Key Notes

- Federal cloud infrastructure growth positions AWS as dominant supplier for presidency AI processing and analysis functions.

- Cryptocurrency markets reply positively with AI tokens gaining collective worth amid rising institutional adoption indicators.

- NEAR Protocol leads sector efficiency whereas selective profit-taking impacts established tokens like Bittensor regardless of bullish traits.

AI-linked cryptocurrencies surged on Nov. 24 as Amazon confirmed a landmark plan to speculate as much as $50 billion in new AI and supercomputing infrastructure for US federal companies. The initiative will deploy almost 1.3 gigawatts of high-performance computing capability throughout AWS High Secret, AWS Secret, and AWS GovCloud areas, starting building in 2026.

According to the press release, the funding will increase US companies’ entry to AWS’s full AI stack, together with SageMaker, Bedrock, Nova, Anthropic Claude, open-weights basis fashions, and AWS Trainium chips.

Federal companies will now be capable to course of a long time of nationwide safety knowledge in actual time. Amazon acknowledged the growth may also help autonomous programs, satellite tv for pc imagery, and scientific analysis beneath the Trump Administration’s AI Motion Plan.

AWS CEO Matt Garman expressed expectations for the funding to rework how federal companies leverage supercomputing to allow crucial workloads with out computational limitations.

Already serving greater than 11,000 companies, the announcement reinforces Amazon’s place as the leading cloud service provider to the US authorities.

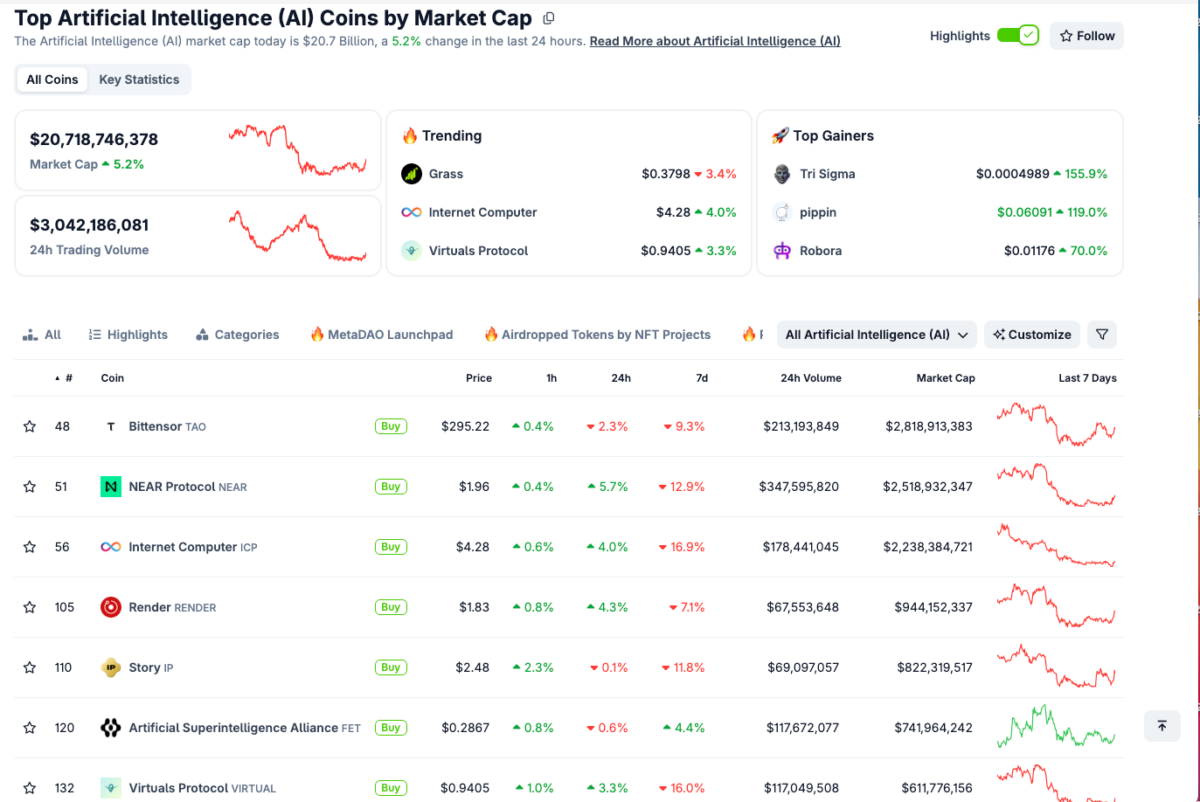

AI Crypto Tokens Rally to $20.7B as Merchants Worth AI Infrastructure Growth

Amazon’s supercomputing announcement arrived barely 24 hours after Elon Musk revealed a breakthrough in Tesla’s inner AI chip manufacturing efforts, setting AI adjoining markets up for a bullish opening on Nov. 24.

The tailwinds have additionally lifted crypto AI tokens, with Coingecko data exhibiting sector capitalization rising 5.2% to $20.7 billion on Nov. 24.

Crypto AI tokens rally to $20.7 billion on Nov. 24 | Supply: Coingecko

Cumulative intraday quantity reached $3.3 billion, reflecting deeper liquidity as merchants rotated into AI-adjacent belongings. NEAR Protocol

NEAR

$1.94

24h volatility:

4.6%

Market cap:

$2.48 B

Vol. 24h:

$365.32 M

led good points with a 5.7% enhance, supported by rising developer exercise and powerful L2 interoperability flows. Web Laptop

ICP

$4.21

24h volatility:

2.7%

Market cap:

$2.27 B

Vol. 24h:

$198.14 M

and Render [NC] adopted, every posting 4% good points as traders priced in rising demand for decentralized computing.

Nevertheless, merchants remained selective. Bittensor

TAO

$294.8

24h volatility:

2.2%

Market cap:

$2.83 B

Vol. 24h:

$222.35 M

, the sector’s largest token by market cap, dropped 2.7% amid profit-taking and up to date promote strain from miners. Story Protocol

IP

$2.49

24h volatility:

1.8%

Market cap:

$822.89 M

Vol. 24h:

$63.78 M

and Synthetic Superintelligence

FET

$0.28

24h volatility:

0.5%

Market cap:

$731.68 M

Vol. 24h:

$122.41 M

additionally remained flat, whereas seven of the opposite prime 10 ranked AI tokens traded in revenue.

Finest Pockets Presale Crosses $17.4M as Amazon Fuels Bullish Sentiment

As Amazon’s $50 billion funding boosts market sentiment, strategic merchants are switching focus to early-stage AI-driven tasks like Finest Pockets.

Finest Pockets Presale

Finest pockets affords safe storage, staking rewards, and built-in multi-chain entry, combining self-custody and passive earnings alternatives.

Finest Pockets presale has now raised $17.4 million. Early individuals have lower than 24 hours to safe BEST tokens at $0.026 through the official Best Wallet website earlier than the following value tier unlocks.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.