On-chain knowledge reveals the variety of energetic Ethereum addresses has lately spiked as much as a brand new all-time excessive. Right here’s what occurred up to now when the metric reached such excessive values.

Ethereum Energetic Addresses Surge To A New All-Time Excessive

As identified by an analyst in a CryptoQuant post, a sign that has normally been bearish for the worth of the crypto has gone off lately.

The “active addresses” is an indicator that measures the whole variety of Ethereum pockets addresses that confirmed some motion on any given day. The metric takes into consideration each senders and receivers.

When the worth of this metric goes up, it means an rising variety of addresses are displaying some exercise proper now. Particularly giant values generally is a signal of excessive exercise from retail traders.

Alternatively, low values of the indicator recommend not too many Ethereum wallets are making strikes in the intervening time.

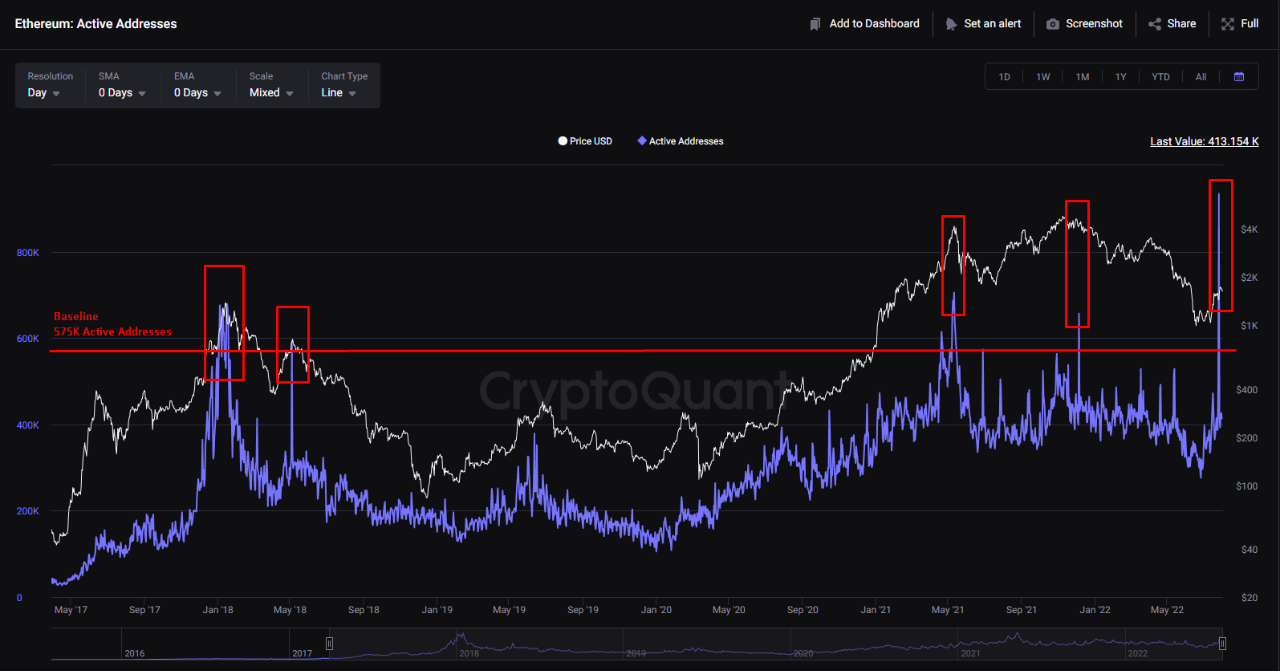

Now, here’s a chart that reveals the development within the ETH energetic addresses over the previous few years:

The worth of the metric appears to have been fairly excessive in latest days | Supply: CryptoQuant

Within the above graph, the quant from the put up has marked the related factors of development for the Ethereum energetic addresses.

It seems to be like at any time when the indicator has risen above the “575k energetic addresses” degree, the crypto’s value has registered a neighborhood prime.

The metric has only recently noticed a really sharp spike and set in a brand new ATH. The final all-time excessive occurred again within the 2017 bull run and coincided with the rally’s prime.

If the previous development is something to think about, then the newest surge to values by no means seen earlier than could show to be bearish for the coin this time as effectively.

Usually, one would suppose a considerable amount of addresses ought to as a substitute be bullish because it reveals excessive investor exercise. Nevertheless, the analyst believes it to not be the case.

The metric’s worth offers hints about what sort of traders are energetic out there proper now. In accordance with the quant, the newest surge may very well be coming from traders who’re FOMO’ing into the crypto after studying concerning the merge and the latest upwards momentum that Ethereum has loved.

ETH Value

On the time of writing, Ethereum’s price floats round $1.6k, up 14% within the final seven days. Over the previous month, the crypto has gained 51% in worth.

Under is a chart that reveals the development within the value of the coin during the last 5 days.

Appears like the worth of the crypto has slid down during the last couple of days | Supply: ETHUSD on TradingView

Featured picture from Choong Deng Xiang on Unsplash.com, charts from TradingView.com, CryptoQuant.com