All eyes are at present on Ethereum because the U.S. Securities and Trade Chairman Gary Gensler acknowledged that the approval of the spot Ethereum ETF will occur by the top of this summer season. Though this information introduced some optimism to the ETH neighborhood, it has but to replicate within the Ethereum worth which is buying and selling beneath $3,500 as of press time.

Ethereum Demand Skyrockets

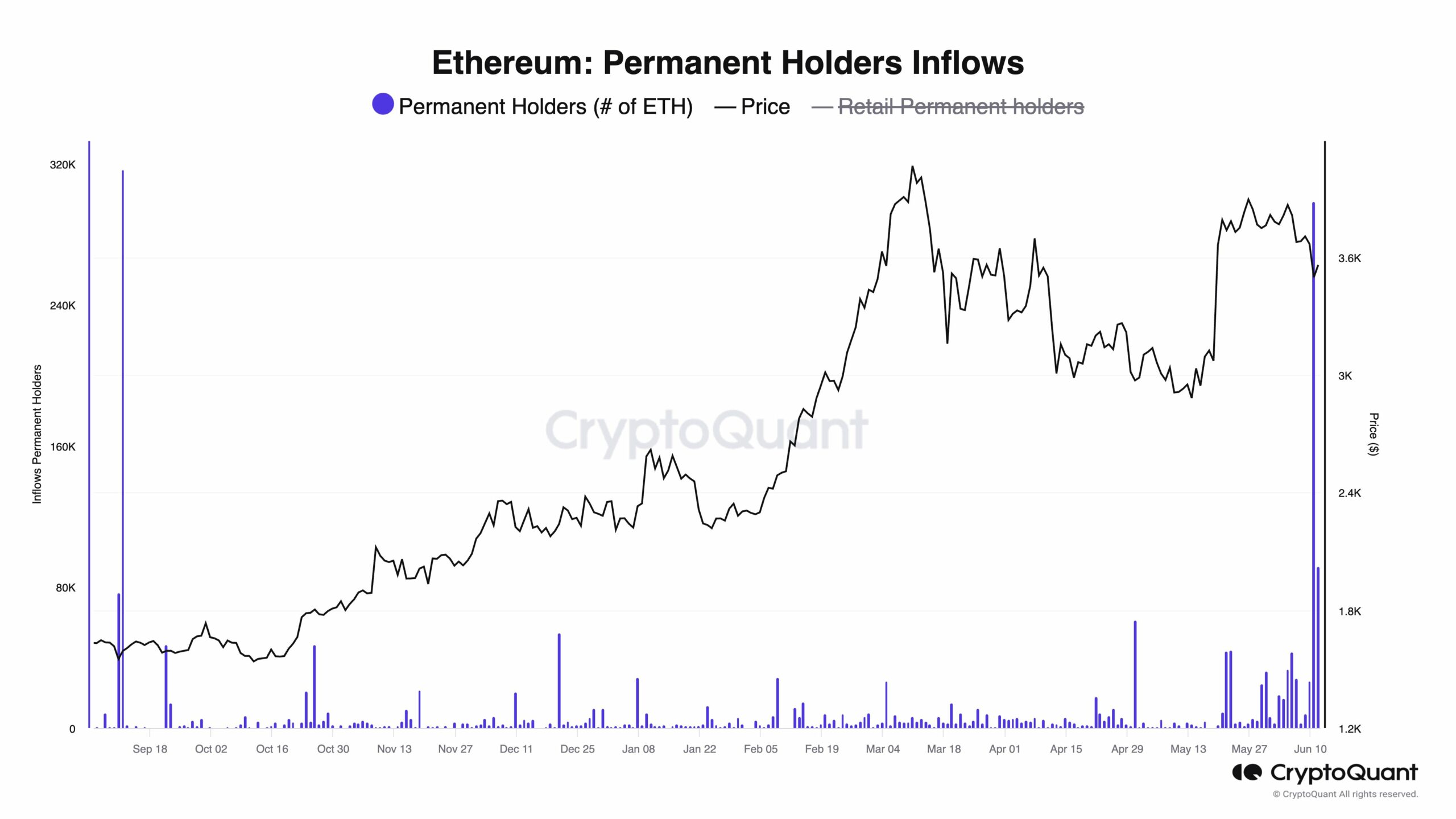

Julio Moreno, the pinnacle of analysis at CryptoQuant acknowledged that there’s a big surge within the Ethereum demand at present available in the market. As per Moreno, the everlasting ETH holders purchased a staggering 298,000 ETH yesterday, making this the second-highest each day buy on document.

The document for the very best each day shopping for stays on September 11, 2023, as of now, when the ETH holders scooped 317,000 ETF. Nevertheless, even the present spike in Ethereum demand highlights the rising curiosity and confidence amongst long run traders within the crypto market.

The huge surge in demand for Ethereum has come because the ETH price has corrected greater than 9% previously seven days. Nevertheless, as we noticed, the on-chain metrics proceed to point out power for the world’s second-largest cryptocurrency.

As reported by CoinGape, Ethereum’s withdrawal from the Coinbase change surged to an enormous 300K, thereby making it one of many largest outflows in 2024. With this, the entire worth of the Ethereum withdrawal has surged previous $1 billion.

ETH Worth Motion Forward?

Regardless of the constructive on-chain indicators, the ETH bulls haven’t gained sufficient management to set off a rally previous $4,000. Presently, Ethereum is buying and selling slightly below its essential help zone of $3,500.

Final time, the ETH worth dropped beneath $3,500 again in April, it led to a 25% decline hitting the low of $2,814 by Could 2. All eyes can be on how swiftly the SEC chair provides a go-ahead to the spot Ethereum ETF to go dwell for buying and selling. That is prone to infuse main capital inflows as we noticed after the approval of the spot Bitcoin ETF.

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: