Whereas Ethereum has moved again above the $3,500 value mark, renewed shopping for strain is being noticed across the main digital asset. Each small and large buyers or merchants are beginning to buy the altcoin at a speedy price, pointing to a strategic positioning of the buyers.

Prime-Tier Traders Are Steadily Shopping for ETH

Following the current rebound in the price of Ethereum, a number of buyers are exhibiting newfound curiosity within the main altcoin. The report from Prime on X reveals that this contemporary shopping for strain is especially evident amongst top-tier gamers, additionally acknowledged as whale buyers within the crypto panorama.

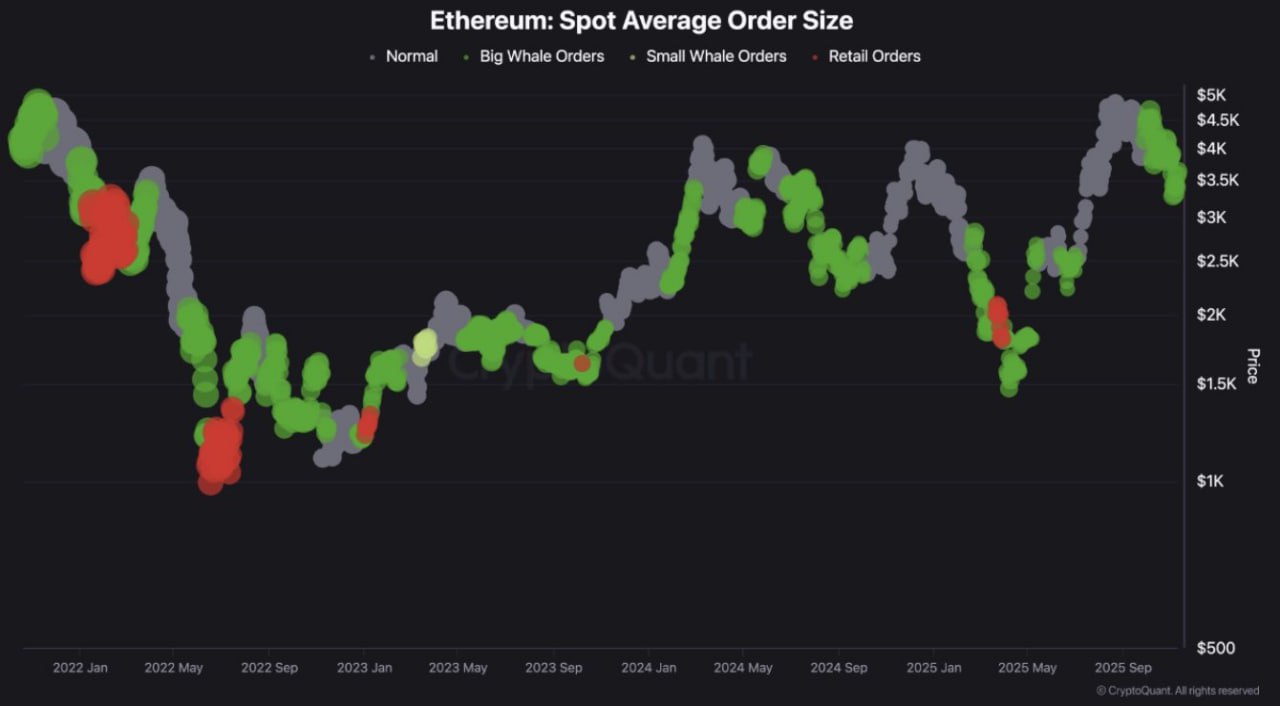

In keeping with information from the Ethereum Spot Common Order Dimension, ETH’s whale investors are quietly returning to the steadily bullish crypto market. This means a transparent shift in whale motion, with large pockets addresses accumulating ETH as soon as once more after a number of weeks of outflows and worry.

The renewed curiosity from deep-pocketed buyers coincides with ETH’s gradual restoration from current pullback, indicating that whales view current ranges as an interesting long-term entry level reasonably than an indication of weak spot. Whereas accumulation amongst giant buyers surges, it means that good cash is perhaps prepping up for ETH’s subsequent main breakout.

It’s value noting that this shopping for strain from large gamers is noticed on the $3,200 value degree. Prime acknowledged that whales are benefiting from the drop in Ethereum’s price, as they buy the altcoin at low costs.

A continuation of this whale acquisition is prone to spur the anticipated rally. Within the meantime, the subsequent attainable goal for ETH is between the $4,500 and $4,800 vary if the $3,000 – $3,400 support zone holds strong.

Companies Are Nonetheless Betting On ETH

This sturdy accumulation by giant gamers is obvious within the persistent buy of the asset by institutional corporations corresponding to Bitmine Immersion. Institutional adoption and curiosity look like rising in tandem with the transient surge in ETH’s value.

Ash Crypto, a market analyst and investor, has reported a contemporary huge Ethereum acquisition linked to the main treasury asset firm. Knowledge shared by the market analyst reveals that the corporate purchased over 23,521 ETH, valued at roughly $82.8 million, as the brand new week started. “Tom Lee desires all of your Ethereum,” As Crypto added.

In another X post, Ash Crypto highlighted that Bitmine Immersion acquired ETH value over $400 million previously week. Such heavy and protracted shopping for motion underscores the agency’s unwavering conviction within the altcoin’s long-term prospects. Bitmine’s ongoing accumulation stands out amid this era of conflicting market sentiment, indicating that the corporate believes that the subsequent development section for ETH could also be removed from over.

Amid the shopping for strain, the latest readings from the Ethereum Concern and Greed Index present that the market is slipping firmly into Concern ranges. A transfer into the worry zone indicators growing anxiousness because of the present unstable state of the broader cryptocurrency market.

Featured picture from Pxfuel, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.