Key Notes

- Eric Trump-backed agency expands Bitcoin treasury to 4,004 BTC via mining operations and market purchases.

- Bitcoin ETFs recorded $3.5 billion in outflows over six classes as authorities shutdown impacts markets.

- Institutional buyers like Technique and Attempt elevate capital choices regardless of correction, signaling long-term conviction.

Eric Trump-backed American Bitcoin Corp. (Nasdaq: ABTC) has introduced a purchase order of roughly 139 Bitcoin

BTC

$101 198

24h volatility:

0.2%

Market cap:

$2.02 T

Vol. 24h:

$86.63 B

, bringing its whole holding above the 4,000 BTC mark. The acquisition affirmation comes amid intense market sell-off because the US government reports worse-than-expected influence of shutdown.

Along with strategic purchases, a good portion of American Bitcoin’s 4,004 BTC haul Bitcoin mining income, which incorporates Bitcoin held in custody or pledged for miner purchases beneath an settlement with BITMAIN.

“We proceed to increase our Bitcoin holdings quickly and cost-effectively via a twin technique that integrates scaled Bitcoin mining operations with disciplined at-market purchases,” Eric Trump stated.

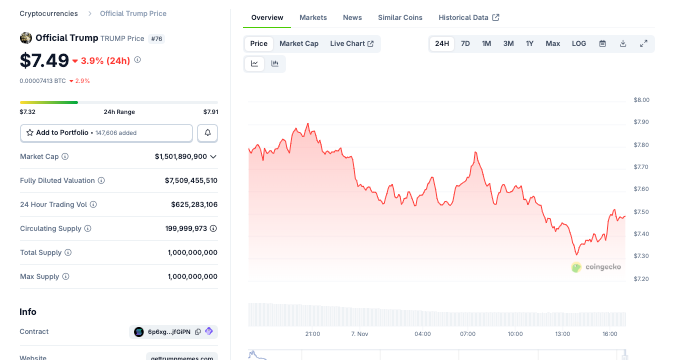

Official Trump memecoin worth declines 3% to $7.5 on Nov 7, 2025 | Supply: Coingecko

The Official Trump memecoin, which is commonly pushed by main bulletins from Trump-linked entities, additionally plunged with the market on Nov. 7, 2025. The Trump token is buying and selling at $7.5, down 3% intraday, with a market capitalization of $1.5 billion, according to Coingecko data.

Institutional Traders Stay Resilient Amid ETF Revenue-Taking

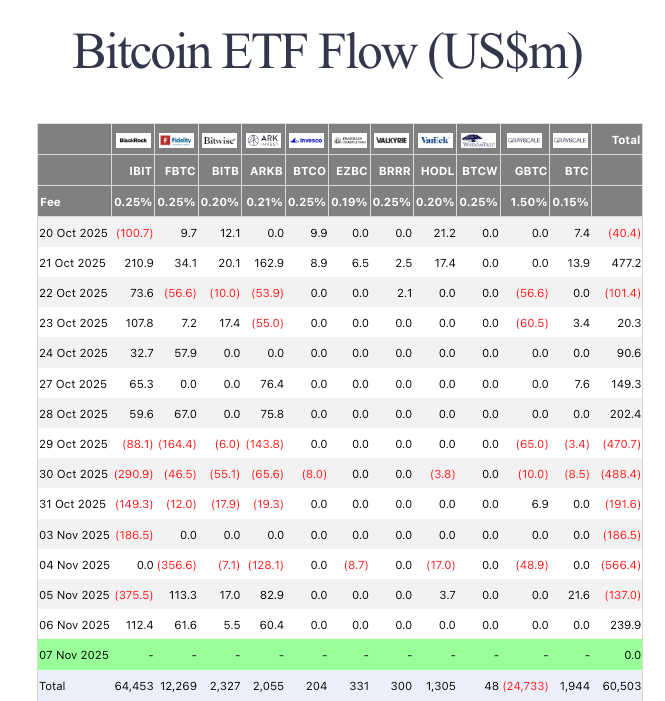

Bitcoin ETFs have confronted important withdrawals this month, with $3.5 billion in outflows throughout six consecutive buying and selling classes in early November, based on Farside datahttps://farside.co.uk/btc/. The selloff coincides with rising short-term bond yields because the US government shutdown delays spending resolutions, prompting capital rotation away from equities and threat property.

Bitcoin ETF Flows | Supply: FarsideInvestors

Nonetheless, institutional buyers with a longer-term horizon are capitalizing on the wobbling Bitcoin costs to extend their holdings.

Amid the market-wide corrections on Nov. 7, Bitcoin funding agency Technique raised its Stream Perpetual Most well-liked Inventory (STRE) providing to €620 million ($715 million).

Technique upsized providing follows Attempt’s $80 IPO which almost doubled its Perpetual Most well-liked Inventory (SATA) from 1.25 million to 2 million shares.

After Charles Schwab’s Bitcoin ETF announcement on Nov. 6, web inflows resumed throughout the ETF sector, with $239.9 million re-entering the market as Bitcoin stabilized close to $100,000.

Maxi Doge (MAXI) Presale Positive aspects Momentum Amid Bitcoin Accumulation Pattern

Whereas institutional gamers like American Bitcoin Corp proceed accumulating Bitcoin, retail buyers are flocking to rising alternatives like Maxi Doge (MAXI). The dog-themed meme coin has captured important consideration lately, elevating near $4 million in its ongoing presale.

With options together with staking rewards and upcoming partnerships centered on perpetuals-based buying and selling, the mission mirrors the bullish sentiment seen throughout the broader crypto market.

Presale highlights:

* Present worth: $0.000266.

* Funds raised: $3.88 million.

* Ticker: MAXI.

Traders should purchase MAXI tokens utilizing bank cards, debit playing cards, or cryptocurrencies. With its fast-growing momentum and sustained investor curiosity, Maxi Doge is positioning itself as one of many best crypto presales of 2025.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.