Knowledge reveals the US Ethereum spot ETFs have seen internet inflows for eight consecutive weeks now, an indication of continued institutional demand.

Ethereum Spot ETF Netflow Stays Constructive

In a brand new post on X, the on-chain analytics agency Glassnode has shared an replace on how the weekly netflow for the US spot exchange-traded funds (ETFs) of Ethereum has been trying. Spot ETFs confer with funding autos that permit traders to realize publicity to an asset with out having to immediately personal it. These ETFs commerce on the normal platforms, so they permit for a better funding methodology for individuals who discover cryptocurrency exchanges and wallets overwhelming to navigate.

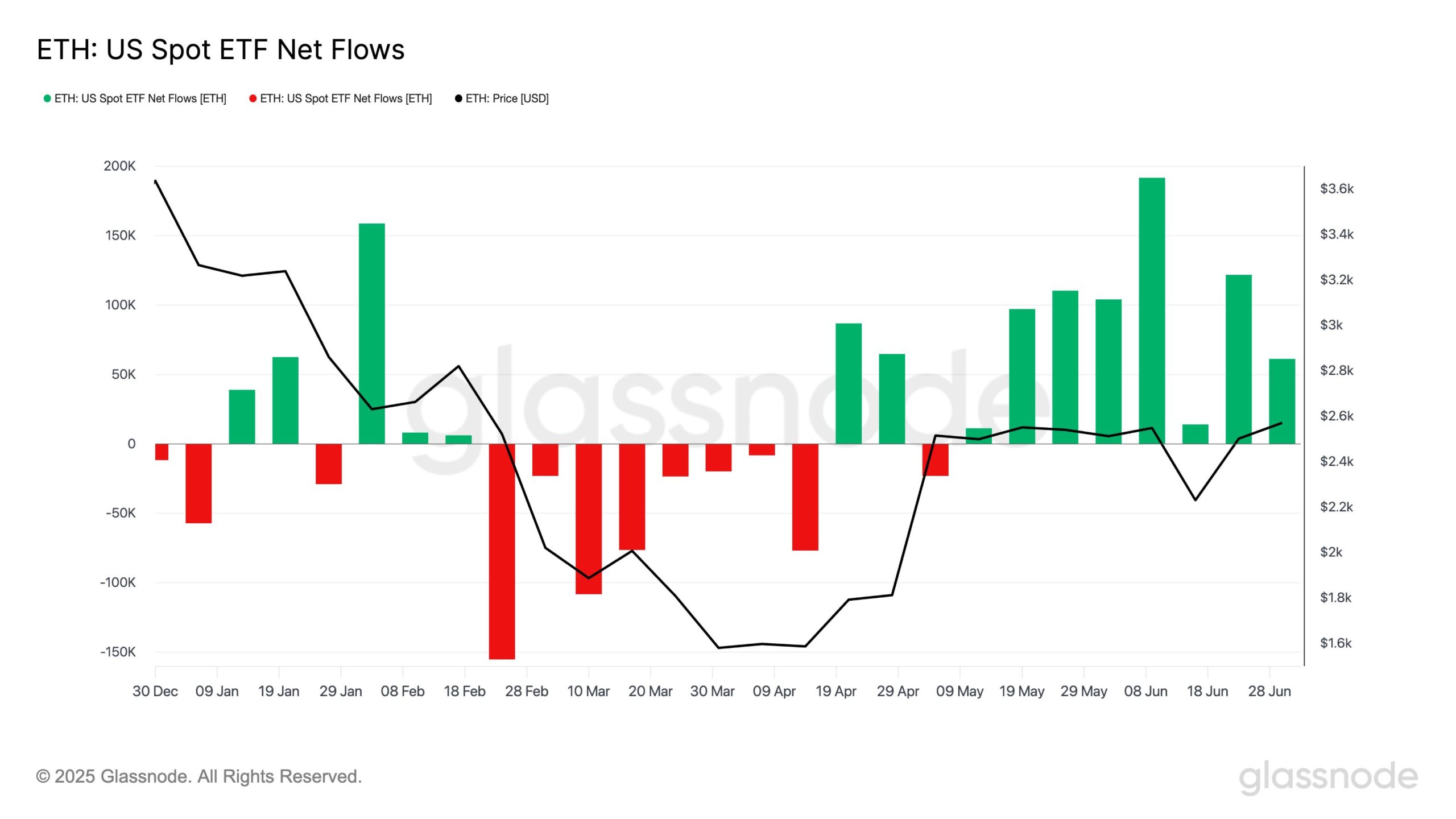

Under is the chart shared by the analytics agency that reveals how the American Ethereum spot ETFs have been doing recently:

From the graph, it’s seen that the netflow associated to the Ethereum spot ETFs has just lately been on a inexperienced streak. Because of this inflows into wallets hooked up to the ETFs are constantly taking place. Final week noticed a internet influx of 61,000 ETH, value $157.3 million on the present trade fee. With these inflows, the spot ETFs of the cryptocurrency have seen optimistic values for eight straight weeks.

Since institutional investors typically take this funding route into Ethereum, the continual inflows might be an indication of sustained demand from them. Regardless of this curiosity, the ETH value has remained locked in a part of sideways motion.

Ethereum isn’t the one asset that’s observing demand on the ETFs. Because the on-chain analytics agency Santiment has identified in an X post, Bitcoin has additionally been having fun with internet inflows.

As displayed within the above chart, the Bitcoin ETFs have seen a optimistic netflow on 16 out of the final 17 buying and selling days. The one exception was on July 1st, when outflows occurred.

In another information, Ethereum has noticed new on-chain capital inflows throughout the previous week, as Glassnode has revealed in one other X post.

Within the graph, the info for the Realized Cap of cash aged lower than 1 week is proven for Ethereum and Solana. The “Realized Cap” measures the quantity of capital that the traders have put right into a given community. The model of the metric of focus right here particularly calculates the capital that has are available over the previous week.

From the chart, it’s seen that the metric has seen a rise for each ETH and SOL throughout the previous week, indicating contemporary capital has flowed in. The latter has outperformed the previous, nevertheless, with the metric standing at $6.2 billion and $8.3 billion, respectively.

ETH Worth

On the time of writing, Ethereum is floating round $2,580, up over 5% within the final week.