Appreciable declines have rocked the crypto marketplace for the primary time for the reason that October rally began, led by Bitcoin price drop from $35,000 resistance, down 2.2% to $33,977. Ethereum price was not spared, because it encountered headwinds, sliding under assist/resistance at $1,800 to commerce 1.3% decrease on the day to $1,773.

The overall market worth suffered a 2.1% dip to $1.29 trillion on account of altcoins taking a significant hit. As an illustration, Solana is down 6.4% to $31, Chainlink is down 5.2% to $10.53 whereas Bitcoin Money dodders at $243 after its market worth fell 5.1% in 24 hours.

Are Ethereum Worth Dips Worthwhile?

The primary main dip for the reason that uptrend began early final week has many analysts and traders questioning if dips might flip worthwhile. Analysts like Rekt Capital imagine that dips provide traders alternatives to fill their baggage because the bull run continues. Altcoins specifically are anticipated to have bursts of bullish moments and appreciable corrections.

A #BTC breakout to new Yearly Highs opens up Cash Movement into Altcoins

So even when you missed the $BTC breakout…

You can also make up for it after which some by enjoying the Altcoin breakouts

There may be at all times one other alternative across the nook#Crypto #Bitcoin pic.twitter.com/TvF7Gu6jfW

— Rekt Capital (@rektcapital) October 25, 2023

Altcoin Sherpa, a famend dealer and analyst shared the same sentiment earlier immediately asking traders “to be cognizant about what the beginning of a very robust rally appears like.”

Though I at all times attempt to preach persistence, you additionally have to be cognizant about what the beginning of a very robust rally appears like. I am not saying that is something near 2021 but it surely’s nonetheless good to notice what this spark appears like

Verify $LUNA $AVAX: no pullbacks, simply large strikes pic.twitter.com/ay5he7KQac

— Altcoin Sherpa (@AltcoinSherpa) October 26, 2023

He added in one other publish on Twitter (now X) that there was the probability of altcoins correcting by between 10-20%. “I feel that’s nonetheless potential and legitimate,” he added.

I am nonetheless ready for alts to tug again 10-20%, I feel that’s nonetheless potential and legitimate.

And earlier than anybody says I am sidelined, I am at all times fucking max lengthy and have the vast majority of my networth in crypto. It has been that means since I went full time and I do not count on it to alter.

— Altcoin Sherpa (@AltcoinSherpa) October 26, 2023

Ethereum Worth Prediction: ETH Nonetheless On Course To $2,000

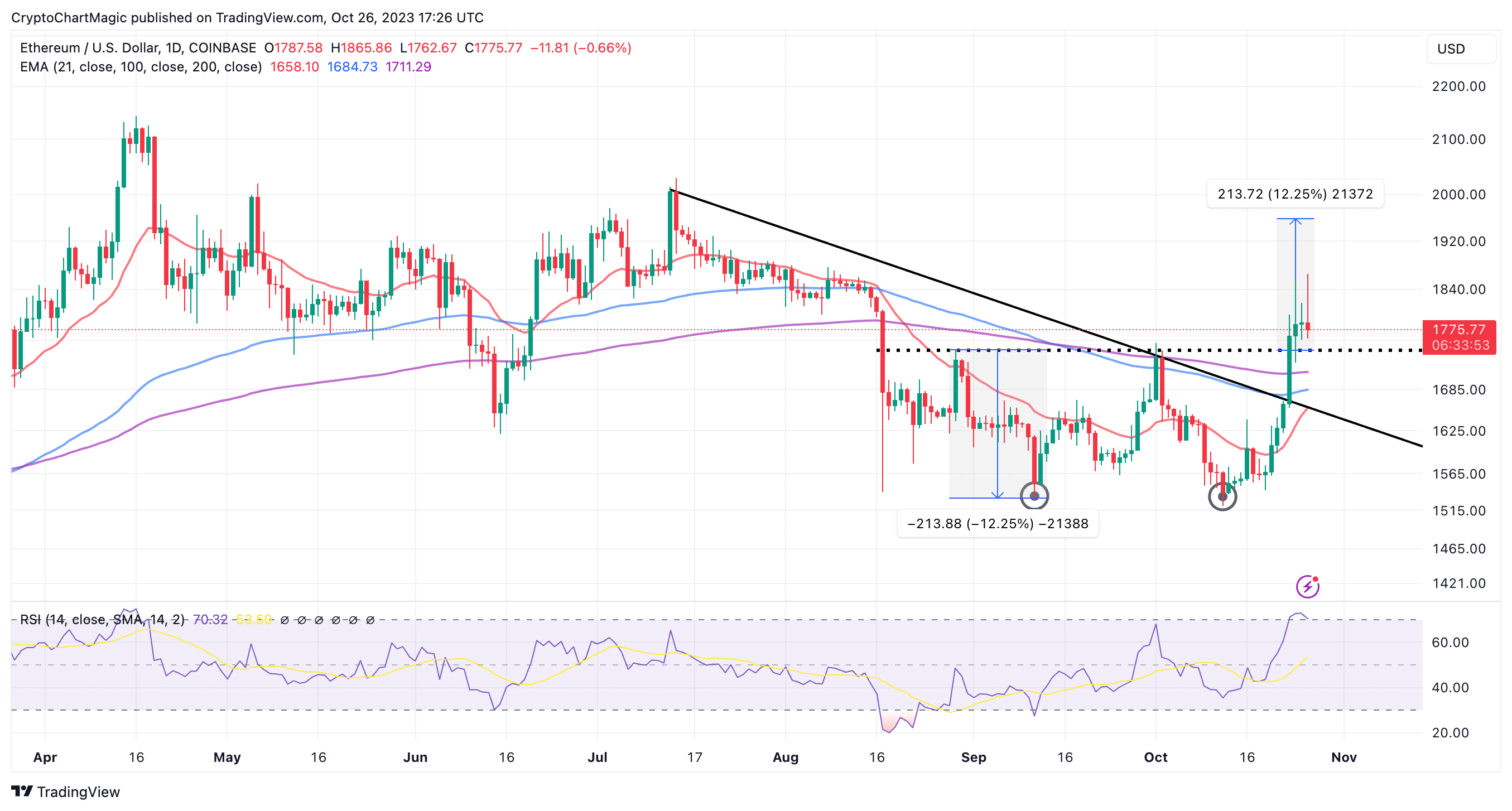

Ethereum began the rally by capitalizing on a double-bottom sample with assist roughly at $1,545. Subsequent steps above key shifting averages just like the 21-day Exponential Transferring Common (EMA) (crimson), the 100-EMA (blue), and 200-EMA (purple).

The breakout from the double-bottom sample focused a 12.25% transfer to $1,958 however the pullback on Thursday noticed Ethereum worth abandon the uptrend at $1,868.

If assist on the double-bottom sample neckline holds, Ether can be able to make a stronger transfer, presumably above the coveted $2,000 blockade.

The place of the Relative Energy Index (RSI) within the overbought area regardless of Ethereum’s correction from October highs, affirms the bullish outlook. In different phrases, bulls are more likely to resume the uptrend versus bears taking on and pushing for decrease costs under $1,700.

All three shifting averages, beginning with the 200-day EMA at $1,711, the 100-day EMA at $1,648, and the 21-day EMA at $1,658 can be in line to soak up the promoting stress to provide bulls an opportunity to push for an additional rebound.

Associated Articles

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: