Ethereum climbed to $1,700 on Thursday following a number of days of nursing losses and nurturing help at $1,630. The bullish wave traversing the crypto market comes at a time when many buyers are counting losses amid the promise of a bull run that presently appears nothing fairytale.

Ethereum Uptrend Weakens Regardless of Whale Exercise

Ethereum markets have remained squashed since Friday, regardless of reviews of whales rising publicity to the token. Information by Lookochain exhibits that 5 whales have within the final seven days cumulatively bought $94 million price of Ether.

The largest whale (smartestmoney.eth) scooped up roughly 18.2k ETH price round $30.6 million, adopted by 18k ETH valued at $30 million, 17.9k ETH price roughly $30 million, and 2k ETH roughly $3.4 million.

Whales are accumulating $ETH from the underside!

4 whales collected 56.1K $ETH ($94M) up to now 7 days.

– 0x3CEE collected 18K $ETH($30M);

– 0x3478 collected 2K $ETH($3.4M);

– 0x5bA3 collected 17.9K $ETH($30M);

– smartestmoney.eth collected 18.2K $ETH($30.6M). pic.twitter.com/M93Mhkpn6p

— Lookonchain (@lookonchain) August 24, 2023

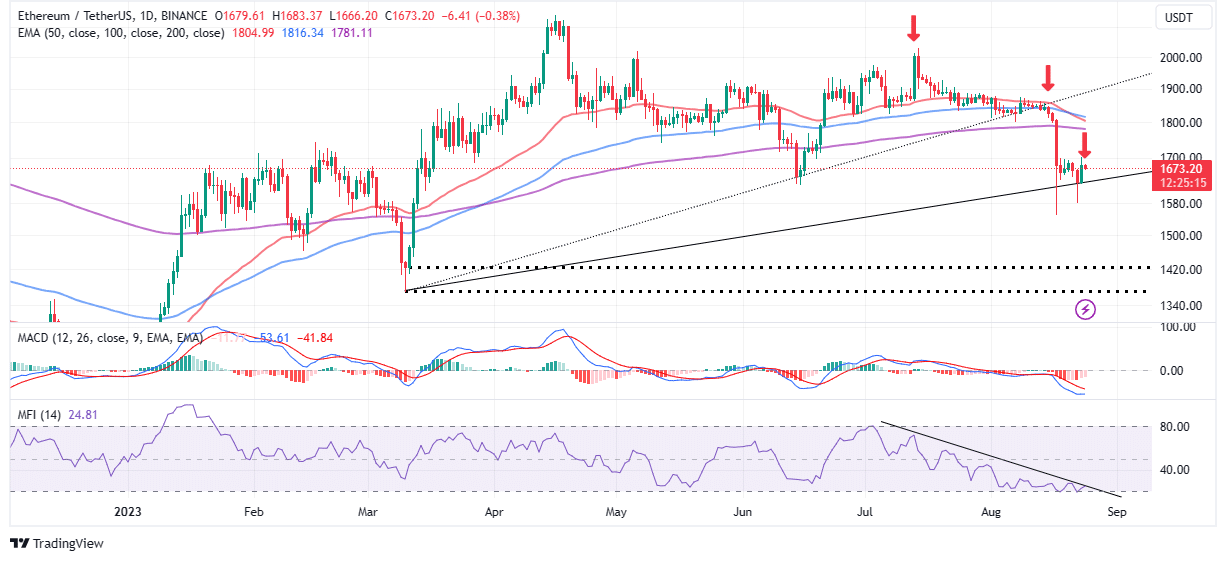

Regardless of this uptake of ETH amongst whales and an uptrend forming on the ecosystem whole worth locked (TVL) within the decentralized finance (DeFi) sector, the technical outlook will not be robust sufficient to maintain positive aspects previous $1,700.

Merchants are adamant about reserving new lengthy positions in Ethereum, contemplating most indicators are in a worrisome downward pattern.

The Shifting Common Convergence Divergence (MACD) indicator affirms the bearish stance available in the market with a promote sign that has caught round since early July. Except the MACD line flips above the sign line in blue, the trail with the least resistance would stay downward.

Including credibility to the bearish outlook is the Cash Circulation Index, which measures the outflow and influx quantity of cash in ETH markets. For the reason that starting of July, outflow quantity has considerably surpassed influx quantity.

A latest report by CoinShares discovered that Ethereum was the second among the digital assets funding merchandise that noticed the best outflows final week in comparison with the week earlier than.

Crypto analyst @ali_charts mentioned that “giant holders of Ethereum additionally known as whales, have been “reshuffling since February. About 112 whales have adjusted their portfolios, both promoting or redistributing their ETH.”

Till whales throw their full weight behind ETH, the token could proceed to wrestle to maintain the uptrend, particularly above $2,000.

Massive #Ethereum holders with 10,000+ $ETH have been reshuffling since February. About 112 whales have adjusted their portfolios, both promoting or redistributing their #ETH. pic.twitter.com/YswJ6e2JK4

— Ali (@ali_charts) August 22, 2023

Assist at $1,600 is presently in place to soak up the promoting strain. It has been strengthened by the decrease ascending trendline. Nonetheless, declines to $1,400 the place the following sturdiest help lies, can’t be dominated out simply but, contemplating the battered market construction.

Associated Articles

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.