Ethereum bulls are turning energetic as soon as once more earlier than the spot Ether ETFs go reside for buying and selling within the coming two months. Within the final 24 hours, the Ethereum (ETH) price has bounced again once more by 5% and is at present buying and selling at $3,957 with a market cap of $469 billion. Additionally, the every day buying and selling volumes for Ethereum have skyrocketed by 68% to just about $17 billion.

Ethereum (ETH) Value Eyes Breakout Above $4,000

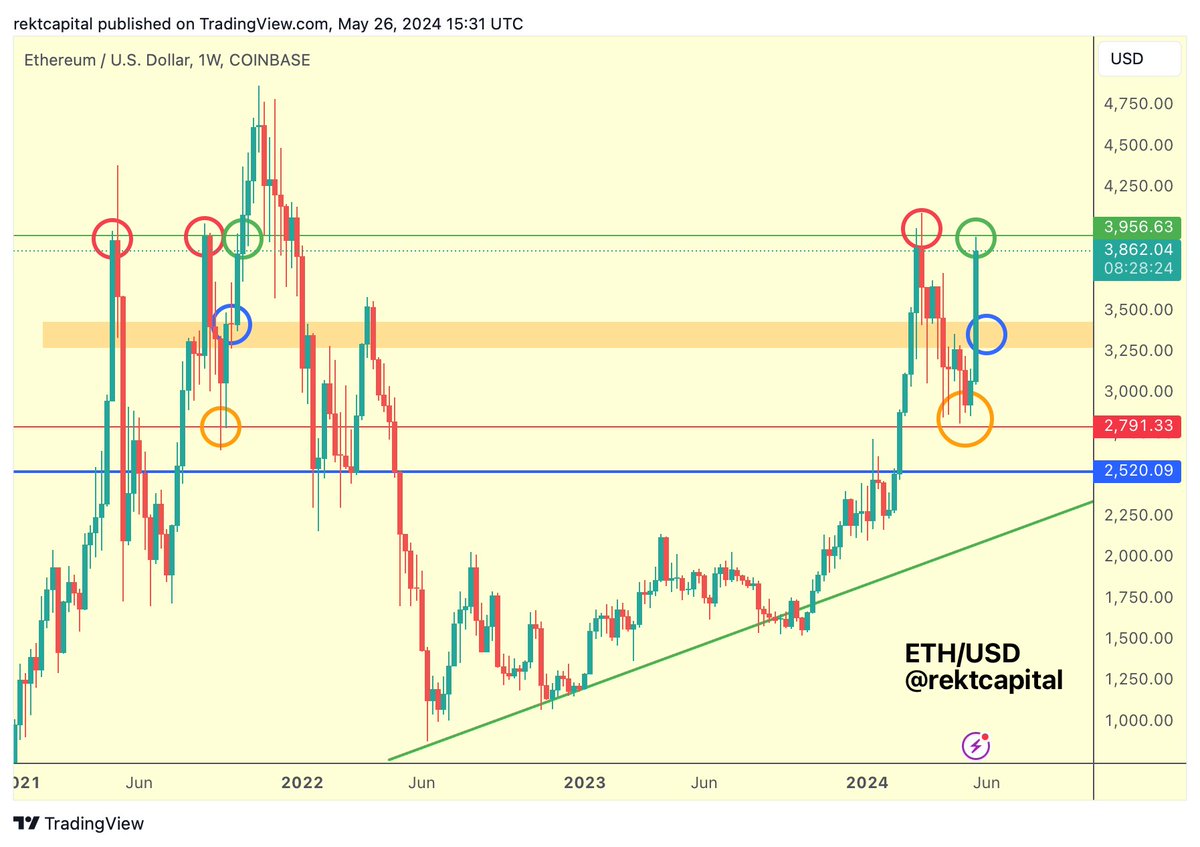

Rekt Capital, a distinguished crypto analyst, acknowledged that Ethereum (ETH) requires a weekly shut above $3956 to maneuver into the $4000+ vary. At the moment, ETH is forming a decrease excessive, but it surely has spent important time across the $2791 stage, traditionally a precursor to an upside motion again to roughly $4000.

Rekt Capital emphasised {that a} weekly shut above the orange field stage is inevitable and can affirm that the bulls have regained momentum. The analyst’s observations spotlight the essential thresholds ETH should surpass to proceed its bullish trajectory.

Quickly after the information of the spot Ether ETF final week, the ETH value consolidated for some time earlier than resuming the latest uptrend. On the weekly chart, Ethereum poses a wholesome 27% achieve suggesting a stable uptrend going forward.

ETH Value to Attain $4,500 Earlier than ETF Goes Dwell

Arthur, the founding father of DeFiance Capital, predicts that Ethereum (ETH) will attain $4,500 earlier than the graduation of spot ETH ETF buying and selling. Supporting this optimistic outlook, a survey by WuBlockchain throughout the Chinese language group reveals that 58% of respondents consider ETH can surge to $10,000 or extra within the present market cycle.

4.5k earlier than spot ETF go reside for buying and selling imo.

— Arthur (@Arthur_0x) May 26, 2024

Crypto traders extensively anticipate important institutional demand for Ethereum (ETH) within the coming weeks. In anticipation of this inflow, massive Ethereum traders have been making substantial purchases for the reason that ETF approval announcement.

A Santiment chart reveals real-time modifications within the balances of ETH cash held by the highest 1,000 largest wallets. On Could 19, these high traders collectively held 76.01 million ETH. Following the information from Bloomberg analysts on Could 20 in regards to the SEC’s impending approval of ETH ETFs, these “whales” elevated their shopping for exercise. As of Could 26, the highest 1,000 Ethereum wallets now maintain 76.52 million ETH, indicating an acquisition of 510,000 ETH in simply 5 days.

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: