Ki Younger Ju, the CEO of blockchain analytics platform CryptoQuant, has declared that the Bitcoin bull cycle is over. Notably, the premier cryptocurrency has struggled to ascertain a sustained uptrend since hitting a brand new all-time excessive of round $109,000 in January, inflicting doubts concerning the viability of the present bull run.

Bitcoin’s Unresponsive Worth Factors To Bear Market Onset

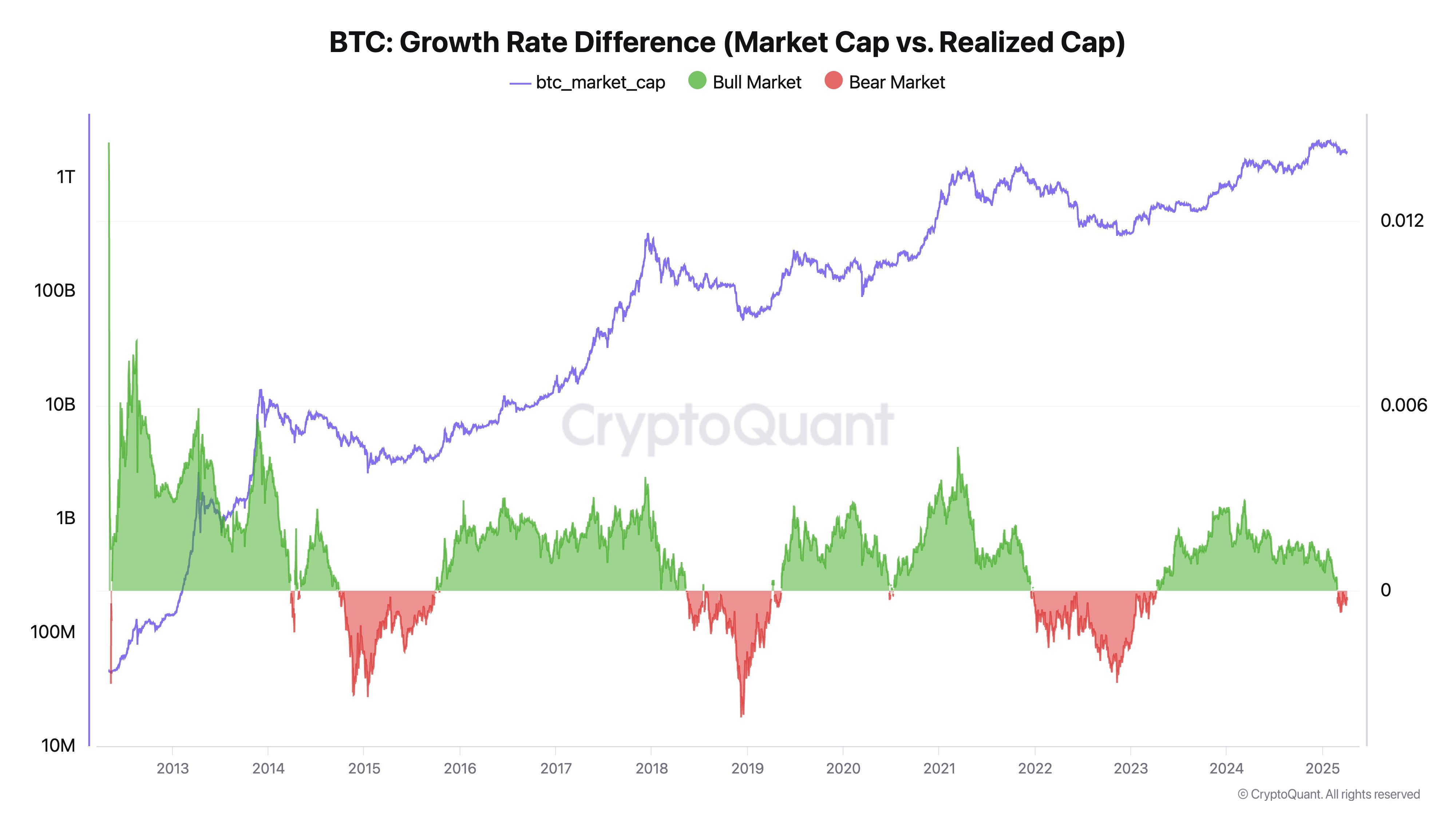

In an X post on April 5, Ki Younger Ju shared an attention-grabbing concept on why Bitcoin could have concluded its present bull run. The distinguished crypto determine has based mostly this postulation on on-chain knowledge ideas across the Realized Cap and the Market Cap.

Younger Ju describes the Realized Cap as the overall capital that flows into the BTC market as revealed by precise on-chain exercise. The Realized cap reveals a extra correct measurement of the BTC community by summing the value at which every coin final moved.

Then again, the Market Cap supplies a BTC community valuation based mostly on the most recent change buying and selling costs. The CryptoQuant CEO explains that market cap/costs don’t enhance or lower in proportion to transaction sizes based mostly on widespread misconceptions however in response to the stability between shopping for and promoting strain.

Younger Ju states that amidst low promote strain, a small purchase may cause an increase in worth and market cap. Then again, giant Bitcoin purchases throughout excessive promote strain can fail to impact a optimistic worth response because the market consists of a excessive variety of sellers.

Taking a look at each ideas, it’s understood that Realized Cap measures the capital inflows into the BTC market whereas Market Cap signifies worth response to those inflows. Due to this fact, the CryptoQuant boss explains {that a} rise in Realized Cap, whereas Market Cap declines or stays unchanged, presents a basic bearish sign as costs are failing to reply positively regardless of new investments.

Alternatively, a stagnant Realized Cap accompanied by an elevated Market Cap is a bullish sign that displays the low stage of sellers; thus any small quantity of recent capital can induce substantial worth features.

Ki Younger Ju states the previous state of affairs is at the moment taking part in out within the Bitcoin market with costs failing to rise influx as indicated by on-chain knowledge in change transactions, ETF markets, and custodial wallets exercise. This growth suggests the presence of a bear market. Whereas Younger Ju states that the present promote strain might wane at any time, historic knowledge helps a reversal interval of no less than six months.

Bitcoin Worth Overview

At press time, Bitcoin was buying and selling at $83,700 reflecting a decline of 0.94% previously day.

Featured picture from TheStreet, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.