Key Takeaways

- Dogecoin’s value surged 30% off the again of Elon Musk altering the Twitter brand to the Dogecoin canine

- Meme season could also be over, nonetheless, our Analyst writes

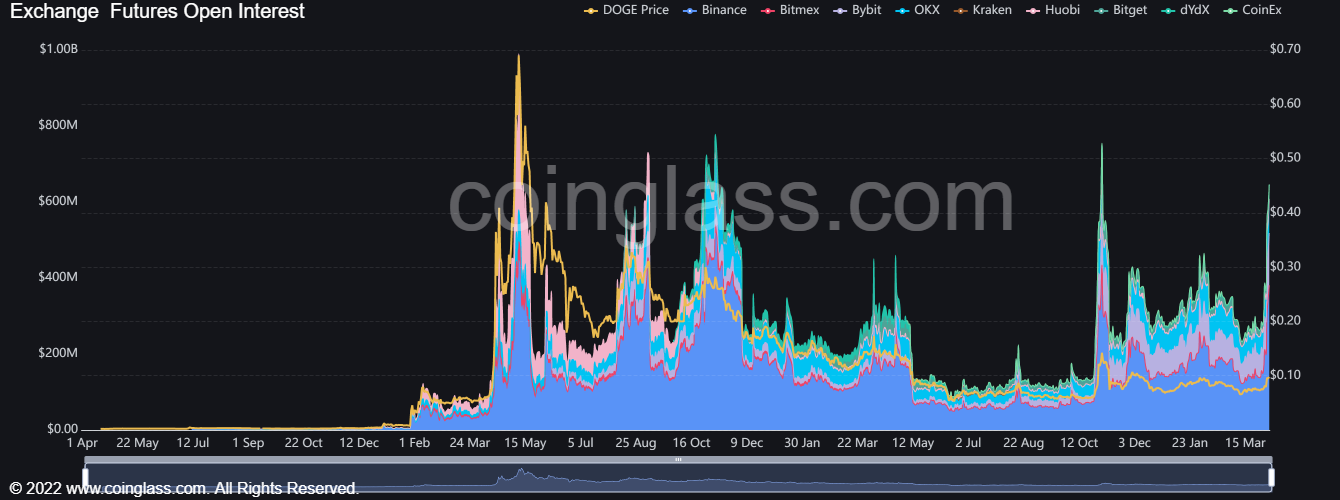

- Open curiosity surged to its highest degree since November

- Musk is unfazed by a $258 million lawsuit accusing him of racketeering by pumping and dumping the Dogecoin value

It’s starting to really feel like 2021 once more.

A 12 months that was stuffed with facemasks and restrictions on how shut you may stand to someone could also be banished to the depths of our reminiscences for a lot of, however for Dogecoin buyers, that was a cheerful time.

The meme coin exploded onto the scene, returning over 3500% for buyers because it surged from $0.004 as excessive as $0.73.

The one downside is that meme cash don’t precisely supply loads of worth. Predictably, Dogecoin subsequently collapsed because the bear market ravaged the crypto world in 2022.

The times of Robinhood buyers blindly punting obscure tokens with doggy logos have been over, and Dogecoin careened down, the occasion over as quickly because it started.

Elon revives Dogecoin

But it surely’s 2023 now. And after simply over 1 / 4 of value motion, Dogecoin has printed a 39% achieve.

This was aided, by Elon Musk rolling again the clock with old style Dogecoin joke. He modified the emblem of Twitter to the Dogecoin canine Monday, after all saying it on the platform itself.

As promised pic.twitter.com/Jc1TnAqxAV

— Elon Musk (@elonmusk) April 3, 2023

Instantly, the value jumped 30%. Previous to the endorsement, Dogecoin had been lagging the remainder of the market badly. Whereas its value was up 13% on the 12 months, Bitcoin and different cash have printed huge positive factors off the again of expectations round rates of interest shifting to a extra dovish forecast.

Taking a look at derivatives markets, the Elon impact was tangible right here too. Open curiosity soared to its highest degree because the FTX collapse final November, based on knowledge from Coinglass. Open curiosity measures the quantity of open contracts that merchants have opened on the underlying asset.

What occurs subsequent?

Making an attempt to foretell the short-term worth of any meme coin is a idiot’s endeavour, however I do ponder whether the meme craze is over.

Regardless of occasions of the final couple of days, this can be a very totally different market local weather than the hysteria of the stimmy-cheque-Robinhood period of 2020 and 2021. Rates of interest have been hiked quicker than any level in historical past, tech and crypto have been pillaged, and inflation is spiralling whereas recession fears abound.

It’s a distinct world. Not solely that, however the novelty of memes, and crypto normally, has worn off. The Dogecoin story just isn’t a brand new one, the pumps and dumps now acquainted to all, maybe inciting much less FOMO whereas definitely attracting much less mainstream consideration than years previous.

Quite a few scandals have rocked Crypto during the last 12 months and its fame has undoubtedly taken a success. With the dimensions of the bear market so contemporary in buyers’ minds, it’s arduous to check a situation whereby Dogecoin ramps up because it beforehand did.

Then once more, this can be a meme, and memes don’t obey rhyme or purpose. I’ve by no means “invested” in memes, one thing which my pockets didn’t admire in 2020 and 2021, however maybe I simply don’t get it.

Who is aware of with Elon anyway? Maybe he actually does have plans to include Dogecoin into Twitter correctly. Or possibly he’s simply trolling, and Dogecoin is getting a fast day within the solar earlier than yet one more inevitable crash.

Both approach, the newest Dogecoin pump by Musk reveals the billionaire just isn’t fazed by a $258 million lawsuit at present levelled at him.

A Dogecoin investor accused him of operating a pyramid scheme to help the Dogecoin value. Musk has been accused of racketeering to pump up the Dogecoin value earlier than letting it crash.

Musk’s attorneys appear assured the case shall be thrown out, nonetheless.

Am contemplating taking Tesla non-public at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

The time period market manipulation is thrown round lots in crypto. It appears arduous to conclude that what is occurring right here just isn’t in that bracket, no matter that lawsuit, as frivolous as it could be.

I’m wondering how shut we’re to seeing a tweet saying “taking contemplating taking Dogecoin non-public at $1 a token. Funding secured” from the massive man myself?