Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

CryptoQuant CEO Ki Younger Ju introduced as we speak that Bitcoin’s bull cycle “is over” and warned traders to brace for “6–12 months of bearish or sideways value motion.” This growth comes after the on-chain analytics veteran had beforehand urged warning however maintained a measured outlook in the marketplace as lately as two weeks in the past.

Is The Bitcoin Bull Run Over?

In a publish shared as we speak through X, Ki stated:“Bitcoin bull cycle is over, anticipating 6–12 months of bearish or sideways value motion.”

Associated Studying

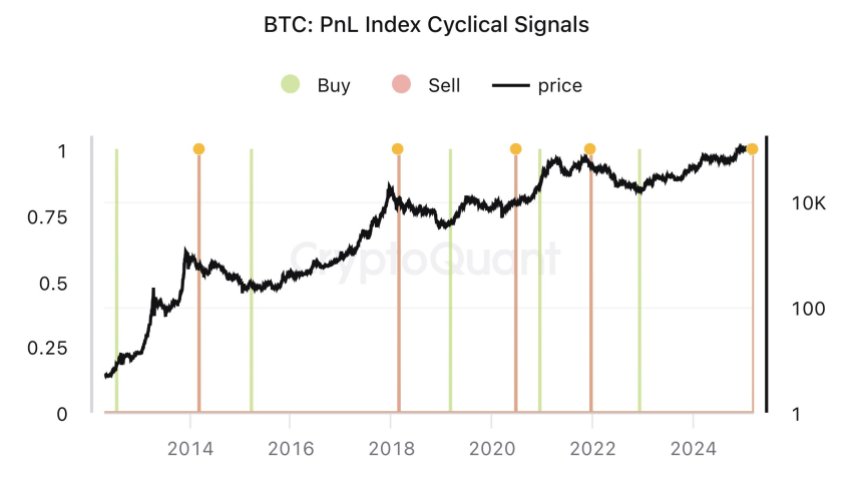

Together with the remark, the CEO highlighted the Bitcoin PnL Index Cyclical Alerts—an index that aggregates a number of on-chain metrics, resembling MVRV, SOPR, and NUPL, to pinpoint market tops, bottoms, and cyclical turning factors in Bitcoin’s value. In accordance with Ki, this indicator has traditionally provided dependable purchase and promote indicators.

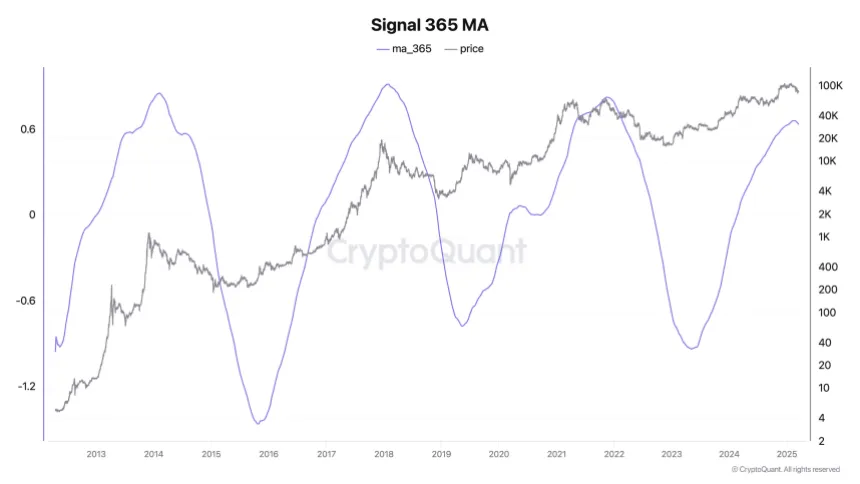

He additional defined how an automatic alert, beforehand despatched to his subscribers, mixed these metrics right into a 365-day shifting common. As soon as the development on this 1-year shifting common modifications, it usually indicators a big market inflection level. As proof, Ki additionally shared a chart: “This alert applies PCA to on-chain indicators like MVRV, SOPR, and NUPL to compute a 365-day shifting common. This sign identifies inflection factors the place the development of the 1-year shifting common modifications.”

Ki pointed to drying liquidity and contemporary promoting strain by “new whales” who, he stated, are unloading Bitcoin at decrease costs. Notably, he revealed that CryptoQuant customers who subscribed to his alerts acquired this sign earlier than as we speak’s public announcement. “With contemporary liquidity drying up, new whales are promoting Bitcoin at decrease costs. Cryptoquant customers who subscribed to my alerts acquired this sign a number of days in the past. I assume they’ve already adjusted their positions, so I’m posting this now.”

Associated Studying

This newest declaration contrasts remarks from simply 4 days in the past, on March 14, when Ki struck a extra cautious tone, stating: “Bitcoin demand appears caught, nevertheless it’s too early to name it a bear market.”

At the moment, he shared a chart of the Bitcoin Obvious Demand (30-day sum) indicator, which had turned barely destructive—an early sign that demand may be petering out. Though Ki identified that demand might nonetheless rebound (because it has in previous sideways phases), he acknowledged the potential for Bitcoin teetering on the sting of a bear market.

The pivot in sentiment is very notable given Ki’s stance from two weeks in the past. In that earlier publish, he opined that the “bull cycle remains to be intact,” crediting robust fundamentals and growing mining capacity: “There’s no important on-chain exercise, and key indicators are impartial, suggesting the bull cycle remains to be intact. Fundamentals stay robust, with extra mining rigs coming on-line.”

Nevertheless, he additionally cautioned that the market might flip if sentiment didn’t enhance, significantly in america. With as we speak’s announcement, the warning has evidently crystallized. Reflecting on the potential draw back state of affairs, Ki stated on the time: “If the cycle ends right here, it’s an consequence nobody needed—not previous whales, mining firms, TradFi, or even Trump. (FYI, the market doesn’t care about retail.)”

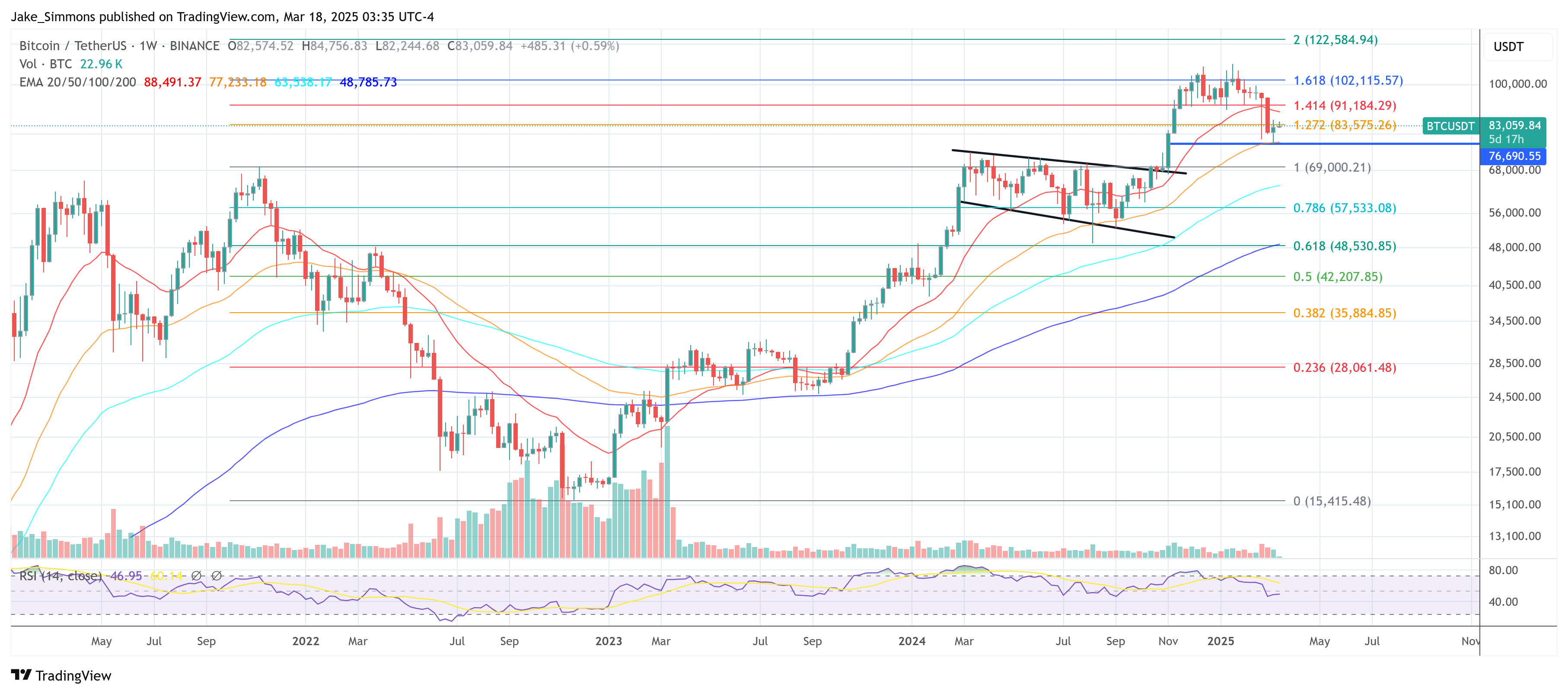

At press time, BTC traded at $83,059.

Featured picture created with DALL.E, chart from TradingView.com