Ethereum (ETH) has been going through heightened volatility over the previous week, following a pointy correction from its latest native excessive at $3,940 all the way down to $3,360. After weeks of aggressive shopping for exercise and bullish momentum, the market is now displaying indicators of fatigue. Analysts are rising cautious, with many warning {that a} deeper correction might be imminent if Ethereum fails to reclaim key assist zones.

Associated Studying

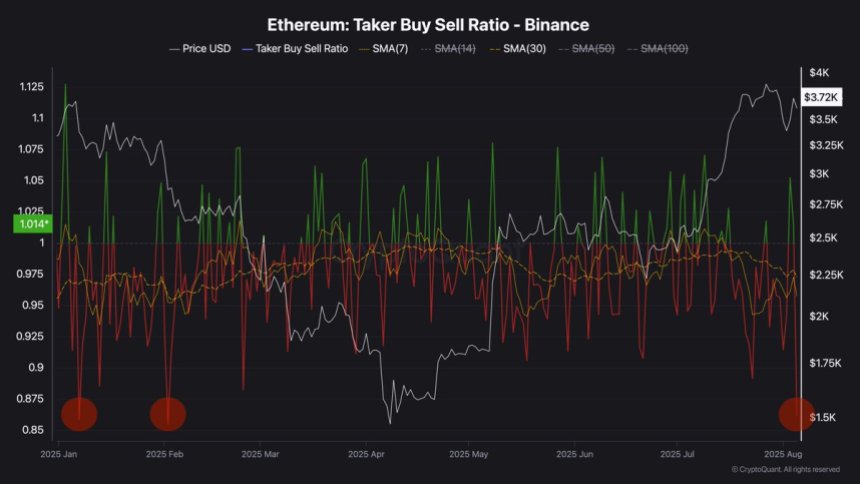

Including to those considerations, contemporary information reveals a big shift in market dynamics. The taker purchase/promote ratio — a key indicator that tracks the aggressiveness of consumers versus sellers — has sharply declined into detrimental territory at this time. This alerts that sellers are at the moment dominating the order books, making use of sustained strain on ETH’s value motion.

Whereas some view this as a typical cooldown section after a serious rally, others consider Ethereum is coming into a riskier phase the place bearish sentiment may intensify if assist fails to carry. The approaching days will likely be vital in figuring out whether or not ETH stabilizes round present ranges or slides additional into correction territory.

Ethereum Faces Quick-Time period Promoting Stress

In line with high analyst Darkfost, Ethereum’s taker buy/sell ratio has dropped sharply into detrimental territory at this time, reaching 0.87—one of many lowest ranges recorded because the begin of the yr. This metric, which measures the ratio of aggressive consumers to sellers in futures markets, reveals that promoting strain is now firmly in charge of ETH’s order books.

Though at this time’s information remains to be incomplete, the present studying already signifies a dominance of promote orders on Ethereum futures. Darkfost notes that this shift has been creating for a number of weeks. Since July 18th, the taker purchase/promote ratio has been principally detrimental, which correlates with Ethereum’s latest lack of ability to interrupt via key resistance ranges and its transition right into a short-term consolidation section.

Whereas this may occasionally appear regarding for bullish merchants, Darkfost emphasizes that such consolidations are a traditional a part of market cycles, particularly after a powerful rally. He means that Ethereum may face a difficult interval within the brief time period, as market sentiment stays fragile and sellers proceed to regulate intraday actions.

Associated Studying

Nonetheless, this section may provide a wholesome basis for the following leg up. If Ethereum manages to stabilize and consolidate above vital assist zones, the broader pattern stays favorable. Lengthy-term fundamentals, together with on-chain accumulation and rising institutional curiosity, nonetheless level towards upside potential as soon as this section of promoting strain eases.

Worth Evaluation: Bulls Try Restoration After Sharp Decline

Ethereum is at the moment buying and selling at $3,654.60, trying to stabilize after a pointy correction from its latest highs round $3,940. The 4-hour chart reveals a restoration bounce that met resistance close to the 50-period SMA (at the moment at $3,668.28), signaling that bulls are going through sturdy promoting strain at this degree.

Regardless of the bounce, ETH stays under the important thing horizontal resistance at $3,860.80, which has capped a number of upward makes an attempt in latest weeks. The bullish try and reclaim momentum earlier at this time was rejected close to this degree, resulting in a fast retracement again into the $3,600-$3,650 zone.

The 100-period SMA (inexperienced line) at $3,695.32 is appearing as dynamic resistance, whereas the 200-period SMA (pink line) at $3,303.42 serves as a longer-term assist degree ought to the correction deepen.

Associated Studying

Quantity spikes point out that consumers are stepping in aggressively on dips, however general, Ethereum stays in a short-term consolidation section between $3,850 and $3,350. A decisive breakout above $3,860.80 is required to regain bullish momentum, whereas failure to carry above $3,600 may expose ETH to a different retest of decrease assist ranges round $3,300-$3,350.

Featured picture from Dall-E, chart from TradingView