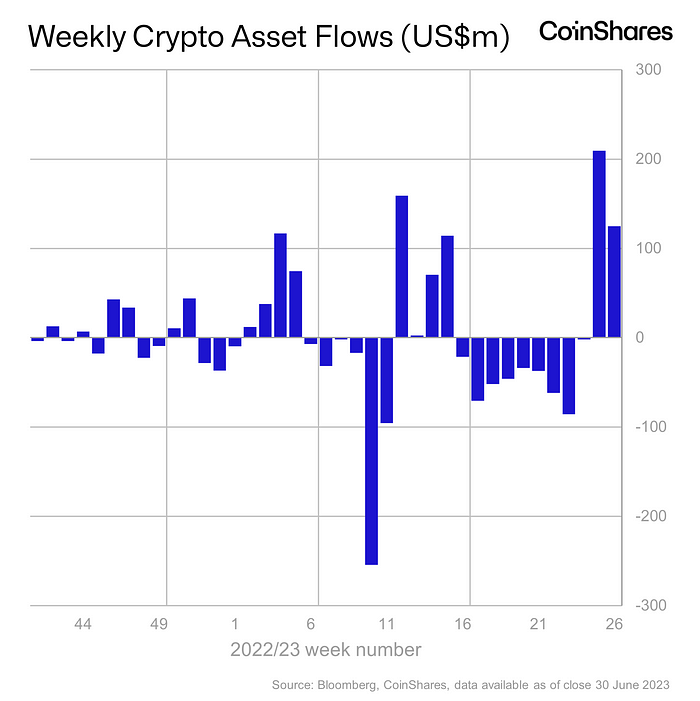

Institutional and retail traders stay bullish on crypto as digital asset funding merchandise noticed a second week of huge inflows. Crypto funds recorded a complete of $334 million of influx within the final two weeks, a $199 million inflow an earlier week and a $125 million influx final week. Bitcoin once more stays the favourite of traders, recording $123 million in inflows.

Bullish Sentiment on Crypto Continues

In keeping with CoinShares data, crypto asset influx for the week ending July 2 was $125 million. One other week of influx brings the whole inflows within the final two weeks to $334 million, virtually 1% of complete property below administration (AUM).

Bitcoin again recorded the biggest share of inflows value $123 million. Nevertheless, brief Bitcoin funding merchandise noticed a tenth week of successive outflows regardless of a latest worth soar, with this week’s outflow of $0.9 million.

“Bitcoin remained the first focus of traders, seeing inflows of US$123m, with the final 2 weeks inflows representing 98% of all digital asset flows. Bitcoin funding merchandise at the moment are again to a internet influx year-to-date having been in a internet outflow place of US$171m simply 2 weeks in the past.”

Traders have been additionally all for prime altcoins together with Ethereum, Litecoin, XRP, and Cardano. ETH led with inflows value $2.7 million. In the meantime, blockchain equities additionally noticed inflows of $6.8 million following a 9-week run of outflows amid constructive sentiment.

ProShares ETFs, Objective Investments, ETC Issuance GmbH, and CI Investments recorded essentially the most inflows final week.

Additionally Learn: Shiba Inu Official Predicts BONE Price At $3 As Shytoshi Kusama Hints At Shibarium Launch

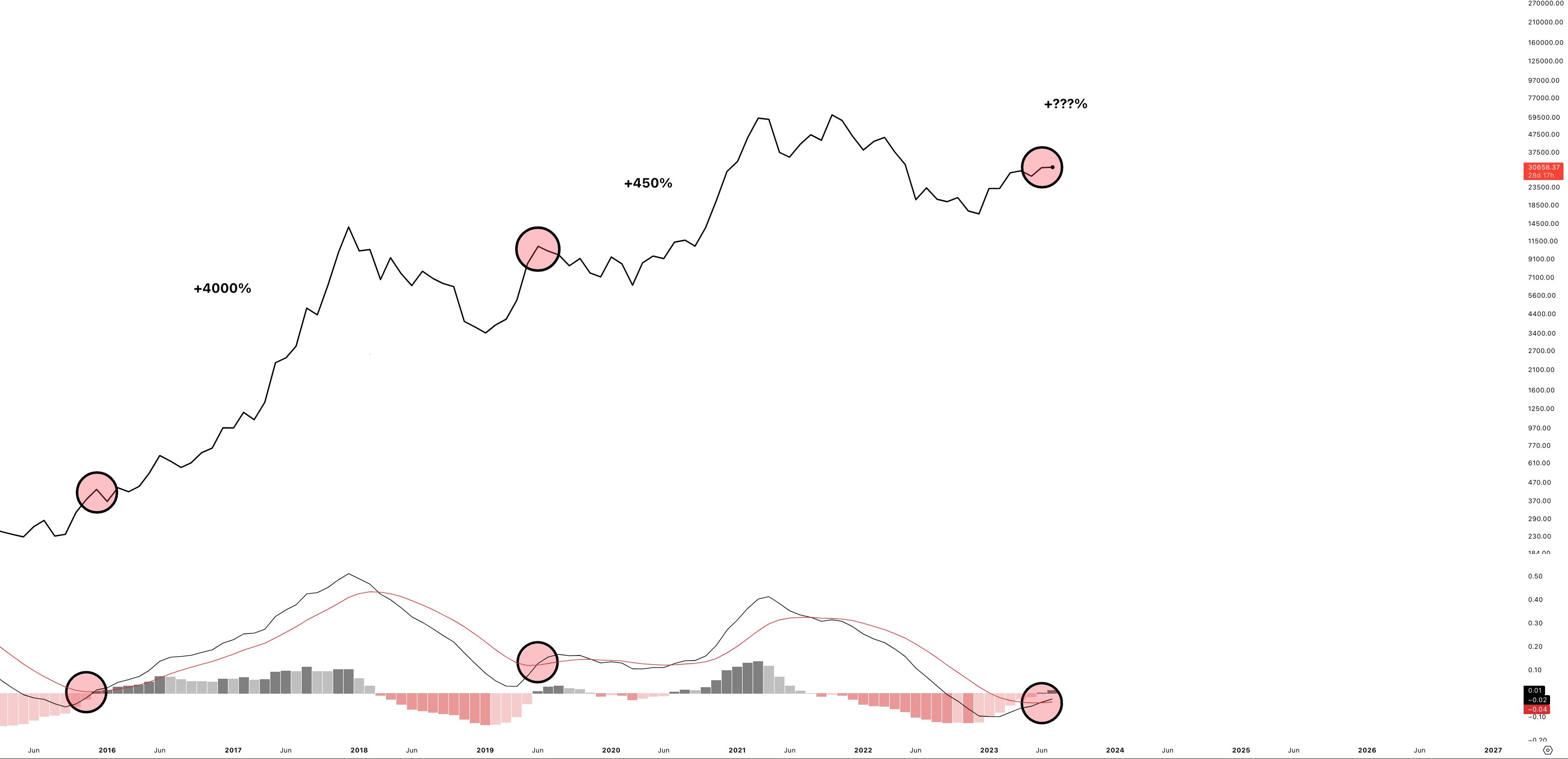

Bitcoin Worth Extra Bullish As Month-to-month MACD Turns Inexperienced

Bitcoin MACD indicator has turned inexperienced within the month-to-month chart, indicating huge upside strikes within the subsequent few months. It additionally confirms the start of a bull market.

Traditionally, this sign has triggered bull markets within the final two incidences, recording 4,000% and 450% good points. Crypto specialists and Bloomberg’s analysts are already bullish on Bitcoin worth hitting $40,000.

BTC price shifting sideways in the previous few days, with worth presently buying and selling at $30,637, up 0.5% within the final 24 hours. The 24-hour high and low for Bitcoin are $30,264 and $30,789, respectively. In the meantime, ETH price jumps greater than 2% up to now 24 hours, presently buying and selling at $1962.

Additionally Learn: Terra Luna Classic Community Passes Three Crucial Proposals

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.