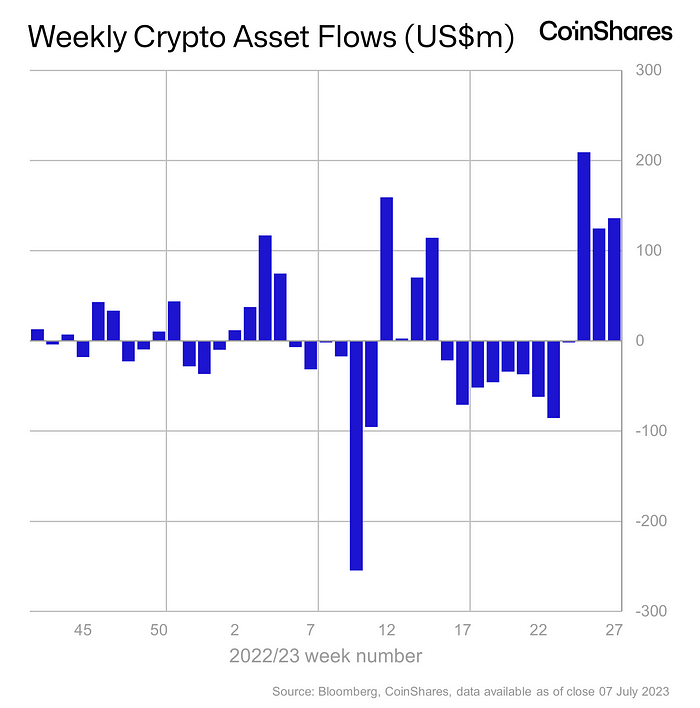

Crypto asset funding merchandise recorded the primary week of outflows after 4 consecutive weeks of inflows from establishments that totaled $742 million, in response to a report by CoinShares on July 24. Crypto asset funding merchandise noticed minor outflows totaling $6.5 million. Merchants speculate whether or not the institutional shopping for is over as they offload some Bitcoin holdings.

Crypto Funds File Outflows Amid Revenue Reserving in Bitcoin

Crypto asset funds noticed a complete of $742 million of inflow within the final 4 weeks. The inflows introduced year-to-date flows to a web constructive regardless of 9 weeks of outflows. Bitcoin recorded enormous inflows amid spot Bitcoin ETF filings by BlackRock, Fidelity Investments, and different monetary giants.

Nevertheless, $6.5 million in crypto asset outflows final week raised hypothesis of correction within the crypto market. Traders offered Bitcoin value $13 million and switched to Ethereum, which noticed $6.6 million inflows. Additionally, quick Bitcoin funding merchandise recorded the thirteenth consecutive week of outflows totaling $5.5 million.

After Ethereum, XRP recorded probably the most inflows of $2.6 as a consequence of Ripple’s partial win in opposition to the US SEC. Different altcoins Solana, Uniswap, and Polygon (MATIC) noticed inflows totaling $1.1 million, $0.7 million, and $0.7 million, respectively. Buying and selling volumes decreased considerably final week.

ProShares ETFs, ETC Issuance GmbH, and Objective Investments recorded probably the most outflows final week. Unfavourable sentiment was primarily centered on the North American market, which noticed 99% of outflows ($21 million). This was offset by $12 million in inflows into Switzerland and $1.9 million into Germany.

Additionally Learn: Binance And Other Crypto Exchanges Announce Worldcoin (WLD) Listing

Bitcoin, Ethereum, and Altcoins Noticed Sudden Fall

A broader selloff throughout the crypto market noticed over $90 million value of crypto property liquidated in an hour and $150 million liquidated prior to now 24 hours. BTC price fell sharply to the $29,000 stage, with the worth at present buying and selling close to $29,200. In the meantime, ETH price trades close to $1850, falling comparatively lower than Bitcoin.

Authorities bond yields around the globe retreated, with the US 10-year Treasury word yield falling to three.81%. Merchants additionally bracing for key occasions comparable to rate of interest selections from the US Federal Reserve, the ECB, and the Financial institution of Japan.

Learn Extra: Crypto Market Selloff – Bitcoin, ETH, XRP Price Falling Sharply; What Happened?

The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.