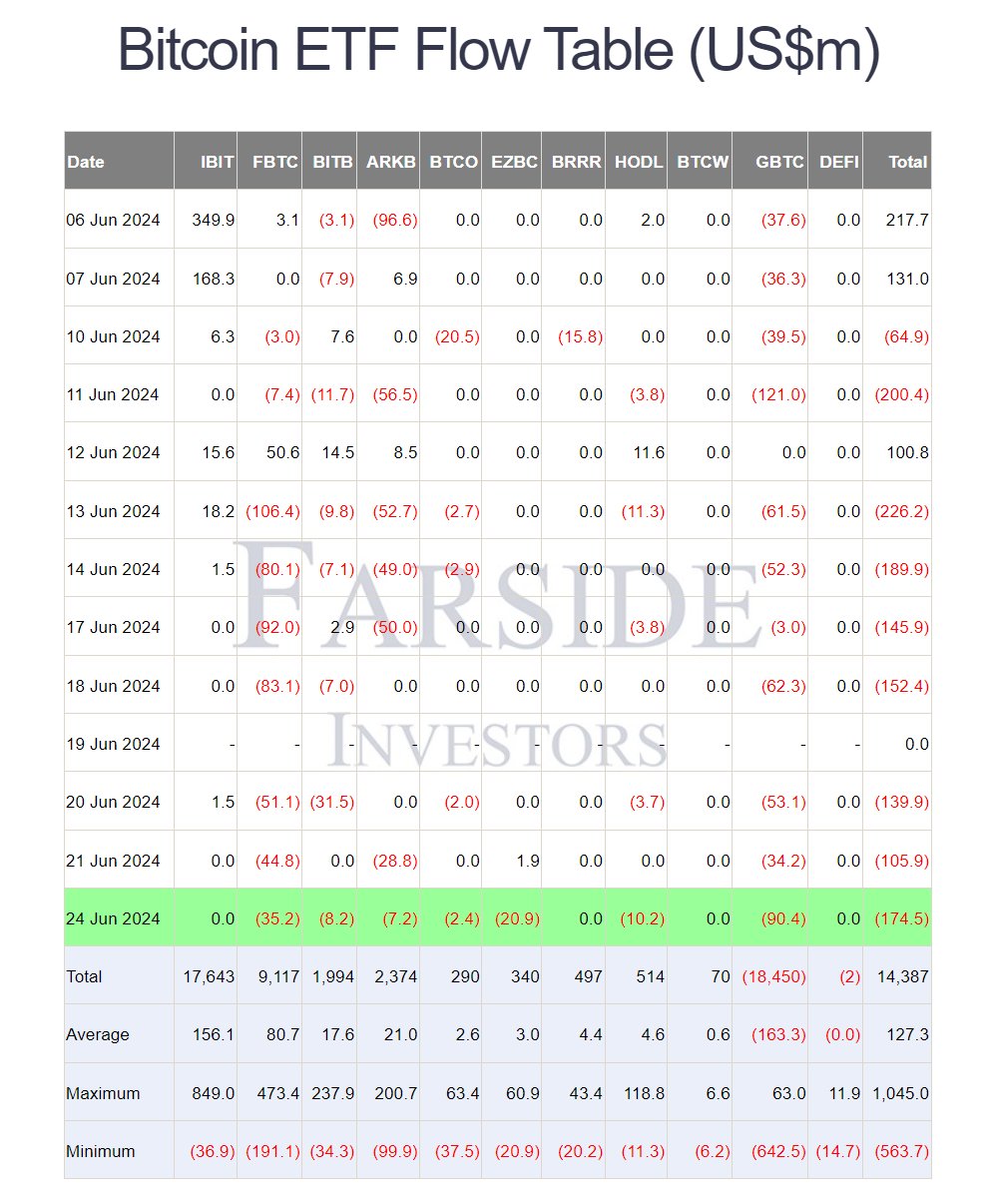

Amid this, the continued outflow from the U.S. Spot Bitcoin ETF has additionally weighed closely on investor sentiment, contributing to the general bearish outlook. In keeping with current knowledge, the U.S. Spot Bitcoin ETFs recorded an outflow of $174.5 million on June 24.

Additionally Learn: Toncoin Price Regains Support After 5% Surge, What’s Coming Next?

What’s Subsequent?

As Bitcoin navigates this turbulent part, buyers are carefully looking forward to indicators of a backside. The potential for Bitcoin to dip to $50,000 stays an actual risk, pushed by each inner market dynamics and exterior pressures.

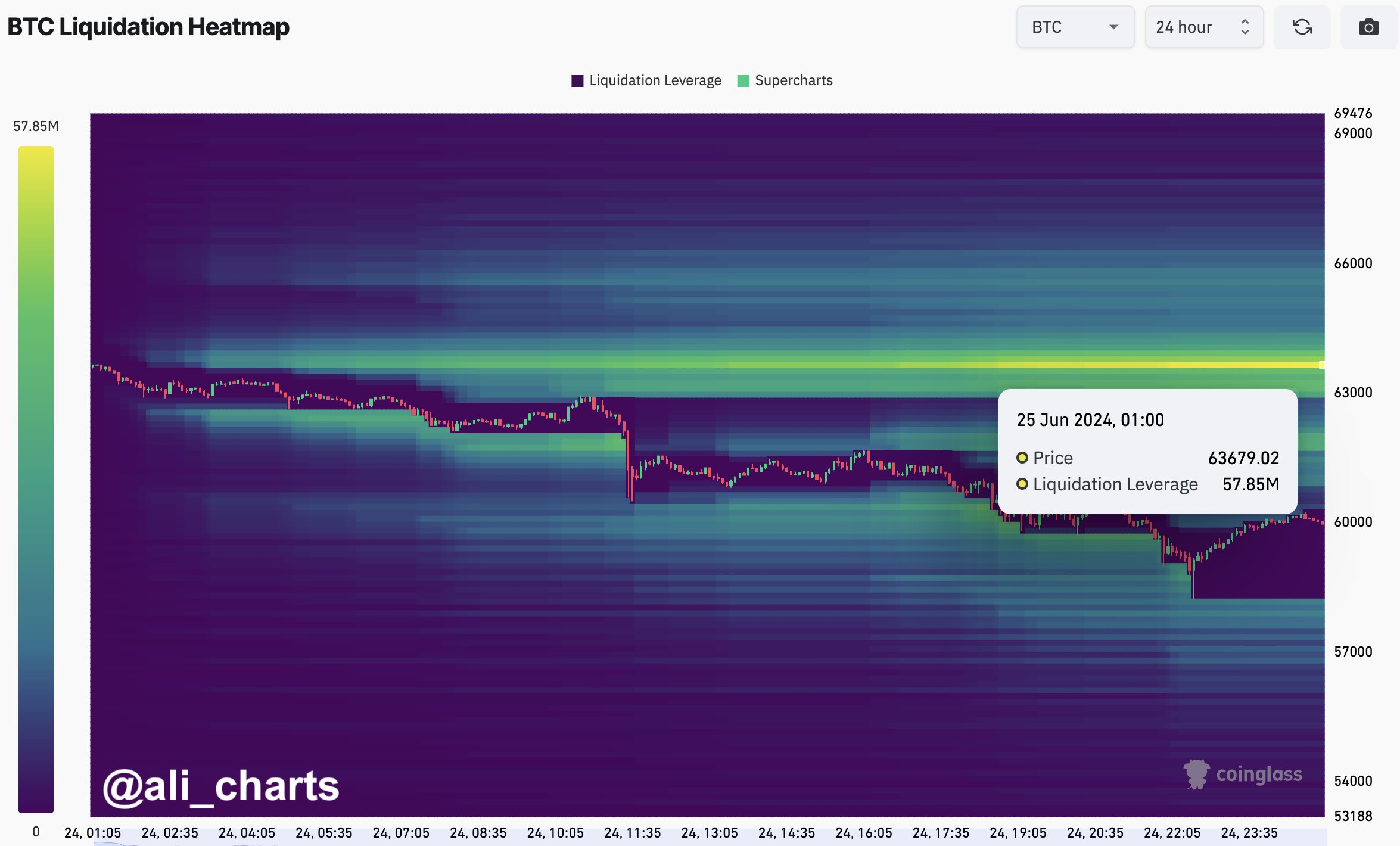

Nonetheless, some market pundits are nonetheless bullish on Bitcoin value’s trajectory in the long term. The consultants have argued that the current BTC dip would offer extra shopping for alternatives for buyers, which in flip might probably drive the Bitcoin value increased. Regardless of that, it’s price noting that in style crypto market analyst Ali Martinez warned of over $57.85 million liquidation if Bitcoin value hits the $63,7000 mark.

In the meantime, as of writing, Bitcoin price traded close to the flatline within the final 24 hours and crossed the $61,000 mark. The 24-hour excessive for BTC was $62,900.83, whereas a low of $58,601 was famous in the identical time-frame, indicating the heightened risky state of affairs available in the market.

Moreover, CoinGlass knowledge confirmed that Bitcoin Futures Open Curiosity (OI) rose 0.84% to $32.62 billion within the four-hour time-frame.

Additionally Learn: Shiba Inu Coin & Pepe Coin Whales Offload $26M In SHIB & PEPE, What’s Next?

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: