On this planet of digital property, 2023 has seen a noticeable comeback for cryptocurrencies like Ethereum and Bitcoin. This rebound has not solely signaled a turnaround however has additionally been essential in drawing important inflows into bitcoin funds all yr lengthy.

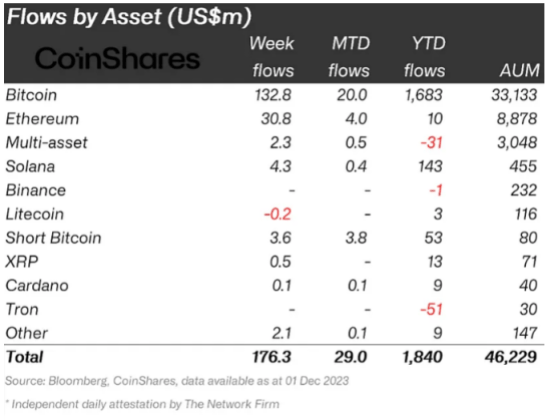

Asset managers equivalent to ProShares, 21Shares, Grayscale, and others have reportedly acquired inflows totaling over $1 billion this yr, together with over $290 million within the final month, in line with CoinShares.

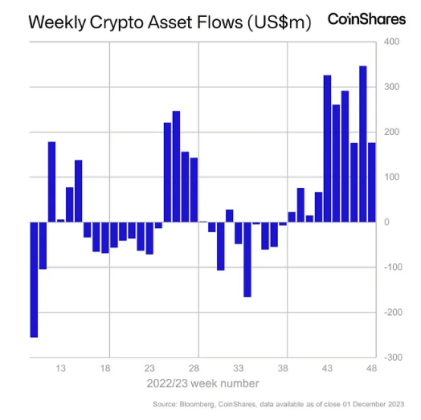

A latest report from CoinShares reveals that investments in cryptocurrency funds increased this week to a document $1.76 billion, the most important worth because the introduction of futures-based exchange-traded funds (ETFs) within the fall of 2021.

With $133 million in inflows, bitcoin is the biggest cryptocurrency on the planet. Ethereum got here in second with $31 million. The vast majority of inflows went towards bitcoin. In comparison with the earlier week’s document inflow of $312 million for bitcoin, this represents an increase.

Institutional Inflows Soar: 10 Weeks Of Consecutive Development

In accordance with CoinShares Head of Analysis James Butterfill, the most recent influx determine represents 4% of the $46.2 billion in property now beneath administration.

Based mostly on CoinShares knowledge, as of November statistics, year-to-date inflows have reached $1.14 billion, which is the third-highest quantity ever. Concurrently, the overall property beneath administration elevated by 9.6% final week and by 99% because the yr 2023 started.

When it comes to regional contributions to cryptocurrencies inflows, Canada and Germany continued to carry the highest spots with $79 million and $56.9 million, respectively. US traders contributed a further $53.5 million.

The Asian area is one among the many few to have web outflows this yr, regardless of having a really low complete AUM and a really low variety of ETPs.

As a result of market pleasure surrounding the approaching bitcoin halving and the potential approval of a spot bitcoin ETF by the US Securities and Trade Fee, the costs of each bitcoin and ether have surged significantly in latest weeks, reaching 18-month highs.

As of at the moment, the market cap of cryptocurrencies stood at $1.4 trillion. Chart: TradingView.com

The Enchantment Of Cryptocurrencies: Buyers Flock To Digital Belongings

Crypto fund inflows, to place it merely, are the sums of cash that traders are placing into funds created particularly to carry completely different cryptocurrencies, equivalent to Ethereum and Bitcoin.

Cryptocurrency funds, akin to standard funding funds, mixture money from numerous traders to buy and oversee a various assortment of digital property.

The rise in inflows into cryptocurrency funds in 2023 is indicative of a rising development, as extra individuals and organizations are selecting to put money into these funds on account of the opportunity of positive factors in cryptocurrency values.

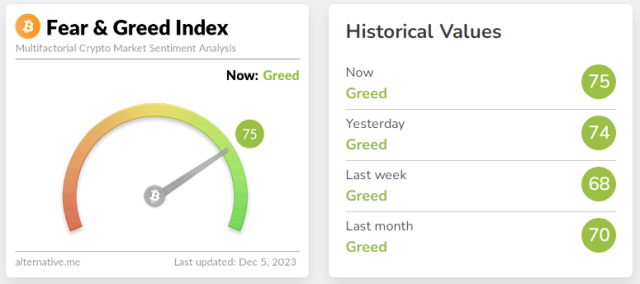

Crypto Worry & Greed Index. Supply: Alternative

Buyers trying to acquire publicity to the potential progress and alternatives introduced by cryptocurrencies are demonstrating a bigger curiosity in and confidence within the digital forex sector.

In the meantime, evaluation by Various signifies that the Crypto Worry & Greed index remains to be rising into “Greed” space, with a present rating of 74 out of 100, the best since November 2021, when Bitcoin reached an all-time excessive of $68,790.

Featured picture from iStock