Glassnode knowledge may suggest Ethereum worth dynamics are extra influenced by derivatives and different off-chain markets in comparison with Bitcoin.

CBD Information Reveals Divergence In Spot Exercise For Bitcoin & Ethereum

In a brand new post on X, on-chain analytics agency Glassnode has talked about how the Cost Basis Distribution (CBD) has diverged between Bitcoin and Ethereum lately.

The CBD refers to an indicator that tells us in regards to the quantity of a given asset that addresses or traders on the community final bought at every of the value ranges visited by the cryptocurrency in its historical past.

This metric is beneficial as a result of traders put particular emphasis on their break-even stage and have a tendency to make some form of transfer when a retest of it happens. The extra quantity of the asset that the holders bought at a selected stage, the stronger is their response to a retest.

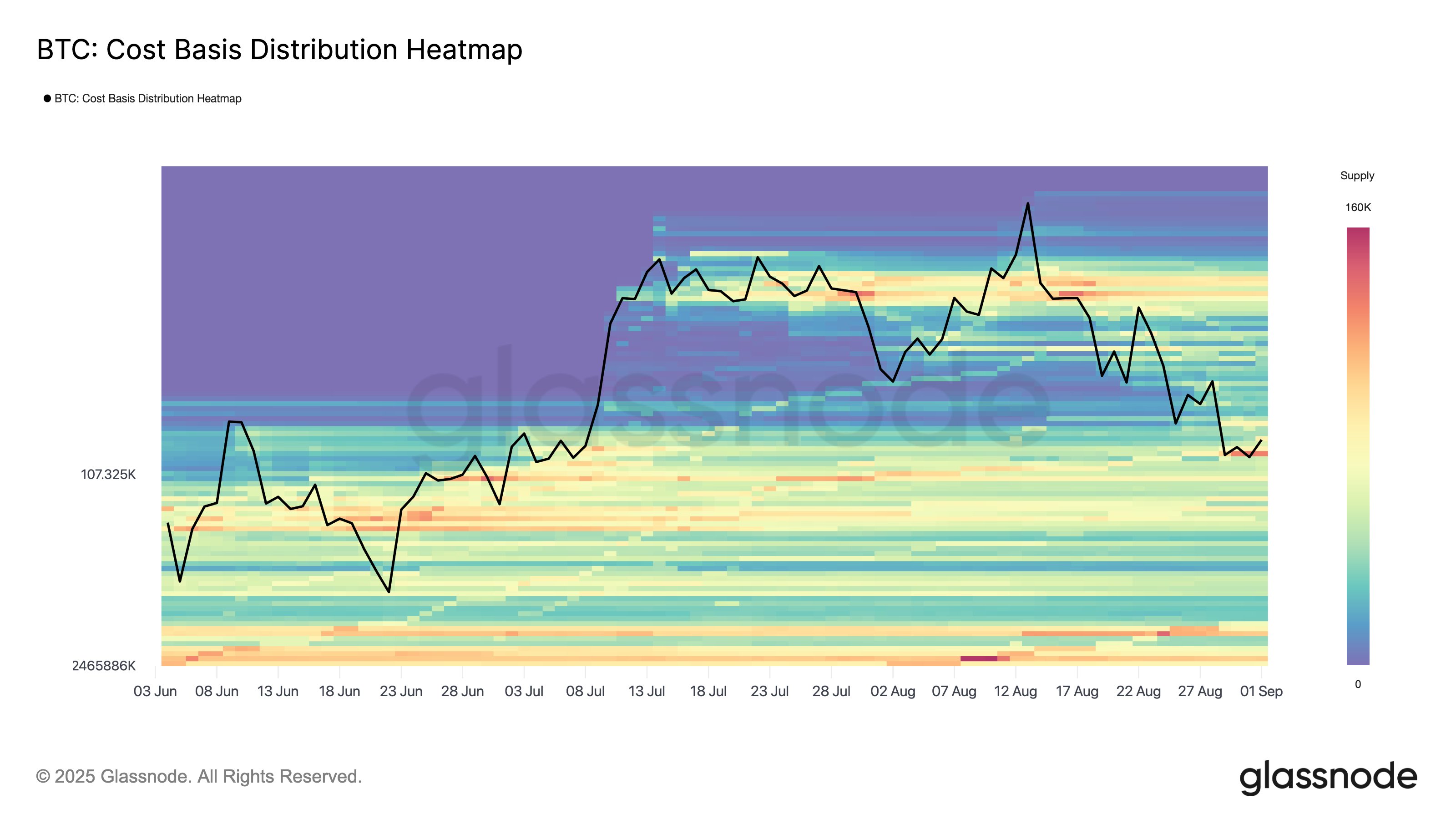

Now, first, here’s a chart that reveals the development within the CBD for Bitcoin over the previous couple of months:

Seems to be like BTC is at the moment retesting a serious demand zone | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin CBD acquired a big “air hole” when Bitcoin noticed its explosive rally again in July. This occurred as a result of BTC moved via worth ranges too quick for getting and promoting to happen at them, so only a few cash had been capable of obtain a price foundation at them.

As BTC consolidated after the rally cooling off, ranges began being crammed up with provide. The identical has adopted through the newest part of decline and now, the earlier air hole has disappeared. This reveals that demand for spot buying and selling has maintained for the cryptocurrency.

Whereas Bitcoin has seen this development, the CBD has behaved in another way for the second largest asset within the sector, Ethereum.

How the CBD has modified for ETH over the previous few months | Supply: Glassnode on X

From the chart, it’s obvious that Ethereum’s rallies have additionally created air gaps, however in contrast to Bitcoin, its phases of slowdown haven’t resulted in any ranges filling as much as a notable diploma. “This implies ETH worth dynamics could also be extra influenced by off-chain markets comparable to derivatives,” notes Glassnode.

Traditionally, worth motion constructed on merchandise like derivatives has typically confirmed to be extra unstable. Provided that Ethereum is at the moment not observing any excessive ranges of spot shopping for, it solely stays to be seen what the destiny of its bull run could be.

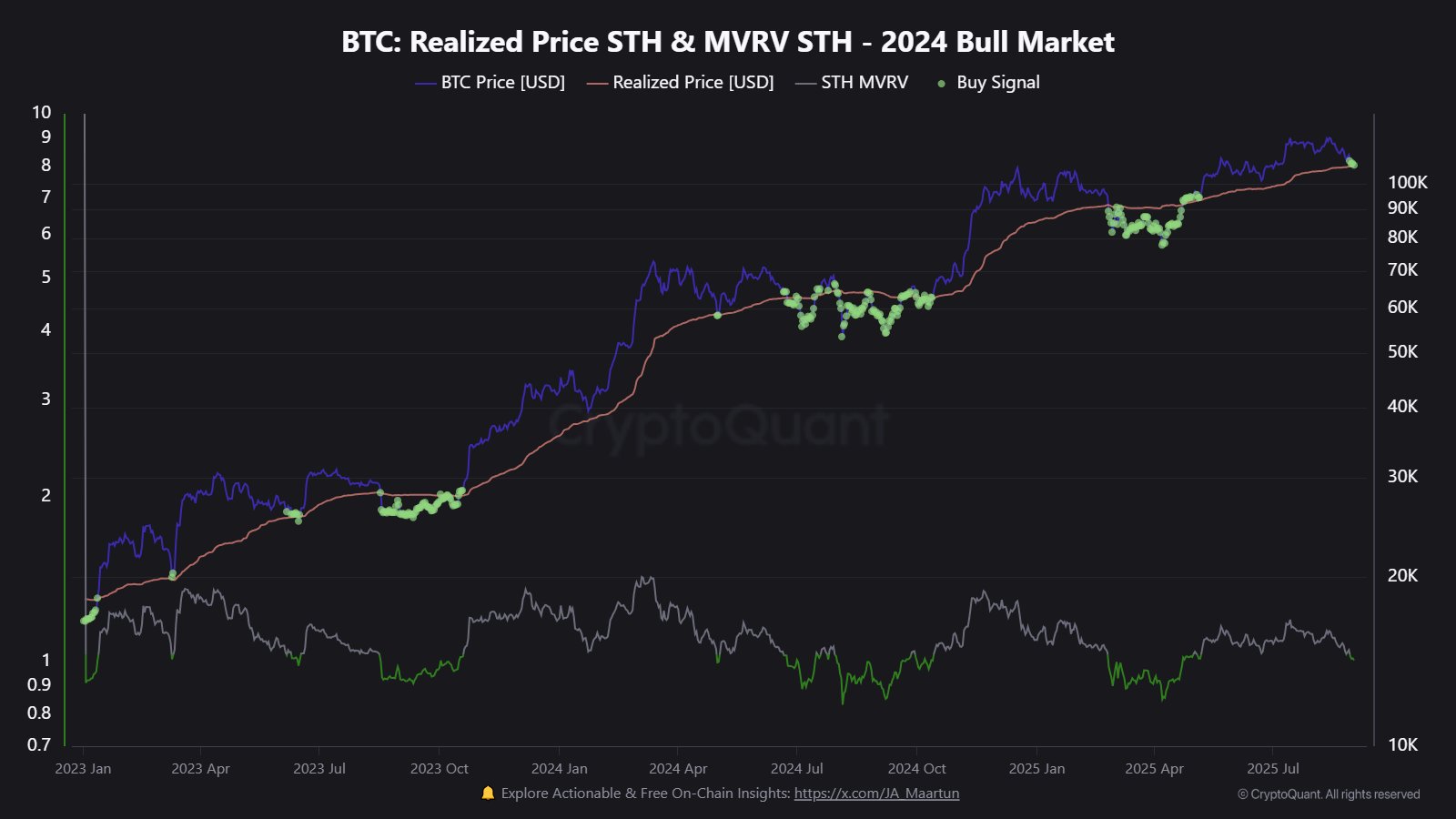

In another information, Bitcoin has been buying and selling close to an vital on-chain cost basis level after the current worth decline, as CryptoQuant writer Maartunn has identified in an X post.

The development within the Realized Worth of the BTC short-term holders | Supply: @JA_Maartun on X

The extent in query is the typical value foundation of the short-term holders, traders who bought their Bitcoin inside the previous 155 days. Prior to now, dropping the extent typically resulted in short-term shifts to bearish phases.

ETH Worth

Ethereum has been on the best way down lately with its worth falling to $4,270 after a 6% weekly pullback.

The worth of the coin seems to have gone down lately | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.