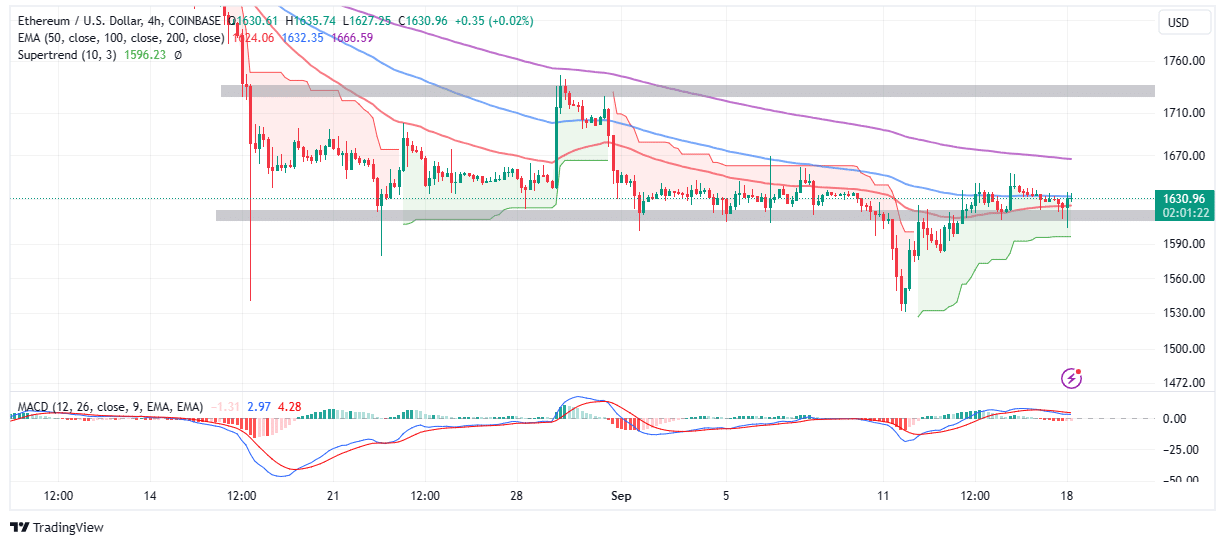

ETH value is ushering within the new week with noticeable features after bulls efficiently battled requires a sell-off as a result of rising inflation in the USA. After briefly succumbing to promoting strain over the weekend, probably the most vital sensible contracts token bounced off help at $1,600 and is now buying and selling at $1,630 as bulls capitalize on the enhancing market sentiment.

ETH Worth Bulls Again In Motion

Regardless of the damaging strain available in the market since June when the Securities and Alternate Fee (SEC) sued Binance and Coinbase whereas implicating numerous cryptocurrencies together with Cardano (ADA), Solana (SOL) and Polygon (MATIC), ETH value has sustained help above $1,530.

If the upper help space from $1,600 to $1,630 holds, Ethereum may settle for consolidation with the higher restrict at $1,700 earlier than the subsequent breakout focusing on highs above $2,000.

Based mostly on the Transferring Common Convergence Divergence (MACD) indicator, sideways buying and selling may take priority till ETH value weakens the quick resistance at $1,632 – highlighted by the 100-day Exponential Transferring Common (EMA) (blue).

The 50-day EMA (pink) at $1,623 serves because the quick help, and subsequently it’s a reduction to the foremost purchaser congestion areas at $1,600 and $1,530, respectively.

Merchants ought to search for a purchase sign prone to emanate from the momentum indicator. New or further purchase orders could also be positioned above the 100-day EMA and solely after the blue MACD line crosses the pink sign line on the four-hour chart.

The prevailing technical outlook should preserve enhancing for Ethereum to uphold the much-needed stability forward of the obvious chance of the primary futures-based ETH exchange-traded fund (ETF) approval within the US.

Specialists and analysts available in the market consider that though a futures-based ETF doesn’t have a direct hyperlink to the Ethereum spot value, it validates the willingness of the regulatory company to license crypto merchandise.

Bitcoin rallied by greater than 60% following the approval of the same product in 2021, which contributed considerably to the earlier bull run.

Ethereum live price is about to be the most effective performer compared to Bitcoin if the futures-based ETF will get the inexperienced gentle.

Basic insights shared by Santiment, an on-chain analytics platform discovered that “Bitcoin and Ethereum’s alternate provide has resumed going decrease as merchants seem content material hodling.”

As provide on exchanges decreases, demand tends to soar thus creating an ideal atmosphere for an ETH price rally.

Tether (USDT), the most important stablecoin, has been transferring into exchanges in massive volumes and as per Santiment analysts it’s “now on the highest degree since March. This means extra future purchase curiosity.”

Buyers shopping for Tether reveal their readiness to leap on a possibility to purchase Ethereum if the SEC approves the future-based ETF in October.

Associated Articles

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: