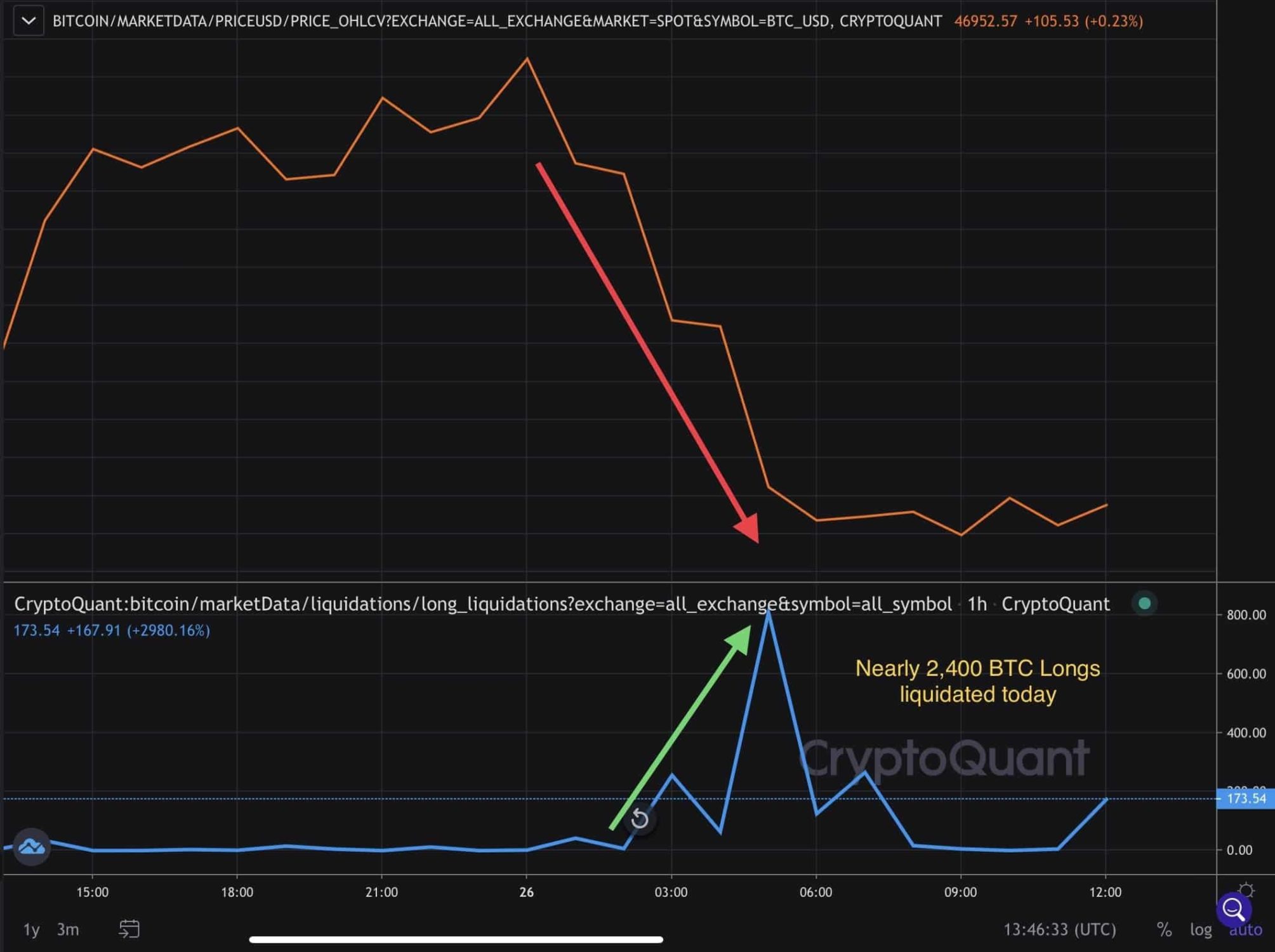

Bitcoin has formally entered right into a bear market. Indicative of that is the large crypto market liquidations which were occurring during the last three days. Within the final 24 hours, there was over $900 million price of crypto market liquidations in response to information from crypto analytics platform Coinglass. Near 80% of the liquidations resulted from merchants in lengthy positions getting worn out.

Bitcoin liquidations have amounted to shut to $500 million since Wednesday. The Bitcoin liquidations have been the results of the worth of Bitcoin falling from its $46,000 worth ranges to under $42,000. Bitcoin worth is at present at round $41,700, down 3.52% on the day.

Bitcoin market sentiment is now cut up between bulls and bears

Following the Bitcoin price drop and Bitcoin liquidations, market sentiments have turn out to be polarized. Some market observers have declared that Bitcoin is now formally in a bear market. One observer, KSICRYPTO, who beforehand referred to as the worth drop a bear entice has retraced and stated that it’s a full-out bear market.

Bitcoin investor and skeptic CryptoWhale, who has lengthy been predicting a Bitcoin bear market in 2022 has reiterated that he’s not stunned by the worth drop. He maintains that Bitcoin has lengthy been in a bubble that’s propped up by pretend cash and fraud. He factors out Tether, the issuer of the USDT stablecoin, to be behind this fraud and provides that Bitcoin has very low demand as the one folks shopping for have been retail buyers that didn’t know higher concerning the bubble.

Moreover, he expects cryptocurrency exchanges to start out performing up and going offline in an try to scale back buying and selling and cease the worth of Bitcoin from dropping decrease. Regardless of this, this Bitcoin bear market will drag the worth of Bitcoin to below $10,000 in response to him.

Is it over for Bitcoin (bBTC) bulls? On-chain metrics reveals there’s nonetheless hope

In distinction, some market analysts’ are nonetheless bullish about Bitcoin. Based on “Smartcontracter,” Bitcoin costs are prone to backside out at round $37,500 and can give an identical construction to the market in 2019. The analyst nonetheless expects Bitcoin to clinch $100,000 thousand this 12 months.

i believe #btc bottoms wherever between now and 37.5k and provides us an identical construction to what we noticed in 2019 simply on a bigger timescale, with a run to 100k nonetheless on the desk for 2022 imo. pic.twitter.com/64WniL0bG1

— Bluntz (@SmartContracter) January 7, 2022

This take is much like the that of on-chain analytics platform Glassnode. In its current report, Glassnode defined that Bitcoin was not at present in a bull market judging from sluggish on-chain exercise. Nonetheless, Glassnode expects that ought to the variety of new entities coming into the market proceed to extend because it was doing, Bitcoin may collect momentum to enter a bull market once more identical to the market did in 2019. When this occurs Bitcoin worth can be anticipated to get well.

Disclaimer

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.