Ethereum is at the moment consolidating between $3,600 and $3,850 after an explosive rally that noticed the second-largest cryptocurrency surge greater than 80% since late June. Regardless of the temporary pause in upward momentum, ETH stays in a robust technical place, holding above key assist and displaying indicators of sustained bullish management. This era of sideways motion might be a wholesome reset, permitting the market to soak up current positive factors earlier than initiating the subsequent leg up.

Associated Studying

What’s fueling the optimism is not only value motion, however a supportive macro and regulatory setting. Ethereum fundamentals proceed to strengthen, with rising on-chain exercise, institutional curiosity, and long-term holders accumulating. Including to the bullish case is the rising authorized readability within the US, which is making a extra steady setting for crypto innovation and funding. As regulatory fog lifts, many buyers now imagine that Ethereum may lead the cost into what some analysts are calling the start of an altseason.

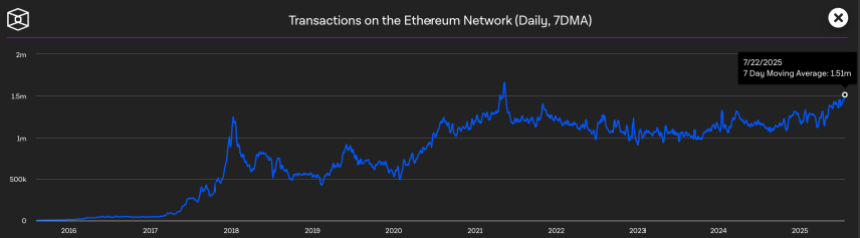

Ethereum Transactions Surge As Adoption And Momentum Speed up

Ethereum is displaying sturdy indicators of renewed momentum as key community exercise hits ranges not seen in years. Based on data from The Block, Ethereum day by day transactions simply reached a multi-year excessive of 1,510,000—the very best since 2021. This surge factors to rising adoption throughout the community, with elevated exercise from each retail and institutional individuals. Analysts recommend that this spike in transaction quantity is greater than a brief pattern; it might sign the start of a a lot bigger section in Ethereum’s development cycle.

The renewed exercise aligns with broader market actions and rising confidence in Ethereum’s long-term worth. Institutional gamers are starting to build up ETH, whereas sensible cash continues to place for upside. These inflows come at a time when Ethereum is consolidating just under main resistance ranges, providing what many see as a key entry zone forward of additional value appreciation.

Notably, Ethereum is now outperforming Bitcoin and far of the broader crypto market. This relative power is critical, as ETH usually leads the altcoin market throughout bullish phases. Because the cycle progresses, Ethereum’s mixture of sturdy fundamentals, rising utility, and institutional adoption is making a compelling case for continued development.

Associated Studying

Ethereum Holds Above Help After Rally, Eyes Subsequent Breakout

Ethereum (ETH) continues to commerce inside a key vary following a robust rally that pushed the worth from under $2,500 to over $3,750 in just some weeks. As of at the moment, ETH is consolidating round $3,660 after being rejected close to $3,742—a significant resistance degree seen since early 2024. The present weekly candle reveals an extended higher wick, indicating profit-taking on the prime quality, however value stays supported above the vital $2,852 degree, now appearing as a flipped assist.

The rising quantity seen throughout the current breakout suggests sturdy participation from patrons, and value motion stays bullish so long as ETH holds above its key transferring averages. The 50, 100, and 200-week SMAs are all aligned under present value ranges, offering structural assist and reinforcing the bullish pattern.

Associated Studying

Merchants at the moment are intently awaiting a decisive breakout above the $3,742 zone. If ETH clears that resistance, the subsequent logical targets lie within the $4,000–$4,200 vary. On the draw back, a breakdown under $2,850 would invalidate the current breakout construction.

Featured picture from Dall-E, chart from TradingView