Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has prolonged its decline beneath $90,000 as on-chain information reveals whales selling off in large quantities. This value decline comes amidst the otherwise bullish news of Donald Trump signing an govt order for a Strategic Bitcoin Reserve (SBR). The dearth of bullish momentum regardless of this has introduced into play the possibility of an prolonged bearish transfer from right here.

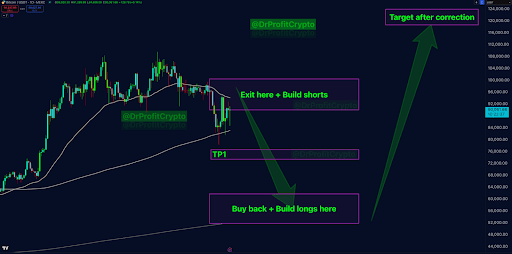

A well known crypto analyst, Physician Revenue, has raised alarms about an impending main correction in Bitcoin’s value. In an in depth publish on social media platform X, he outlined his causes for this shift, arguing that the present market situations sign the beginning of the primary massive Bitcoin correction of this cycle.

Strategic Bitcoin Reserve: A Misinterpreted Narrative?

Fashionable crypto analyst Physician Revenue revealed that he’s promoting a good portion of his holdings and getting into brief positions. Notably, the analyst pointed to the latest information surrounding the Strategic Bitcoin Reserve as a key issue that led him to reevaluate his bullish stance. He emphasised that whereas retail traders see this as a game-changing improvement, massive gamers and whale traders have already priced within the affect.

Associated Studying

Many crypto traders anticipated an accumulation of Bitcoin by the US authorities to be able to strengthen the reserve. Nonetheless, as a substitute of the anticipated ensuing shopping for strain on Bitcoin, the chief order targeted on Bitcoin confiscated from earlier seizures, which left bullish traders underwhelmed.

In keeping with Physician Revenue, the choice to log out on this coverage sooner than anticipated signaled a shift in market dynamics. His expectation was that this transfer would materialize months later, permitting Bitcoin’s value to maintain upward momentum earlier than the primary important correction. As an alternative, he now sees this because the primer for a long-term decline.

Is This The Starting Of Bitcoin’s First Large Correction? Value Ranges To Warch

Physician Revenue firmly believes that Bitcoin has but to expertise a proper correction in this cycle, noting bull market tendencies the place the asset has seen no less than one 40-50% drop earlier than reaching new all-time highs. He sees the latest developments as the ultimate push earlier than a 40% to 50% decline. As such, the analyst famous that that is the best window for distributing promote orders and getting into brief positions.

Associated Studying

His outlook suggests a retracement to as little as $50,000–$60,000 earlier than Bitcoin resumes its long-term bullish trajectory. Breaking down his buying and selling technique, he disclosed that he has already bought 50% of his Bitcoin holdings, which he amassed at $16,000. He has positioned brief orders inside the $90,000–$102,000 vary, with goal earnings set at $74,000 for the primary take-profit stage, adopted by a whole exit within the $50,000–$60,000 area and a full buyback to double holdings.

Regardless of his short-term bearish outlook, the analyst maintains that Bitcoin will eventually rally to new highs within the $120,000–$130,000 vary. On the time of writing, Bitcoin is buying and selling at $86,530.

Featured picture from Unsplash, chart from Tradingview.com