Ethereum is on the verge of breaking its all-time excessive after surging to the $4,700 degree, its strongest worth since November 2021. Bulls stay firmly in management, with momentum constructing after weeks of regular good points which have reignited market optimism. The rally has positioned ETH simply shy of the $4,860 peak, a breakout level that might usher in a long-awaited worth discovery part.

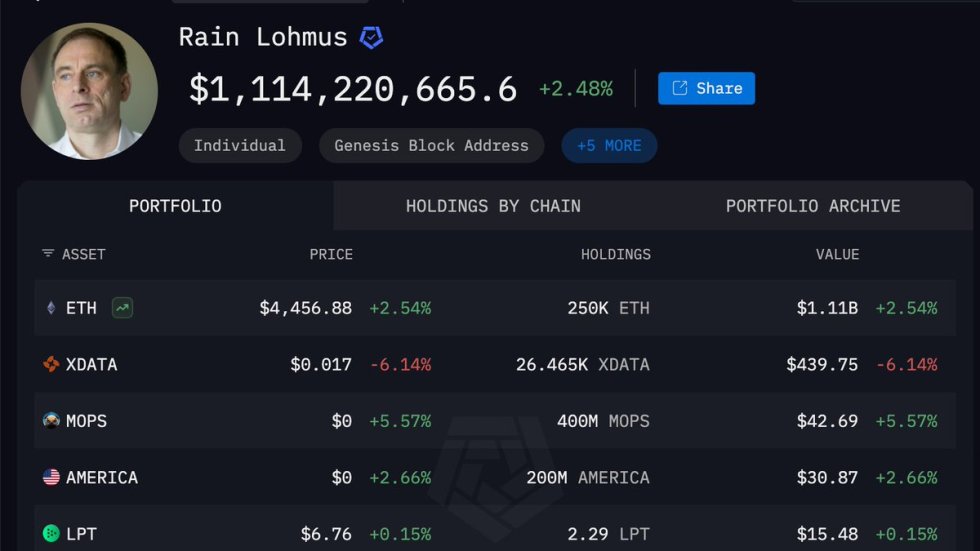

Including intrigue to the present bullish backdrop, Arkham Intelligence — a blockchain analytics platform identified for deanonymizing the people and firms behind blockchain wallets and transactions — has uncovered a outstanding story. In keeping with their findings, a distinguished determine has misplaced entry to a pockets holding over $1.1 billion value of Ethereum. The loss stems from forgotten or inaccessible credentials, successfully locking away a fortune that can by no means enter the market until recovered.

With sentiment driving excessive and technicals pointing to a breakout, merchants are watching carefully to see if ETH can lastly surpass its all-time excessive and enter a brand new chapter in its market historical past — one outlined by each file valuations and extraordinary blockchain narratives.

Ethereum Nears Historic Breakout as $1B Misplaced Pockets Story Emerges

Arkham Intelligence has revealed a hanging chapter in Ethereum’s historical past — one which underscores each the potential and the dangers of early crypto funding. In keeping with their report, Rain Lohmus, a well known Estonian investor and entrepreneur, spent simply $75,000 on ETH through the 2015 preliminary coin providing (ICO).

These cash, bought when Ethereum was nonetheless in its infancy, would at the moment be value over $1 billion. Sadly, Lohmus misplaced entry to the pockets, rendering the fortune completely inaccessible until the keys are recovered — a near-impossible feat with out the unique credentials.

This story surfaces at a pivotal second for Ethereum. The asset is buying and selling close to $4,700, inside hanging distance of its all-time excessive at $4,860, and market dynamics are turning more and more favorable for bulls. Provide on exchanges and over-the-counter (OTC) desks is drying up quickly, an indication of robust accumulation from each retail and institutional gamers. As fewer cash can be found on the market, upward worth stress intensifies, particularly when demand stays robust.

Ethereum is on the verge of coming into uncharted territory, and the broader altcoin market is displaying renewed indicators of life, fueled by ETH’s management. The subsequent few days may very well be essential in figuring out whether or not Ethereum breaks decisively larger, setting new information and doubtlessly igniting a recent wave of altcoin rallies.

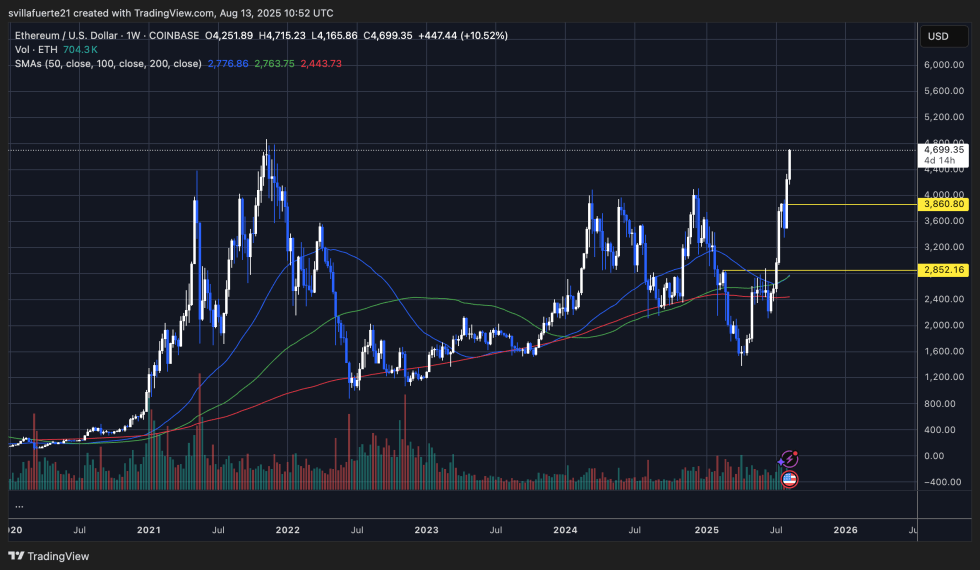

Worth Evaluation: Nearing All-Time Excessive Resistance

Ethereum (ETH) is buying and selling at $4,699 on the weekly chart, up 10.52% within the newest session, as bullish momentum pushes the asset towards its all-time excessive close to $4,860. The latest rally has been fueled by a decisive breakout above the $3,860 resistance zone, which now acts as robust help.

Technically, ETH is buying and selling effectively above its 50-week SMA ($2,776), 100-week SMA ($2,763), and 200-week SMA ($2,443), reflecting a powerful long-term bullish development. The slope of the 50-week SMA has turned sharply upward, underscoring the power of the present transfer. The vertical nature of the breakout from the $2,852–$3,860 vary highlights intense shopping for stress, probably supported by institutional flows and diminished change provide.

If ETH can shut above $4,860, it is going to enter worth discovery for the primary time since November 2021, doubtlessly triggering accelerated good points as momentum merchants and long-term buyers add to positions. Nonetheless, the $4,700–$4,860 vary stays a serious resistance zone the place profit-taking might quickly sluggish the rally.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.