Ethereum’s (ETH) latest price rally has sparked renewed debate over whether or not the market is nearing a essential turning level. Analysts are trying intently at previous cycles for perception, with some suggesting that historical past could also be repeating itself. If the patterns maintain true, ETH may very well be solely weeks away from a cycle peak, making this a decisive second for buyers to think about when it is likely to be time to promote every thing.

Ethereum’s Cycle High Alerts When To Exit

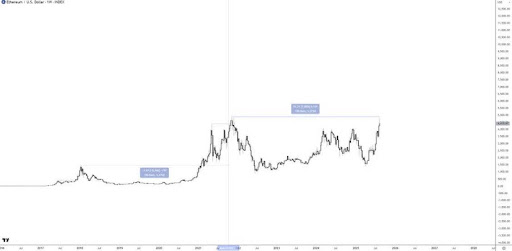

Crypto analyst Jackis has shared insights into Ethereum’s latest value actions, indicating when buyers ought to exit the market completely. In a latest X social media submit, the analyst famous that the ETH price action is intently mirroring its conduct from earlier market cycles.

Associated Studying

Wanting on the chart, Ethereum had hit one among its main cycle tops in January 2018, adopted by one other peak in November 2021. Furthermore, each situations had been preceded by a pointy upward trajectory that culminated in heavy corrections. Jackis additionally factors out that in these earlier cycles, ETH was buying and selling considerably above prior highs earlier than topping out. This time, nevertheless, the altcoin has not even broken into a new all-time high but, though it’s at present approaching that essential resistance.

Notably, the timing of ETH’s present setup is important, because the four-year cycle theory means that the cryptocurrency may very well be simply 4 weeks away from a serious prime. Jackis famous that this window aligns with September, which might function a essential second for buyers to reassess dangers and think about whether or not “selling everything” is warranted.

The analyst additional highlighted that whereas Ethereum’s structure shows strength, most altcoins are lagging far behind. Cryptocurrencies akin to Binance Coin (BNB), XRP, and Dogecoin (DOGE) have already established their tops in 2021 and stay far beneath these ranges.

Jackie said that their value motion suggests a market setting extra in line with ETH buying and selling round $2,200, slightly than its present stage beneath $4,500. Bitcoin, in the meantime, has continued to march higher since its November 2022 lows, forming greater lows and better highs in a textbook bull market construction.

ETH Panic Promoting Or Pre-Breakout Alternative?

In different information, crypto market professional Ether Wizz argues that the present panic selling of Ethereum mirrors the identical mistake merchants made with Bitcoin in previous cycles. On the time, early sellers underestimated the power of institutional demand and long-term patrons, solely to observe BTC surge far past expectations.

Associated Studying

The analyst highlighted a latest rebound within the Ethereum value above the 50-week Simple Moving Average (SMA), which traditionally has signaled the start of explosive rallies. The comparability between Ethereum’s 2025 chart and its 2017 breakout additionally highlights a similarity. In each circumstances, the cryptocurrency consolidated, reclaimed its shifting common, after which accelerated greater.

Notably, Ether Wizz factors out that Ethereum might nonetheless expertise a short-term correction of 5% to 10%. Nonetheless, he argues it’s misguided to imagine ETH has already peaked, sustaining as a substitute that the cryptocurrency is within the early phases of a transfer that might finally drive its value towards a brand new all-time excessive of $10,000.

Featured picture from Pixabay, chart from Tradingview.com