The previous few months have seen Ethereum whales, the cryptocurrency world’s Goliaths, flexing their monetary muscular tissues. In accordance with a latest report by Santiment, on-chain information reveals a surge in whale exercise, probably fueled by the inexperienced gentle for spot Ethereum exchange-traded funds (ETFs) from the US Securities and Trade Fee (SEC).

Associated Studying

A Whale Of A Time: Accumulation Anchors Forward

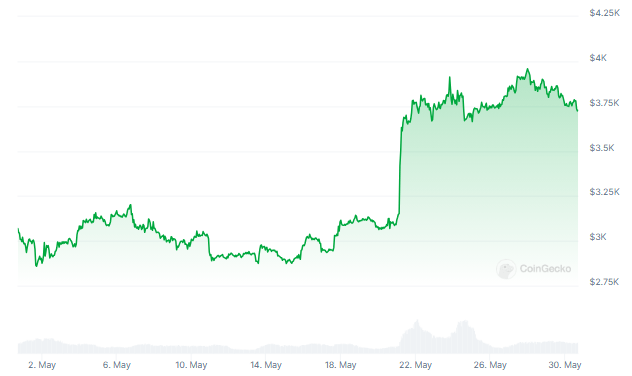

The SEC’s shock approval on Could twenty third of 19b-4 types for ETF applications from heavyweights like BlackRock and Constancy stirred the cryptoverse nest. This long-awaited resolution, following months of radio silence from regulators, appears to have been the harbinger of a shopping for spree for Ethereum’s greatest gamers.

Santiment’s report dives deep, revealing an almost 30% enhance in holdings by wallets containing at the least 10,000 ETH over the previous 14 months. This interprets to a staggering 21 million ETH, presently valued at a cool $83 billion, scooped up by these deep-pocketed buyers.

With Ethereum even surpassing Bitcoin by way of proportion good points final month, it’s no shock that the buildup celebration exhibits no indicators of stopping.

Revenue Feast Earlier than The Most important Course?

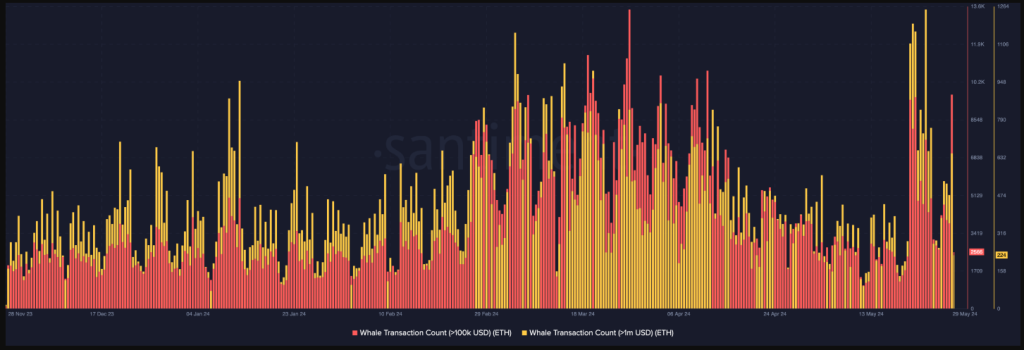

The info suggests a latest uptick in whale transactions exceeding $100,000 and a whopping $1 million, reaching year-to-date highs after the ETF approval. This surge in exercise may very well be interpreted as whales benefiting from the bullish sentiment to lock in some income.

Nonetheless, Santiment suggests this could be a strategic pit cease earlier than diving again into the shopping for pool. So long as these “10K+ ETH wallets are nonetheless transferring north,” the report argues, Ethereum’s value has the potential to proceed outperforming its larger brother, Bitcoin, even amidst market volatility.

Worthwhile Seas For Ethereum Sailors

The excellent news extends past whale exercise. An evaluation by NewsBTC revealed a constructive pattern in day by day Ethereum transactions. Measured over a seven-day transferring common, the ratio of worthwhile transactions to these ending in a loss sits at a wholesome 1.87. This means that for each dropping commerce, there are practically two profitable ones, suggesting a wave of optimism amongst Ethereum buyers.

Ethereum Value Prediction

In the meantime, the anticipated yearly low Ethereum value projection for 2025 is $ 3,716, based mostly on the historic value patterns of Ethereum and the BTC halving phases. In accordance with predictions, Ethereum’s price could rise to $6,722 within the upcoming yr.

Associated Studying

In the mean time, the worth projection for Ethereum in 2025 ranges from $3,716 on the low finish to $6,722 on the excessive facet. If ETH hits the upper value goal, Ethereum’s worth would possibly enhance by 80% by 2025 in comparison with its present worth.