Key Takeaways

- Volatility briefly rose in crypto markets final month however is again close to all-time lows

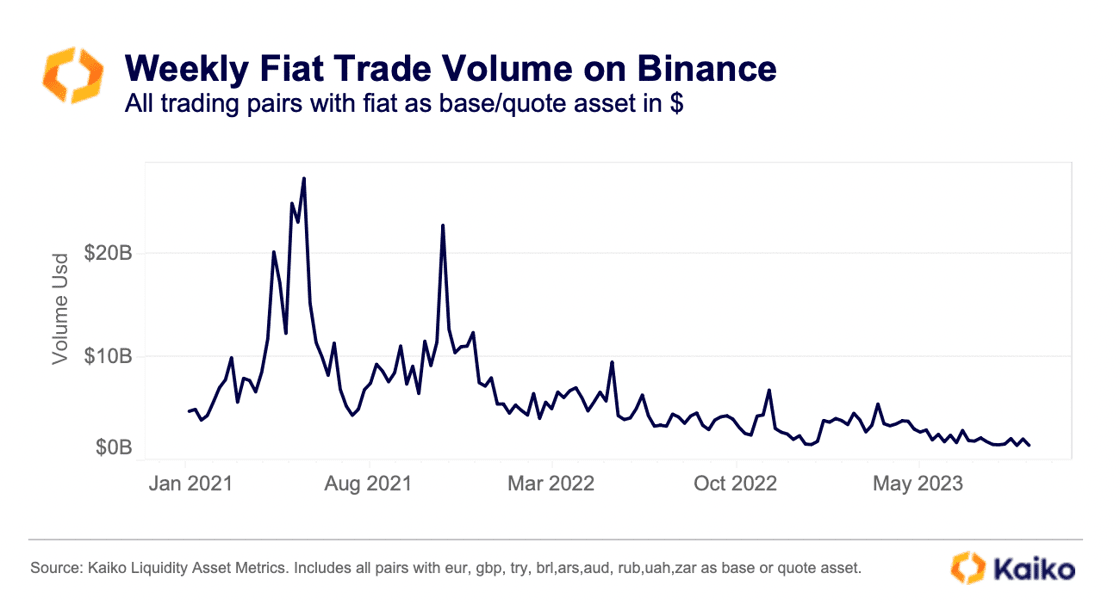

- Capital flight out of the area has been monumental, with liquidity additionally at multi-year lows

- Buying and selling quantity continues to say no, with Binance’s quantity down 95% from the height in 2021

- Ethereum is now buying and selling at an analogous volatility to Bitcoin

- A mix of tight financial circumstances within the financial system, in addition to crypto-specific scandals and a regulatory crackdown, have all made their mark on the area

Volatility within the crypto markets is again to multi-year lows. After a brief pickup amid the constructive ruling on the Grayscale ETF case final month, markets are again to the placid state we now have develop into accustomed to this yr.

Taking a look at 90-day annualised volatility, each Bitcoin and Ethereum are near the bottom ranges we now have seen. The chart under exhibits that, apart from three remoted episodes, we now have seen volatility in a near-constant state of decline since Q1 of 2022. That marks the infelxion level for the broader financial system, once we transitioned to a decent financial environmen, kicking off what would show to be a ugly time in crypto.

The three episodes of reprieve with regard to volatility have been the Terra collapse and subsequent summer time of bankruptcies (from Could 2022), the FTX collapse in November 2022 and, most not too long ago, the banking contagion in March 2022. In any other case, it has been a downhill experience.

The muted state of the once-volatile asset class is hurting market makers and liquidity. Whereas the complete ecosystem has been ravaged, it is very important word that the macro atmosphere has additionally pared down in volatility this yr, as could be seen on the under chart the place we now have included the 90-day volatility of the Nasdaq for reference.

Nevertheless, the size of the decline in crypto has gone above and past. Whereas digital belongings stay extremely correlated with threat belongings (the tech-heavy Nasdaq being the basic instance), the capital flight and drain of each volatility and liquidity kind the blockchain sector have been unmatched elsewhere.

Such is the dearth of volatility that we at the moment are even seeing Ethereum commerce with related volatility to Bitcoin (for a quick interval, Ethereum’s volatility was even even lower than Bitcoin’s), regardless of the previous historically working at volatility ranges above the world’s greatest crypto.

On the one hand, that is constructive for Ethereum and demonstrates a rising maturity. Then again, the convergence is emblematic of the drain in general volatility from the area at giant.

But, within the context of what’s taking place throughout the area, the drawdown is no surprise. We preserve mentioning the capital flight and dearth of liquidity; in trying on the numbers, the chasm in comparison with earlier years is gigantic.

Fiat commerce quantity on Binance, the world’s greatest trade with an approximate two-thirds market share of complete quantity, is right down to its lowest degree in additional than two years. Fiat commerce quantity on Binance has declined by greater than 60% since early January and is down 95% relative to its 2021 peak, in keeping with knowledge from Kaiko.

Whereas Binance is going through myriad points which can have exacerbated the decline, the underlying reality stays: liquidity has fled the area on the pace of sunshine, to the extent which has shocked maybe even probably the most bearish of crypto analysts’ predictions. To not point out, one of many many accusations levelled in opposition to Binance by a number of lawsuits is an alleged manipulation of commerce quantity, so maybe the dropoff is even worse than these above numbers suggest.

Given quantity and volatility go hand-in-hand, the following drawdown within the latter is, due to this fact, not stunning. Crypto resides as far out on the chance spectrum as could be, and in a world that has seen rates of interest soar from 0% to above 5% – and at a tempo among the many quickest in fashionable financial historical past – the fallout is smart. And that’s with out even layering within the quite a few scandals and crypto-specific episodes which have pushed market makers and buyers alike away.