Ethereum worth continues to be buying and selling beneath all the important thing bull market indicators regardless of Bitcoin’s rally to $30,000 this week. The second-largest cryptocurrency is buying and selling beneath its $1,600 help/resistance on Thursday and would possibly have to drop additional to comb by way of recent liquidity ideally at $1,500 and construct the momentum for a rebound.

Addresses On The Ethereum Blockchain Hit 100 Million

Ethereum worth may be caught up within the crypto winter however the identical doesn’t apply to the community, which has continued to expertise important development over the previous few years.

Based on on-chain perception shared by @finelady_p on X (previously Twitter) and reposted by blockchain analytics agency IntoTheBlock (ITB), “ the variety of addresses with a stability has been steadily growing over the previous few years,” affirming the optimistic outlook for Ethereum, in that, “ there’s rising curiosity in Ethereum and that individuals are holding onto their ETH for the long-term.”

100.01M addresses on the ETH blockchain!

The ETH blockchain ahs been clearly and clearly have been within the bears with the remainder of different cryptocurrencies, however there was a turning level for ETH at this time.

One nice perception from the picture is that the variety of Ethereum addresses with… pic.twitter.com/tcOZaiYCvv

— €mm¥ (🐳’👑) (@finelady_p) October 18, 2023

Curiosity in Ethereum has over the previous few weeks continued to rise and this may be attributed to the Securities and Trade Fee (SEC) approving a bunch of Ether futures exchange-traded funds (ETFs) within the US.

“The truth that the variety of Ethereum addresses with a stability is growing and that the value has began to rebound in latest weeks are optimistic indicators for the way forward for Ethereum,” the X person added.

Santiment, one other main on-chain analytics platform, highlighted that Ethereum addresses belonging to whales in the “billionaire tier (holding no less than 1M #ETH)” at the moment account for 32.3% of the circulating provide and that is the primary milestone of this sort since 2016.

Community exercise involving these excessive internet value addresses achieved “transactions valued at greater than $1 million on Wednesday, the second highest day in 5 weeks. Based on Santiment, historical past is unfolding forward of the anticipated bull run in 2024 and 2025.

🐋 #Ethereum‘s whale addresses within the #billionaire tier (holding no less than 1M $ETH) now maintain 32.3% of the out there provide for the primary time since 2016. Yesterday’s transactions valued at $1M+ additionally had its 2nd highest day in 5 weeks. Historical past is being made. https://t.co/sywdtn14k5 pic.twitter.com/SdbSrChJCf

— Santiment (@santimentfeed) October 17, 2023

ETH Bulls Hunt For Help

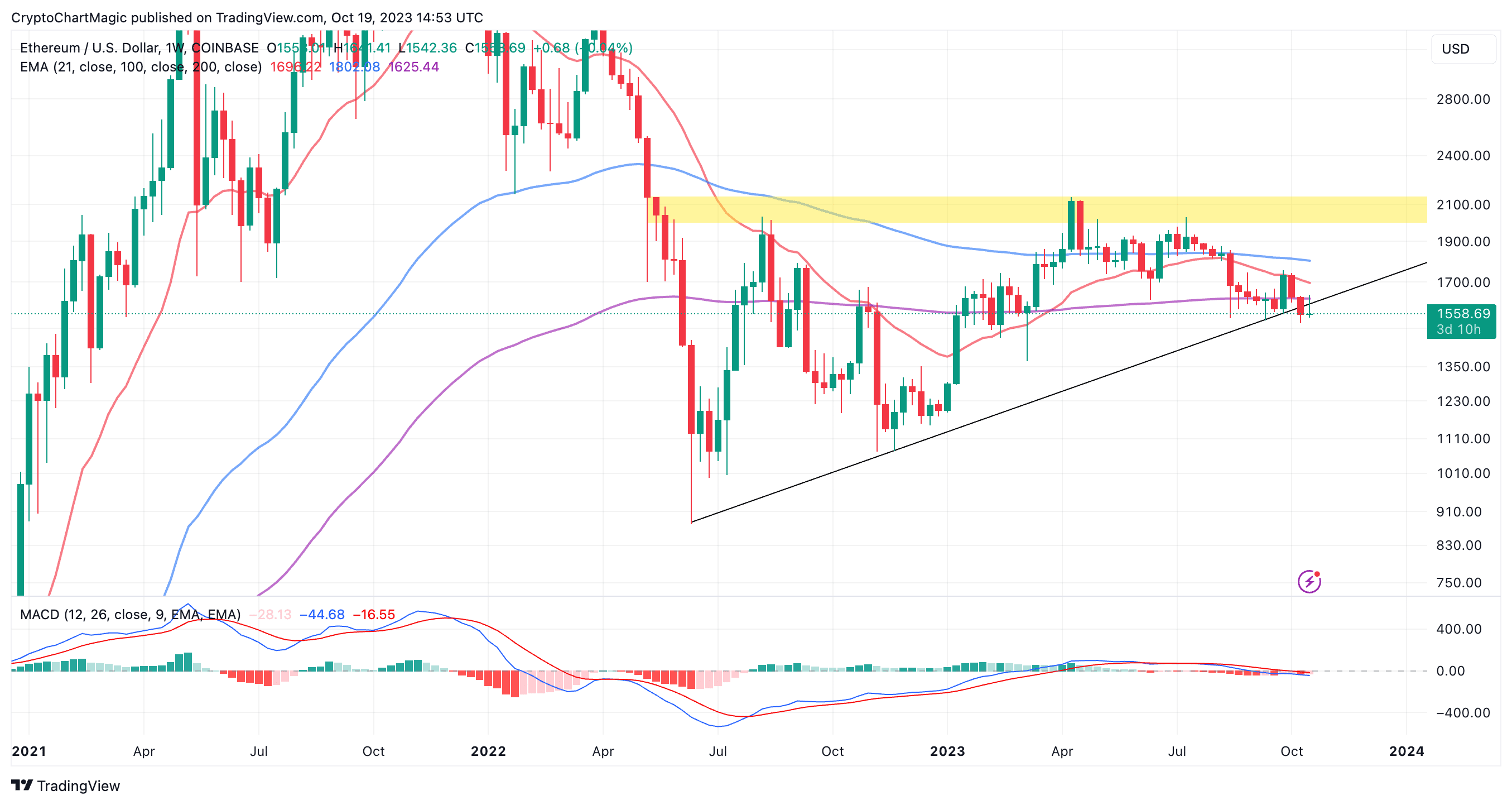

The Transferring Common Convergence Divergence (MACD) indicator reinforces the bearish outlook in Ethereum worth because it slides into the unfavourable area — beneath the imply line (0.00).

Merchants are sure to hunt publicity to brief positions in ETH so long as the promote sign holds. In different phrases, if the blue MACD line holds beneath the sign line in pink.

The place of Ethereum worth beneath the ascending trendline as proven on the weekly chart places bulls at a major drawback. Due to this fact, the downtrend would possibly want to increase to $1,500 help to gather extra liquidity as extra traders buy lower-priced ETH tokens, thus constructing the momentum for a considerable restoration above $1,600.

On the upside, Ethereum could start to flip bullish after stepping above a few of the bull market indicators just like the 200-week Exponential Transferring Common (EMA) (purple) at $1,625 and the 21-week EMA (pink) at $1,696. The next motion above the 100-week EMA might propel ETH to $2,000 and probably set off the subsequent bullish part to $3,000.

Associated Articles

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: