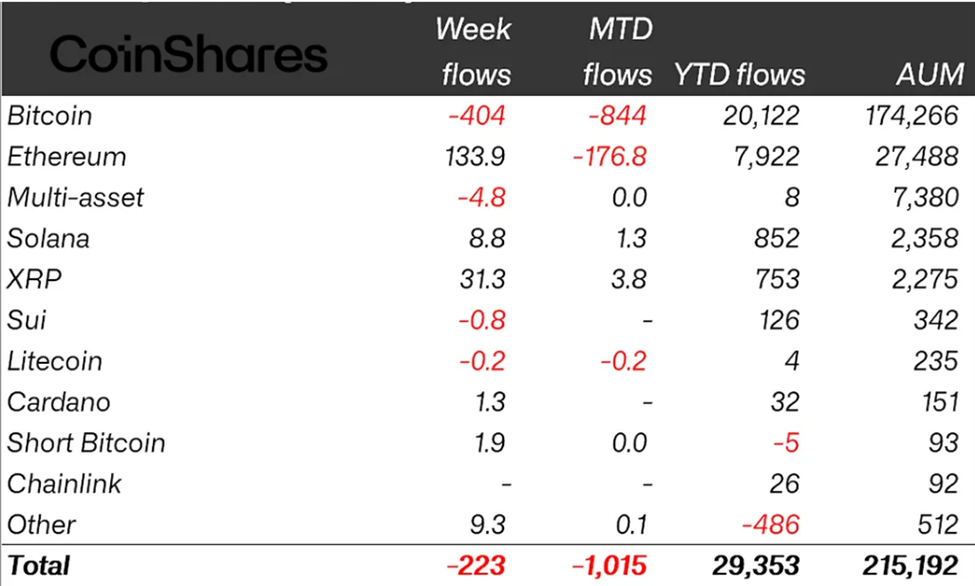

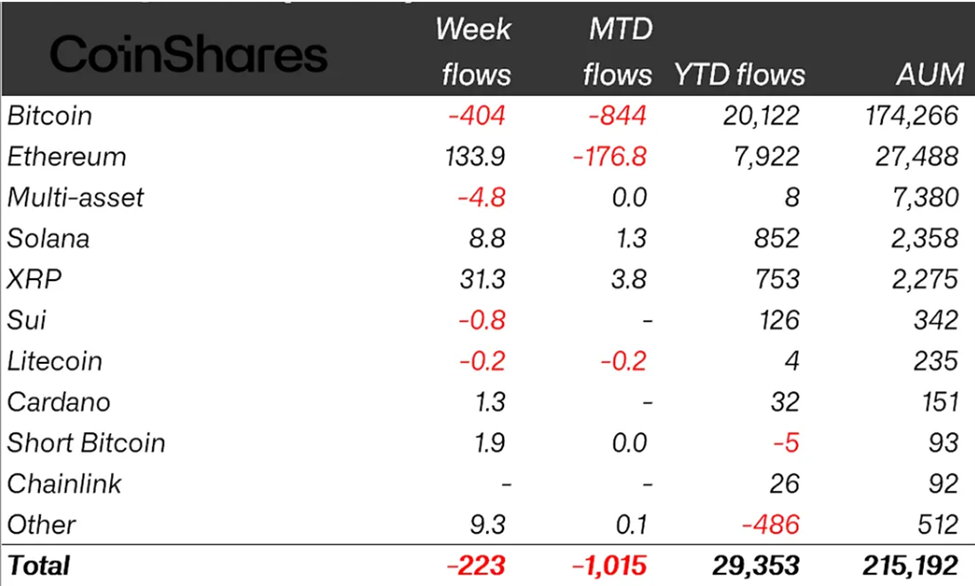

Crypto inflows contracted to $223 million final week, slicing brief the potential to succeed in $1 billion after the trajectory earlier within the week had made it potential.

It adopted a collection of US financial indicators, together with the FOMC, with macro information coming in higher than anticipated.

Crypto Inflows Close to $1 Billion however Macro Information Reversed Pattern to $223 Million

The newest CoinShares report reveals crypto inflows reached $883 million through the first a part of the week, steadily approaching the $1 billion threshold.

Nonetheless, after the FOMC meeting on Wednesday, inflows into digital asset funding applications retracted, closing the week at simply $223 million.

CoinShares head of analysis James Butterfill ascribes the retraction to US economic signals final week, citing FOMC and different macro information.

“The week began sturdy, with US$883m in inflows, however this development reversed within the latter half of the week, possible triggered by the hawkish FOMC assembly and a collection of better-than-expected financial information from the US,” read an excerpt within the newest weblog.

Extra carefully, weak payrolls data at the end of the week had dovish connotations for the Federal Reserve (Fed).

Because it occurred, US job lower bulletins jumped above the 4-year common, greater than doubling the typical July job lower quantity. This backdrop recommended weakening labor market information, which may affect the Fed to chop rates of interest.

The turnout impressed a common risk-off sentiment, upsetting crypto outflows, with $1 billion in detrimental flows recorded on Friday alone. BeInCrypto additionally reported the gap in US employment data, exacerbating the influence.

Nonetheless, Butterfill additionally associates the drop in crypto inflows with profit-taking after the current market rally, with buyers cashing in for early positive aspects.

“Given we have now seen $12.2 billion web inflows over the past 30 days representing 50% of inflows for the yr to this point, it’s maybe comprehensible to see what we imagine to be minor revenue taking,” wrote Butterfill.

In the meantime, final week’s crypto inflows mark a big drop in comparison with the numbers recorded the week ending July 26.

As BeInCrypto reported, crypto inflows approached the $2 billion mark that week, with Ethereum outshining Bitcoin in an altcoin-led rally.

Ethereum Extends Lead Towards Bitcoin as Altcoins Cost

Curiously, Ethereum continues to observe Bitcoin from the rear-view mirror, managing $133.9 million in constructive flows. Solana and XRP additionally did nicely, recording $8.8 million and $31.3 million in constructive flows, respectively.

Conversely, Bitcoin bucked the development, registering $404 million in outflows or detrimental flows. This greater than doubled the outflows seen within the week earlier than the final, when BTC flows have been detrimental $175 million.

Elsewhere, analysts at QCP Capital spotlight Bitcoin’s third consecutive Friday sell-off, pointing to risk-off sentiment in conventional markets.

“… [ this was] pushed by a confluence of things: a weaker than anticipated US jobs report and a contemporary spherical of tariffs from Washington,” wrote analysts at QCP Capital.

Based mostly on this, the present lull available in the market could also be related to buyers recalibrating expectations round world development and liquidity.

In accordance with QCP analysts, this might affect the runway to the much-awaited altcoin season, inflicting a delay however not completely writing it off.

“…regardless of the pullback, the broader structural setup stays intact,” the analysts added.

The current pullback might have been a post-rally shakeout, flushing out extra leverage and doubtlessly setting the tone for renewed accumulation.

The publish Crypto Inflows Reverse to $223 Million Amid FOMC and Economic Data Woes appeared first on BeInCrypto.