The Bitcoin value has been caught under $20,000 as Ethereum and different altcoins take over the value motion and push the sector upwards. Ethereum simply deployed the “Bellatrix” improve, the ultimate step earlier than “The Merge”, and the value of Ethereum is blazing via native resistance.

On the time of writing, Bitcoin value trades at $19,900 with sideways motion throughout the final 24 hours and seven days respectively. Within the meantime, the Ethereum value trades at $1,670 with a 7% and eight% revenue over the identical time intervals, respectively.

Ethereum Might Breakout Of This Vary Whereas The Bitcoin Value Lags

“The Merge” will migrate the Ethereum community from a Proof-of-Work (PoW) consensus to a Proof-of-Stake (PoS) consensus. This occasion has precipitated a whole lot of hype throughout the crypto markets, as some buyers consider Ethereum will see extra enhancements and can enter a brand new period of adoption.

As seen within the chart under, a pseudonym dealer outlines Ethereum value present vary and its try to interrupt out of overhead resistance. If Ethereum validates this bullish transfer, the cryptocurrency may obtain one other milestone and “flip” Bitcoin by way of market capitalization.

In fact, “The Merge” poses many questions for buyers as they surprise if it will function as a “purchase the rumor, promote the information” occasion. The pseudonym dealer said:

ETH making an attempt to interrupt out of a spread. The final time it did so it doubled relative to BTC If it doubles once more relative to BTC it’ll flip it. Will Bitcoiners let it occur? Or will they mercilessly pump BTC to cease the ratio from getting worse? Or will all of it dump for a reset?

Can Ethereum Flip Bitcoin?

Buying and selling desk QCP Capital may present some clues into a few of these questions. In a current report, the agency claims Ethereum value has been correcting after reaching oversold ranges within the aftermath of the Three Arrows Capital (3AC) liquidations.

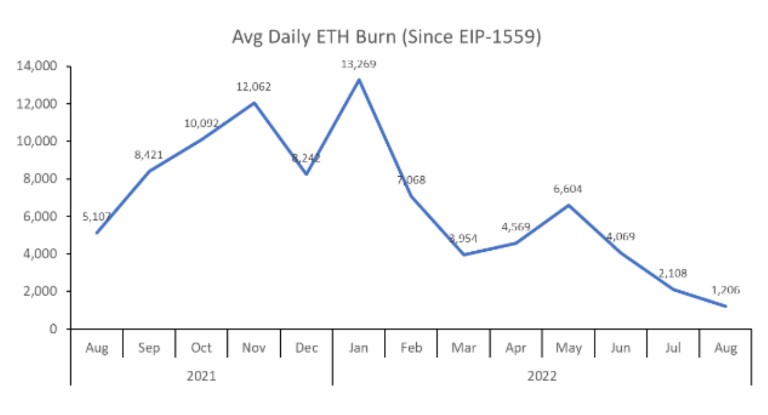

Subsequently, a whole lot of the transfer upward may be the value bouncing again as promoting stress light and fewer associated to “The Merge”. There are two potential bullish elements related to “The Merge”: the transition will scale back ETH provide issuance whereas growing its burning fee.

Whereas the previous is “wanting bullish”, QCP claims, the latter is trending to the draw back. In different phrases, the availability is being burned at a slower fee heading into “The Merge”. QCP Capital added:

This doesn’t change our view on the long-term viability of ETH, and its consequent bullish affect on value. We predict ETH shall be THE asset of the last decade. Nonetheless, it does change the short-to-medium-term value dynamics, and the way a lot of the occasion is already priced in.

As “The Merge” approaches, the buying and selling agency will look into Ethereum value mimicking the Bitcoin value “halving” impact. This might present ETH’s value efficiency with additional assist to reclaim its beforehand misplaced territory and proceed to push the sector up with it, together with the Bitcoin value.

Take a look at our YouTube channel for extra evaluation available on the market, value forecasts, methods, and far more.