Bitcoin, the undisputed king of cryptocurrencies, faces a problem because it approaches a vital second. After a stellar run within the first half of 2024, breaking previous the essential $71,000 barrier, the digital gold has retreated, presently hovering across the essential $61,000 assist zone. This latest dip has sparked a debate amongst analysts, with some clinging to bullish long-term outlooks and others cautioning of potential headwinds.

Associated Studying

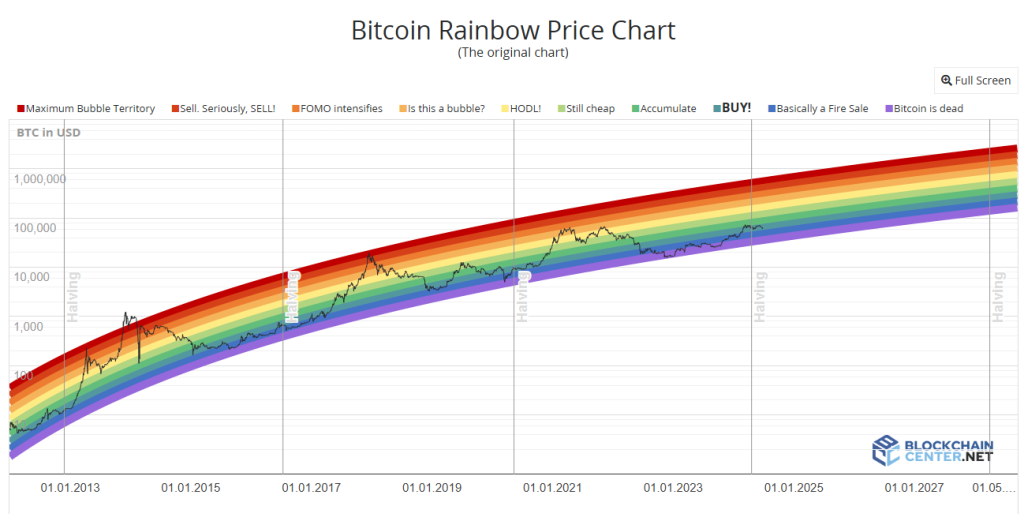

Rainbow Whispers: A Golden Shopping for Alternative Or Idiot’s Gold?

One issue maintaining some bulls optimistic is the Bitcoin Rainbow Chart, a well-liked device that analyzes worth actions on a logarithmic scale. This chart presently positions Bitcoin within the “Purchase” zone, suggesting there’s ample room for progress earlier than reaching a peak.

Moreover, historic worth cycles, particularly these following halving occasions (the place the variety of Bitcoins rewarded to miners is halved), level in the direction of a possible most worth level round September-October 2025. This optimistic timeline interprets to a possible worth goal of $260,000 and even increased, in response to some analysts.

Nevertheless, not everyone seems to be swayed by the Rainbow’s allure. Critics level out that the chart is a historic indicator, and previous efficiency doesn’t assure future outcomes. The latest decline within the “Coinbase Premium Index” throws a bucket of chilly water on the optimist’s parade.

This index displays the distinction in worth between Bitcoin traded on US change Coinbase and worldwide markets. A destructive index, as seen presently, suggests waning curiosity from US buyers, a big market phase.

Investor Jitters And Declining Open Curiosity

One other trigger for concern is the palpable worry and warning gripping buyers. The latest worth drops have shaken confidence, with many adopting a wait-and-see method. This sentiment is mirrored within the sharp decline of “Open Curiosity,” a metric that tracks the entire worth of excellent futures contracts.

With buyers hesitant to take lengthy positions on Bitcoin because of the latest stoop, Open Curiosity has dropped considerably, indicating a possible pullback in market participation.

Nevertheless, some analysts see this decline as a crucial correction. They argue that an overheated futures market fueled by extreme leverage can result in unsustainable bubbles. The present drop, they consider, is hunting down these overleveraged gamers, paving the way in which for a extra secure, long-term progress trajectory for Bitcoin.

Associated Studying

A Bumpy Journey Forward For Bitcoin?

The way forward for Bitcoin stays shrouded in some uncertainty. Whereas the potential for important progress based mostly on historic developments and the Rainbow Chart is simple, short-term investor sentiment and declining US market participation can’t be ignored.

The approaching months can be essential in figuring out whether or not Bitcoin can climate the present storm and resume its ascent or succumb to bearish pressures.

Featured picture from Shutterstock, chart from TradingView